Deleting a company in Tally Prime Tally prime is the latest version of Tally ERP software. In its functionality, it is slightly different from its previous version Tally ERP 9. Hence, the process of deleting a company in Tally Prime is different from that in Tally ERP 9. To delete a company in TallRead more

Deleting a company in Tally Prime

Tally prime is the latest version of Tally ERP software. In its functionality, it is slightly different from its previous version Tally ERP 9. Hence, the process of deleting a company in Tally Prime is different from that in Tally ERP 9.

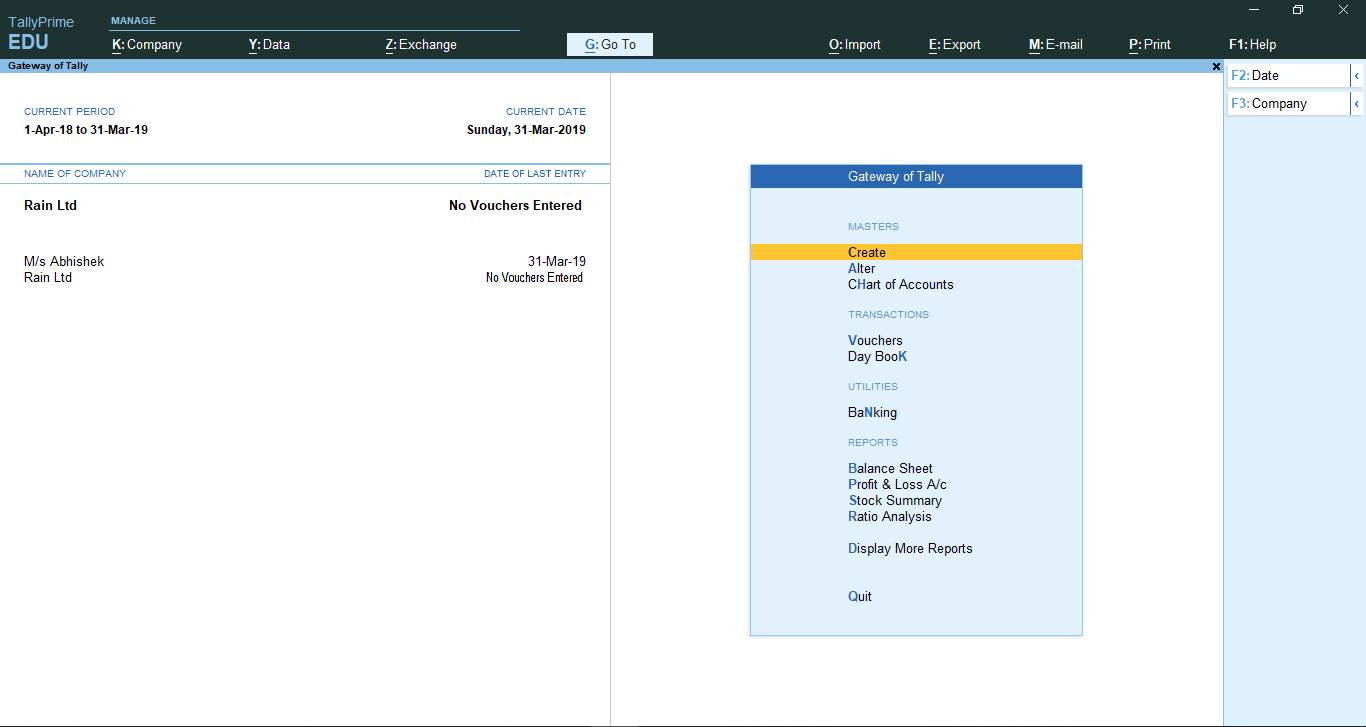

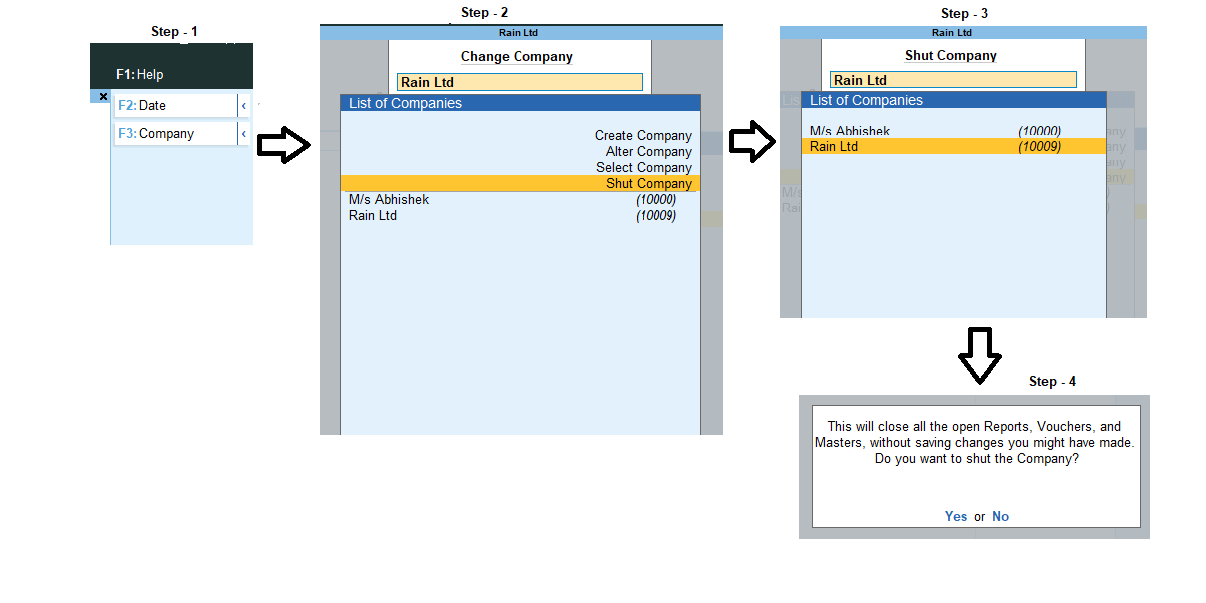

To delete a company in Tally Prime, you need to be in the Gateway of Tally window which looks the following:

On the right-hand side, there is a menu where is an option named ‘F3: Company’. You can either click on it or simply press F3.

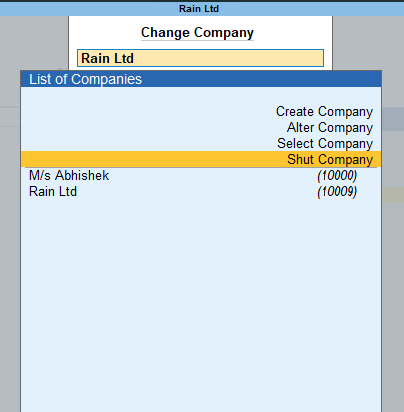

After clicking on the option, the Company menu where a list of names of the companies created in the Tally is there, along with some options above the company name list.

You have to select the option named, ‘Shut Company’. After clicking the option, the screen will display a ‘Shut Company’ menu.

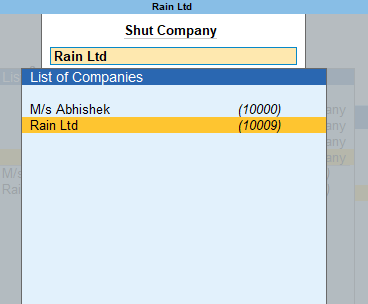

From there, you have to select the company you want to delete. Like in the example given, I have selected the company named Rain Ltd.

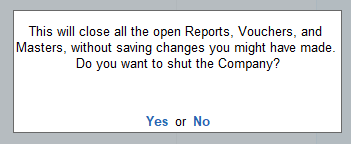

After selecting the name of the company you want to delete, a confirmation dialog box will appear.

You have to click OK and the company will be shut down or deleted.

In short, the steps to delete a company in Tally Prime are as follows:

Gateway of Tally –> Press F3 –> Select ‘Shut Company’ option –> Select the name of the company –> Confirm and press OK

