A Realisation account is prepared at the time of dissolution of the Partnership firm to ascertain profit or loss from the sale of assets and payment of liabilities of the firm. All assets that can be converted into cash (i.e. from which any value can be realised) and all external liabilities to be pRead more

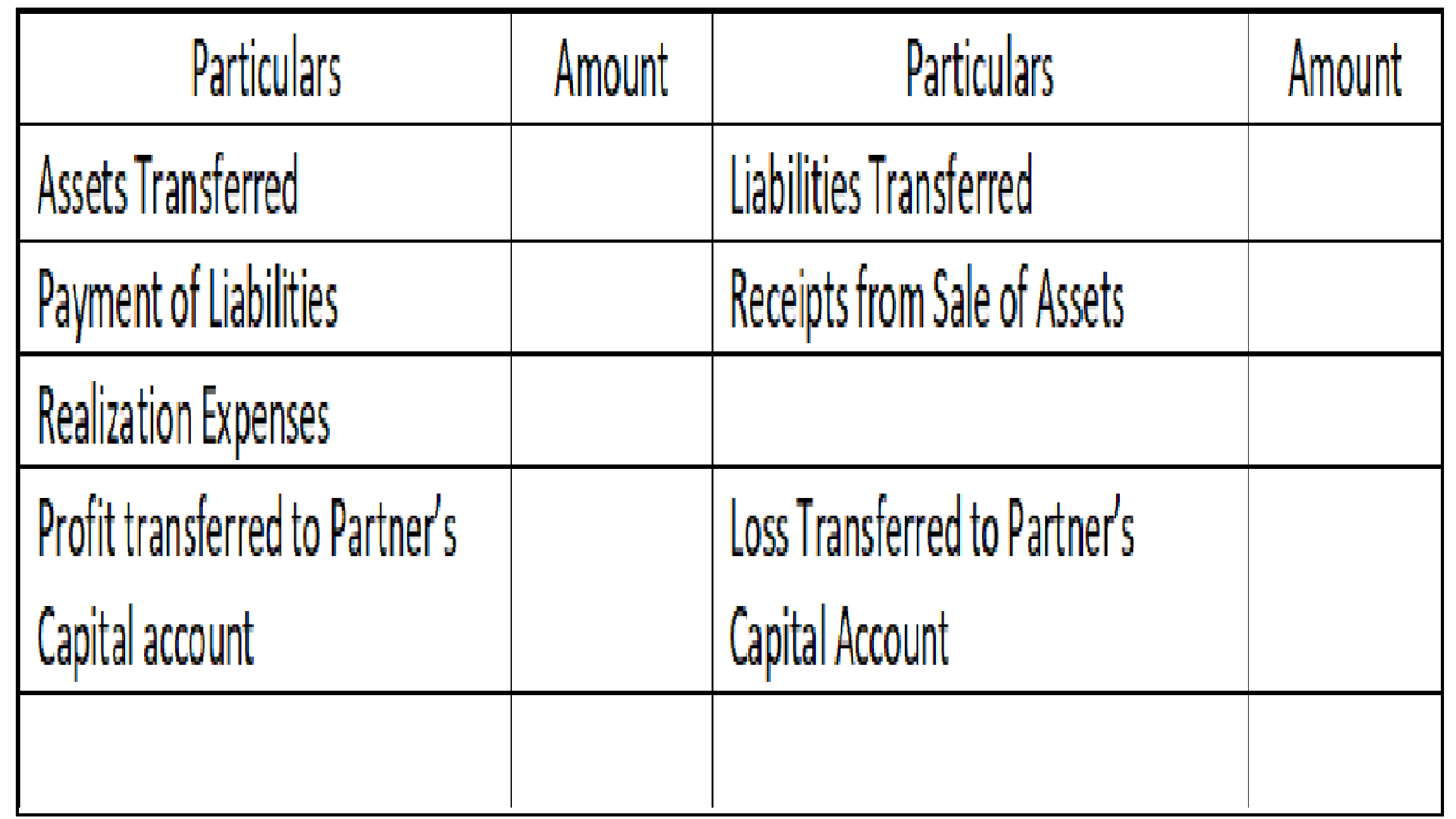

A Realisation account is prepared at the time of dissolution of the Partnership firm to ascertain profit or loss from the sale of assets and payment of liabilities of the firm. All assets that can be converted into cash (i.e. from which any value can be realised) and all external liabilities to be paid are transferred to the Realisation A/c.

