Bad debts mean the money owed by customers who have gone bankrupt or the likelihood of who's ever returning the money is significantly low. Bad debt is a nominal account. A nominal account is an account that records the business transactions belonging to a certain category of income, expense, profitRead more

Bad debts mean the money owed by customers who have gone bankrupt or the likelihood of who’s ever returning the money is significantly low. Bad debt is a nominal account.

A nominal account is an account that records the business transactions belonging to a certain category of income, expense, profit or loss. The balances on nominal accounts are normally written off at the end of each financial year. For example, sales A/c, purchases A/c, interest income, loss from the sale of assets etc.

Why are bad debts A/c classified as a nominal account?

First of all, let us understand the other two types of accounts – personal accounts and real accounts.

Personal accounts deal with the records of the business’ transactions with a particular person or entity. For example Mukesh A/c, Mahesh A/c, Reliance A/c, Suresh and Co. A/c etc.

Real accounts deal with transactions and records related to assets. The balance in these accounts is normally carried forward from one period to another. For example “Furniture A/c “, ” Building A/c ” etc.

Now that we have understood the basic definitions of all three types of accounts, we can discuss the reason behind the classification of bad debts as nominal accounts.

A bad debt is a loss that the company has incurred. It may be due to bankruptcy of customers, customer fraud etc. The company isn’t going to receive that money. The bad debts are written off at the end of the year by transferring them to profit and loss A/c.

Thus, bad debts relate to loss and are normally not carried forward from one period to another. Hence, they are classified as nominal accounts.

Treatment of Bad Debts

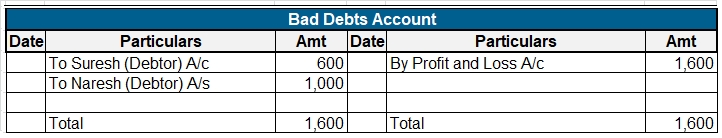

Bad debts are written off at the end of each year by debiting them to the profit and loss A/c. The amount of bad debts is reduced from the amount of debtors that the company has.

A company may also choose to create a provision for bad debts for the balance amount of debtors that the company has after adjusting for bad debts. This provision represents a rough estimate of the amount due to debtors that the business expects to not receive. In other words, it is an estimate of customer bankruptcy that the business expects.

Conclusion

We can conclude that

- There are primarily three types of accounts – real, personal and nominal.

- Bad debts are a nominal account.

- Bad debts is a loss that the business has incurred

- It may be due to bankruptcy of customers, fraud etc

- Bad debts are written off each year by transferring them to the income statement

Definition Bad debts are a debt owed to an enterprise that is considered to be irrecoverable or we can say that it is owed to the business that is written off because it is irrecoverable. Bad debts will be treated in the following ways : On the debit side of the profit and loss account. In the curreRead more

Definition

Bad debts are a debt owed to an enterprise that is considered to be irrecoverable or we can say that it is owed to the business that is written off because it is irrecoverable.

Bad debts will be treated in the following ways :

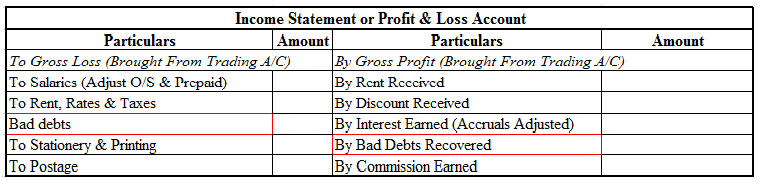

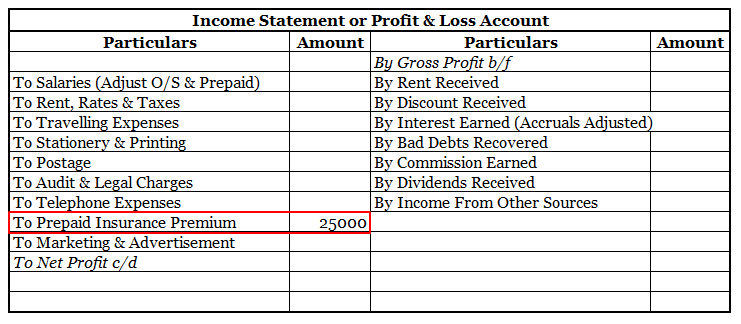

On the debit side of the profit and loss account.

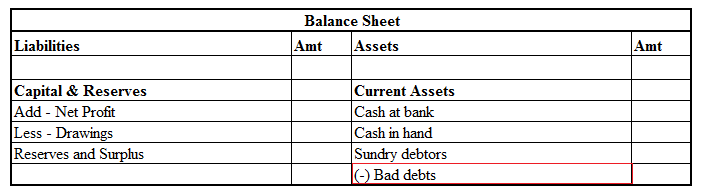

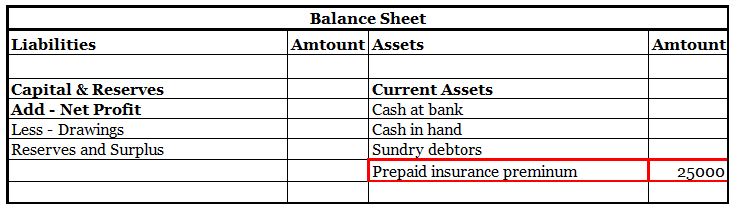

In the current assets side of the balance sheet, these are deducted from sundry debtors.

For example loans from banks are declared as bad debt, sales made on credit and amounts not received from customers, etc.

Now I will show you an extract of the profit and loss account and balance sheet

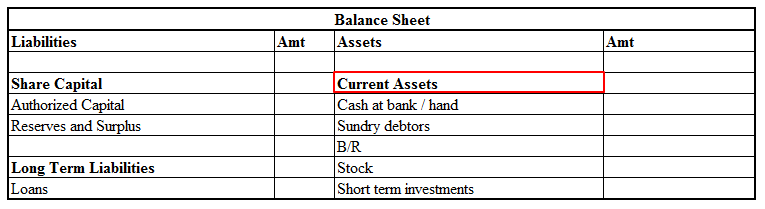

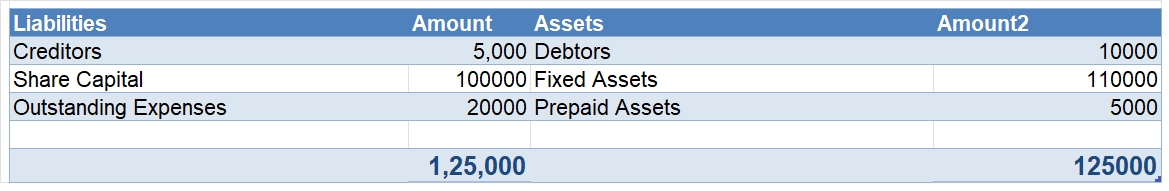

Current assets are defined as cash and other assets that are expected to be converted into cash or consumed in the production of goods or the rendering of services in the ordinary course of business.

For example, debtors exist to convert them into cash i.e., receive the amount from them, bills receivable exist again for receiving cash against it, etc.

Current liabilities are defined as liabilities that are payable normally within 12 months from the end of the accounting period or in other words which fall due for payment in a relatively short period.

For example bills payable, short-term loans, etc.

Accounting treatment

Now let me try to explain to you the accounting treatment for bad debts which is as follows :

Reasons for bad debts

There are several reasons why businesses may have bad debts some of them are as follows:-

Accounting methods

There are two methods for accounting for bad debts which are mentioned below:-

Related terms

So there are a few related terms whose meanings you should know

See less