Journal Entry for Calls in Advance Calls in advance mean excess money received by the company than what has been called up. Calls in advance are treated as Current Liability and shown in the Balance Sheet on the liability side. Journal Entry will be : Here we will "Debit" Bank A/c as it will increaRead more

Journal Entry for Calls in Advance

Calls in advance mean excess money received by the company than what has been called up. Calls in advance are treated as Current Liability and shown in the Balance Sheet on the liability side.

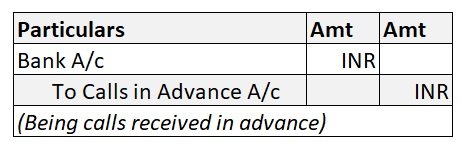

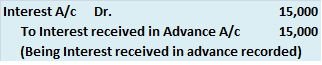

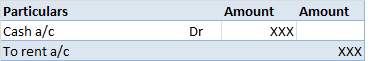

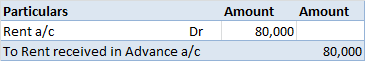

Journal Entry will be :

Here we will “Debit” Bank A/c as it will increase assets of the company and “Credit” Calls in Advance A/c because it will increase the company’s current liabilties.

For Example:

Mr.Z shareholder of ABC Ltd was allotted 2,000 equity shares of Rs.10 each. He paid call money at the time of allotment.

| On Application | Rs 5 |

| On Allotment | Rs 2 |

| On First and final call | Rs 3 |

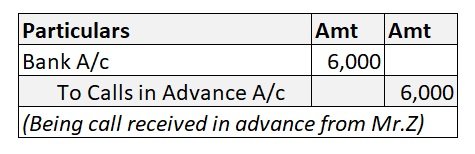

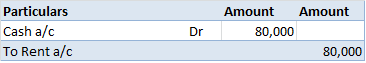

Journal Entry is as follows:

Here, the company received an excess amount of Rs.6,000 (2,000*3) from a shareholder Mr.Z who paid the call money in advance. ABC Ltd will record this under Calls in Advance A/c. While passing journal entry ABC Ltd will debit its Bank A/c by Rs.6,000 and credit calls in advance account by Rs.6,000.

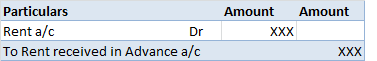

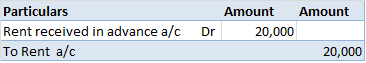

When share calls are called up, calls received in advance are adjusted. The company will hold only the required amount which will make allotted shares fully paid.

Once the amount is transferred to relevant call accounts, calls in advance account will be written off.

See less

When a company earns profit, it distributes a proportion of its income to its shareholders, and such distribution is called the dividend. The dividend is allocated as a fixed amount per share and shareholders receive dividends proportional to their shareholdings. However, a company can only pay diviRead more

When a company earns profit, it distributes a proportion of its income to its shareholders, and such distribution is called the dividend. The dividend is allocated as a fixed amount per share and shareholders receive dividends proportional to their shareholdings.

However, a company can only pay dividends out of its current year profits or retained earnings (profits of the company that are not distributed as dividend and retained in the business is called retained earnings) of previous years but not out of capital.

Dividends can be paid to shareholders in the form of

For companies, payment of regular dividends boosts the morale of the shareholders, investors trust the companies more and it reflects positively on the share price of the company.

For example, Nestle in India paid an interim dividend of 1100.00% to its shareholders in 2021.

The journal entry for dividend paid is

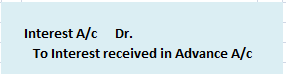

According to the golden rules of accounting-

According to modern rules of accounting-

For example-

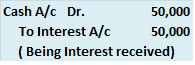

A company paid a dividend of 25 crores to its shareholders in cash, the journal entry according to golden rules will be-

(in crores)

(in crores)

See less