Specimen of Bill of Exchange Important points of Bill of Exchange: Date: When a bill of exchange is drawn, the drawer has to specify the date in the top right corner. The date is important for the purpose of calculating the due date of the bill. Generally, the drawee is given three days as a grace pRead more

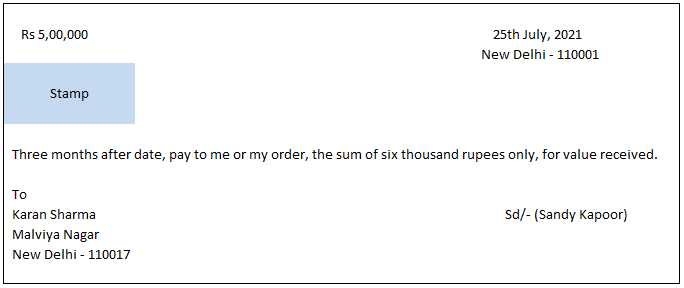

Specimen of Bill of Exchange

Important points of Bill of Exchange:

Date: When a bill of exchange is drawn, the drawer has to specify the date in the top right corner. The date is important for the purpose of calculating the due date of the bill. Generally, the drawee is given three days as a grace period over and above the due date of maturity.

In the above specimen, the date mentioned is 25th July 2021, so the due date will be three months + 3 days( grace period) i.e. to say 28th October 2021.

Term: In the above, the term as agreed by the drawer and drawee is 3 months. So the maturity date will be after 3 months.

Stamp: The Stamp is affixed in the left corner in every bill of exchange, the value of which depends upon the amount specified in the bill.

Parties involved in Bill of Exchange:

- Drawer: The one who makes the bill, i.e. the creditor.

- Drawee: The one on whom the bill is drawn, i.e. the debtor.

- Payee: The one to whom the amount is to be paid is the payee.

Sometimes, the drawer and the payee are the same people.

For Example,

i) A bill of exchange for Rs 10,000 is drawn by Sandy on Karan which is due after three months. Karan accepted the bill which is met at maturity and hence becomes the acceptor of the bill by putting his signature.

Here, Sandy is the drawer and Karan is the drawee. As the payment on maturity is received by Sandy so the payee will be Sandy.

ii) A bill of exchange for Rs 10,000 is drawn by Sandy on Karan which is due after three months. Karan accepted the bill. Thereafter Sandy endorsed the bill in favor of his creditor, Vikash. The bill is met at maturity.

So in this case, Sandy is the drawer, Karan is the drawee and Vikash is the payee as he received the amount at maturity.

Acceptance: Acceptance by the drawee is given on the face of the bill as-

Meaning of BOE:

In a business, in the case of credit sales, the payment is received after a certain period of time. In such a case the seller i.e. the creditor makes a credit note and the purchaser i.e. the debtor accepts the same by giving his acceptance by signing the instrument, to pay the amount of money mentioned to a certain person or the bearer of the instrument.

It is generally a negotiable instrument i.e. can be transferred from one person to another.

Features of Bill of Exchange.

- It is a written document.

- It is an unconditional order to pay.

- It must be signed by the maker of the bill i.e. the drawer.

- It must be properly stamped.

- The amount is payable either to a specified person or to his order or to the bearer.

- It contains an order to pay the amount mentioned in the instrument both in figures and words.

- The amount is to be paid either on the expiry of a fixed period from the date of the bill or on-demand.

See less

Revaluation of Assets is an adjustment made in the carrying value of the fixed asset in case the company finds there is a difference between the current price and the market value of the asset. Generally, the value of the asset decreases due to depreciation but in some cases like inflation in the ecRead more

Revaluation of Assets is an adjustment made in the carrying value of the fixed asset in case the company finds there is a difference between the current price and the market value of the asset. Generally, the value of the asset decreases due to depreciation but in some cases like inflation in the economy, it may increase. so, in order to know the correct value of the asset Revaluation is to be done.

Accounting standard allows two models.

Under the cost model, the carrying value of fixed assets equals their historical cost less accumulated depreciation and accumulated impairment losses.

For Example, Amazon ltd purchased a Plant for 5,00,000 on January 1, 2010, with a useful life of 10 years, and uses straight-line depreciation.

Here, the journal entry would be passed as

As the useful life of the asset is 20 years, so the yearly depreciation would be

5,00,000/10 i.e. 50,000.

So the accumulated depreciation at the end of December 31, 2012, would be 50,000×2= 1,00,000 and

the carrying amount would be 5,00,000-1,00,000= 4,00,000.

Under the Revaluation method, the assets are revalued at their current market value. If there is an increase in the value of an asset, the difference between the asset’s market value and current book value is recorded as a revaluation surplus.

For Example, Amazon ltd purchased an asset two years ago at a cost of 2,00,000. Depreciation @ 10% under straight-line method.

Therefore, the accumulated depreciation for two years would be 40,000,

i.e. 20,000 for a year.

Carrying cost of the asset = 1,60,000

Assuming, the company revalues its assets and finds that the worth of assets is 1,85,000.

Under this method, the company needs to record 25,000 as a surplus.

Accounting entry for the above will be

Depreciation calculated during the third year would be based on the new carrying value of 1,60,000.

Therefore, Depreciation for the 3rd year= 1,60,000/3

= 53,333.33

Accounting entry:

Alternatively, the incremental depreciation due to the revaluation i.e. 13,333.33 can be charged to the revaluation surplus account.

In case, if there is a revaluation loss, the entries would be interchanged.

In case of admission of a partner, the new partner may not agree with the value of assets as stated in the balance sheet, with time the values may have arisen or may have fallen, so in order to bring them to their correct values revaluation is done so that the new partner doesn’t suffer.

Where the assets and liabilities are to be shown in the books at the revised (new) values after the admission of the new partner.

The accounting entries are

2. For a decrease in the value of an asset

3. For transfer of profit on revaluation i.e. if the total of credit side exceeds the debit side.

4. For transfer of loss on revaluation i.e. if the total of debit side exceeds the credit side.

Note: If the total of both sides is equal it signifies that there is no profit or loss on the revaluation of assets. Hence no entry is to be passed.

After preparing for the journal entry, a revaluation ledger account is also prepared wherein the accounts carrying a debit balance are transferred to the debit side and the accounts carrying a credit balance are transferred to the credit side.

In the case of retirement of a partner, the same journal entries are to be passed as in the case of Admission of a partner for revaluation of assets.

Generally, the value of an asset decreases with time but it may increase in certain circumstances especially in inflationary economies.

Conclusion

An entity should do the revaluation of its assets because revaluation provides the present value of assets owned by an entity and upward revaluation is beneficial for the entity and hence the company can charge more depreciation on upward revaluation and can get tax benefits.

See less