Drawings mean the certain sum of amount or goods withdrawn by owners from the business for personal use. The drawings account is not an asset/liability/expense/income account, it is a contra account to the owner's equity or capital account. Drawings A/c will always have a debit balance. Drawings A/cRead more

Drawings mean the certain sum of amount or goods withdrawn by owners from the business for personal use. The drawings account is not an asset/liability/expense/income account, it is a contra account to the owner’s equity or capital account. Drawings A/c will always have a debit balance.

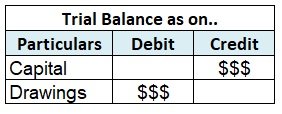

Drawings A/c debit balance is contrary to the Capital A/c credit balance because any withdrawal from the business for personal use will reduce the capital.

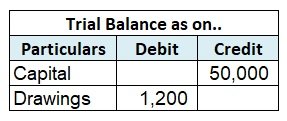

Effect on Trial Balance: Drawings will be shown in the debit column of the trial balance.

Effect on Financial Statements: The owner’s drawings will affect the company’s balance sheet by decreasing the asset that is withdrawn, and a corresponding decrease in the owner’s equity or capital invested.

Example:

Mr.B a sole proprietor withdraws $100 each month for personal use. At the end of the year Drawings A/c had a debit balance of $1,200.

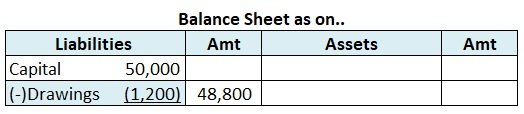

Mr.B records drawings of $100 each month and debits drawings a/c and credits cash a/c. At the end of the year, he will transfer the balance and will debit capital a/c and credit drawings a/c by $1,200.

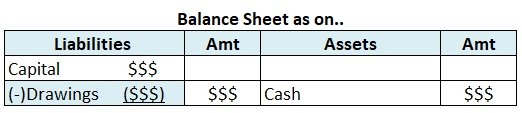

He will show a balance of $1,200 ($100*12) in the trial balance in the debit column. Assuming closing capital of $50,000.

In the financial statement, the balance of drawings a/c will be deducted from the owner’s capital because it is a contra account and this will reduce the owner’s capital for the year.

See less

Interest on Investment is to be shown on the Credit side of a Trial Balance. Interest on investment refers to the income received on investment in securities. These securities can be shares, debentures etc. of another company. When one invests in securities, they are expected to receive a return onRead more

Interest on Investment is to be shown on the Credit side of a Trial Balance.

Interest on investment refers to the income received on investment in securities. These securities can be shares, debentures etc. of another company. When one invests in securities, they are expected to receive a return on investment (ROI).

Since interest on investment is an income, it is shown on the credit side of the Trial Balance. This is based on the accounting rule that all increase in incomes are credited and all increase in expenses are debited. A Trial Balance is a worksheet where the balances of all assets, expenses and drawings are shown on the debit side while the balances of all liabilities, incomes and capital are shown on the credit side.

For example, if Jack bought Corporate Bonds of Amazon, worth $50,000 with a 10% interest on investment, then the accounting treatment for interest on investment would be

Cash/Bank A/C Dr 5,000

To Interest on Investment in Corporate Bonds (Amazon) 5,000

As per the above entry, since interest on investment is credited, it will show a credit balance and hence be shown on the credit side of the Trial Balance. Interest on investment account is not to be confused with an Investment account. Investment is an asset whereas interest on investment is an income.

See less