Meaning of Workmen's Compensation Reserve Workmen compensation reserve is a reserve created to compensate the labourers and employees of a firm in case of an uncertain future event in the line with their work. For example, if a labourer or group of labourers get injured seriously while working on thRead more

Meaning of Workmen’s Compensation Reserve

Workmen compensation reserve is a reserve created to compensate the labourers and employees of a firm in case of an uncertain future event in the line with their work. For example, if a labourer or group of labourers get injured seriously while working on the premises of the firm, then they will be compensated from the money kept aside in the workmen’s compensation reserve.

Workmen’s compensation reserve is created using the profits of a business. The journal entry for the creation of workmen compensation reserve is as follows:

When a claim arises, the claim amount is transferred to Provision for workmen compensation claim A/c

Treatment of workmen compensation reserve in revaluation account

At the time of admission, retirement or death of partner or change in profit sharing ratio, the reserve is distributed among the old or existing partners or kept intact.

Workmen’s compensation reserve is also distributed among the old or existing partners subject to the claim arising on the reserve.

Here are the three situations:

The revaluation account comes into the picture only when the claim is more than the amount available in the reserve. For example, the claim is Rs. 20,000 but the amount in the reserve is only Rs. 15,000.

In such a case, the excess claim will be met by debiting the revaluation account.

The journal will as given below:

Since the revaluation account is debited, it is a loss and this loss will be written from old or existing partners’ capital in the old profit sharing ratio. The journal entry is given below:

See less