The Income Tax 1961 does not provide any rate of depreciation specifically for cameras. But we can consider camera within the block of ‘Computer including software’ for which the rate of depreciation is 40% at WDV method. It is a general practice for non-corporates to charge depreciation at rates slRead more

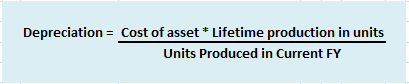

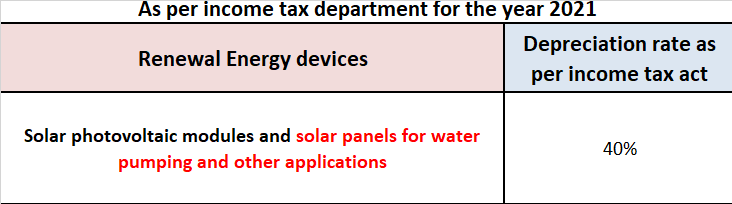

The Income Tax 1961 does not provide any rate of depreciation specifically for cameras. But we can consider camera within the block of ‘Computer including software’ for which the rate of depreciation is 40% at WDV method.

It is a general practice for non-corporates to charge depreciation at rates slightly lower than the rate provided by the Income Tax Act, 1961. But one cannot charge depreciation more than it.

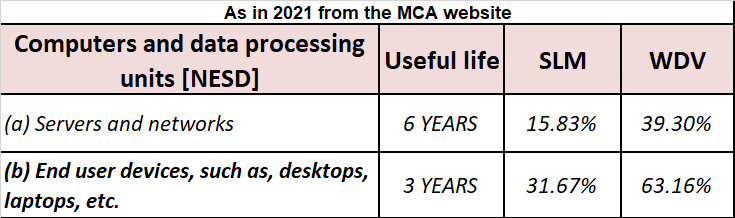

In the case of corporate, the rates for charging depreciation are provided by the Companies Act 2013, which is

- 20.58% WDV and 7.31% SLM for cameras to be used for the production of cinematography and motion pictures.

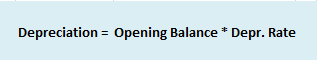

- 25.89% WDV and 9.50% SLM for cameras which is part of electrical installations and equipment (CCTV cameras).

Let’s take an example:

Mr X is a jewellery shop owner and has installed CCTV cameras on 1st April 2021, costing ₹ 40,000 at various points in his shop to ensure safety and security. Keeping in mind the Income-tax rates, his accountant decided to charge depreciation @ 30% p.a. on the CCTV cameras.

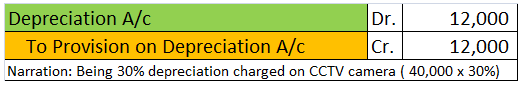

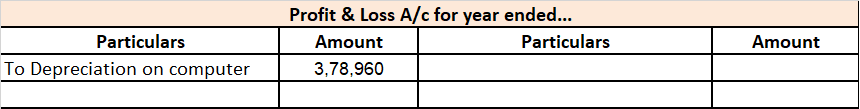

Following is the journal entry:

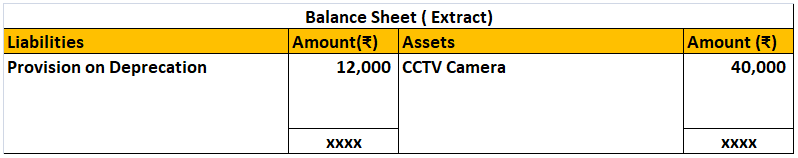

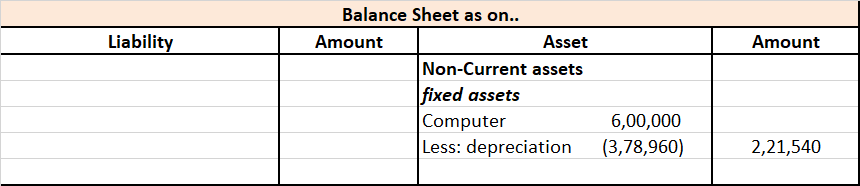

The balance sheet will look like this:

Today, mobile phones especially smartphones are an indispensable part of most businesses and they qualify as fixed assets as they usually last for more than a year. Being a fixed asset, the depreciation on mobile phones is to be provided. The rate of depreciation to be charged on mobile phones is 15Read more

Today, mobile phones especially smartphones are an indispensable part of most businesses and they qualify as fixed assets as they usually last for more than a year. Being a fixed asset, the depreciation on mobile phones is to be provided.

The rate of depreciation to be charged on mobile phones is 15% WDV* as per the Income Tax Act. The rates as per the companies act, 2013 are 4.75% SLM** and 13.91% WDV*.

*Written Down Value **Straight Line Method

A company has to charge depreciation on mobiles in their books as per the rates of Companies Act, 2013.

Any business or entity other than a company can choose the rate as per the Income Tax Act, 1961 which is 15% WDV. It is a general practice for non-corporates to charge depreciation in their books as per the rates of the Income Tax Act.

An important thing to know is that as per the Income Tax Act, 1961, mobile phones are treated as plants and machinery and the general rate of 15% is applied to it.

One may consider mobile phones as computers and charge depreciation at the rate of 40%. However, such a practice is not correct. Mobile phones are not considered equivalent to computers and there is case judgment given by Madras High Court which backs this consideration. The case is of Federal Bank Ltd. vs. ACIT (supra).

Therefore we are bound to this case judgment and should treat mobile phones as part of plant and machinery and charge depreciation on it accordingly for the time being.

See less