So, Cash and Bank (already in liquid form), fictitious assets (doesn’t have any value to be realised), Partner’s Loan (internal liability) and Undistributed profits (not something that can be realised) are not included in the Realisation account.

DISSOLUTION OF PARTNERSHIP FIRM

It means the firm closes down its business and comes to an end. Simply, it means the firm will cease to exist in the future. As the firm is closing down, its assets are sold, liabilities are paid off, and the remaining amount (if any) is distributed among the partners.

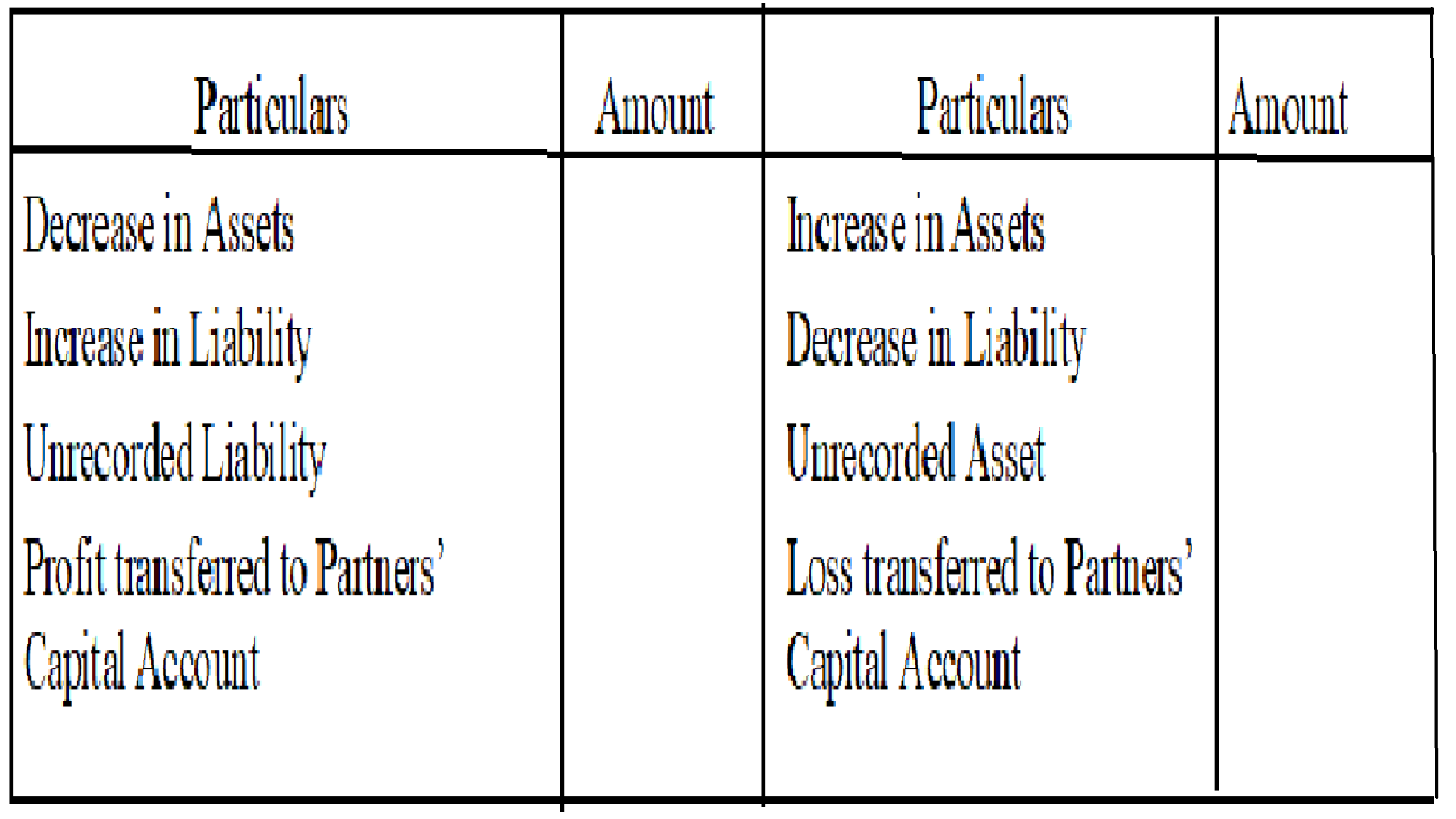

REALISATION ACCOUNT

This account is prepared only once, at the time of dissolution of the Partnership firm. It is opened to dispose of all the assets of the firm and make payments to all the external creditors of the firm.

It ascertains the profit earned or loss incurred on the realisation of assets and payment of liabilities.

Items not included in Realisation A/c

1. ASSETS

CASH AND BANK BALANCES are not included in the Realisation account as the purpose of the Realisation account is to sell assets to realise cash, but cash and bank are already in liquid form and thus, not included.

These are directly used for the payment of liabilities and if there is any remaining amount, then that amount is distributed among the partners.

FICTITIOUS ASSETS are huge expenses or losses that are written off over the years by writing off a portion of it every year for the next few years like accumulated losses, balance of Advertisement expenses, Preliminary expenses, Loss on the issue of Debentures, etc. They don’t have any physical existence or realisable value.

Since nothing can be realised from these assets they are not included in the Realisation account. These are transferred to the Partner’s Capital A/c.

2. LIABILITIES

PARTNER’S LOAN refers to the loan given to the firm by any partner of the firm.

Suppose, there are three Partners A, B and C. ‘C’ gave the firm a loan of $5,000. This $5,000 will be recorded as a Partner’s Loan and not just as a normal loan taken from an external party.

Since, Partner’s Loans are the internal obligation of the firm, they are not included in the realisation account instead a separate account is prepared to settle Partner’s Loan after all external liabilities are settled.

So, we can say in the Realisation account only external liabilities are included and paid.

UNDISTRIBUTED PROFITS are the Profits that are not distributed among the Partners like General Reserve, Reserve Fund, and Credit balance of P&L A/c.

They are not included in the realisation account as they can’t be sold as an asset neither they are any liabilities that should be paid. Undistributed profits belong to the Partners of the firm and thus, are transferred to Partner’s capital A/c.

See less

Meaning of Workmen's Compensation Reserve Workmen compensation reserve is a reserve created to compensate the labourers and employees of a firm in case of an uncertain future event in the line with their work. For example, if a labourer or group of labourers get injured seriously while working on thRead more

Meaning of Workmen’s Compensation Reserve

Workmen compensation reserve is a reserve created to compensate the labourers and employees of a firm in case of an uncertain future event in the line with their work. For example, if a labourer or group of labourers get injured seriously while working on the premises of the firm, then they will be compensated from the money kept aside in the workmen’s compensation reserve.

Workmen’s compensation reserve is created using the profits of a business. The journal entry for the creation of workmen compensation reserve is as follows:

When a claim arises, the claim amount is transferred to Provision for workmen compensation claim A/c

Treatment of workmen compensation reserve in revaluation account

At the time of admission, retirement or death of partner or change in profit sharing ratio, the reserve is distributed among the old or existing partners or kept intact.

Workmen’s compensation reserve is also distributed among the old or existing partners subject to the claim arising on the reserve.

Here are the three situations:

The revaluation account comes into the picture only when the claim is more than the amount available in the reserve. For example, the claim is Rs. 20,000 but the amount in the reserve is only Rs. 15,000.

In such a case, the excess claim will be met by debiting the revaluation account.

The journal will as given below:

Since the revaluation account is debited, it is a loss and this loss will be written from old or existing partners’ capital in the old profit sharing ratio. The journal entry is given below:

See less