Deferred Revenue Expenditure Capital Expenditure Capital Gain Revenue Expenditure

I am assuming that you are asking the question with reference to the sole proprietorship business. In the case of a company, the rates as per the Companies Act, 2013 will apply. A sole proprietor can charge the depreciation in its books of accounts at whatever rate it wants but it should not be moreRead more

I am assuming that you are asking the question with reference to the sole proprietorship business. In the case of a company, the rates as per the Companies Act, 2013 will apply. A sole proprietor can charge the depreciation in its books of accounts at whatever rate it wants but it should not be more than the rates prescribed in the Income Tax Act, 1961.

It is a general practice to take depreciation rate lower than the Income Tax Act, 1961, so that the financial statements look good because of slightly higher profit. There is no harm in it as it is a sole proprietor.

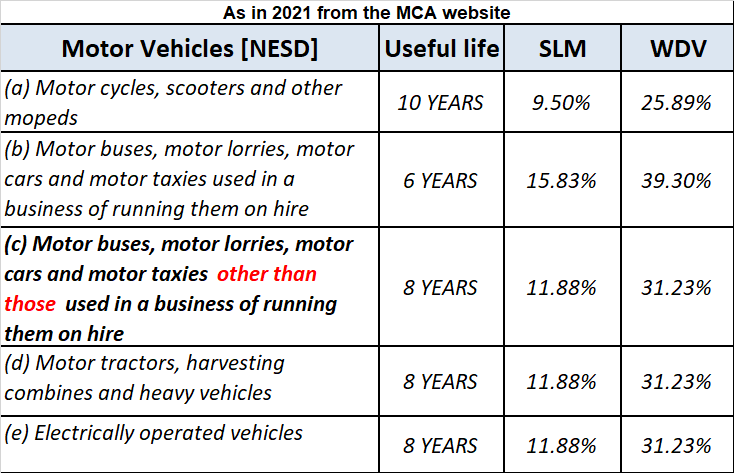

The Income Tax Act, 1961 has prescribed rates at which depreciation is to be given on different blocks of assets. For motor vehicles, the rates are as follows:

| Particulars | Rates (WDV) | |

| 1 | Motor buses, motor Lorries and motor taxis used in a business of running them on hire. | 30% |

| 2 | Motor buses, motor lorries and motor taxis used in a business of running them on hire, acquired on or after the 23rd day of August 2019 but before the 1st day of April 2020 and is put to use before the 1st day of April 2020. | 45% |

| 3 | Commercial vehicles to use in business other than running them on hire. | 40% |

Let’s take an example to understand the accounting treatment:-So a business can choose to charge depreciation at rates slightly lower than the above rates.

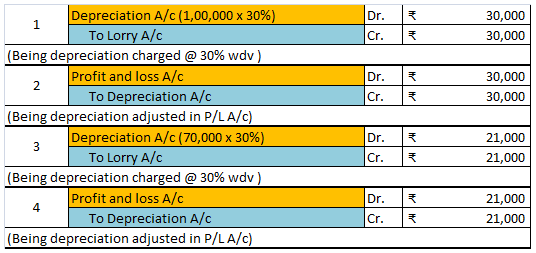

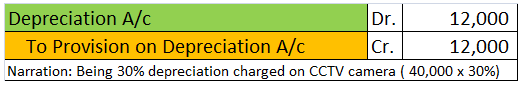

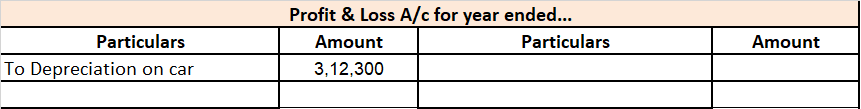

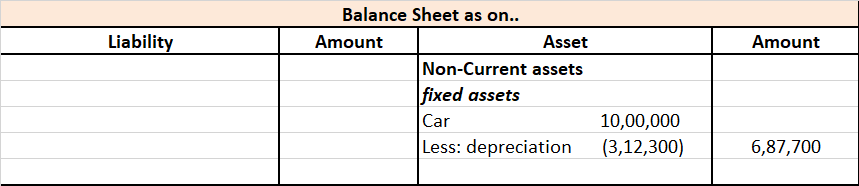

Mr A purchased a lorry for ₹1,00,000 on 1st April 2021 for his business, to be used for transportation of the finished goods. Now, Mr A decided to charge depreciation on the WDV method @30% (prescribed rate is 40%).

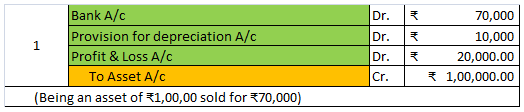

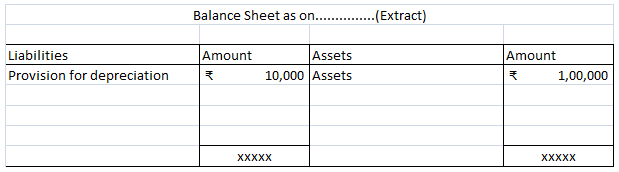

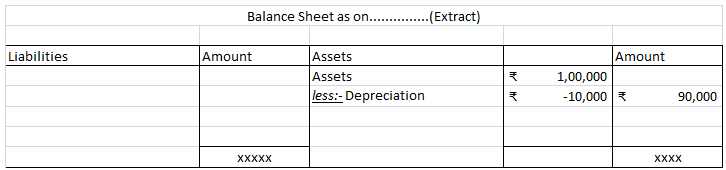

Following will be the journal entries.

I hope I was able to answer your question.

See less

The correct answer is 4. Revenue Expenditure. Depreciation is a non-cash expense and is charged on the fixed asset for its continuous use. Revenue expenditure is a day-to-day expense incurred by a firm in order to carry on its normal business. Depreciation is considered a revenue expense due to theRead more

The correct answer is 4. Revenue Expenditure.

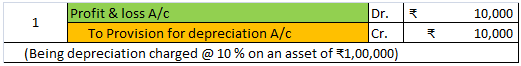

Depreciation is a non-cash expense and is charged on the fixed asset for its continuous use. Revenue expenditure is a day-to-day expense incurred by a firm in order to carry on its normal business. Depreciation is considered a revenue expense due to the regular use of the fixed assets.

Depreciation is the systematic and periodic reduction in the cost of a fixed asset. It is a non-cash expense. Mostly, depreciation is charged according to the straight-line method or written down method as per the policy of the company.

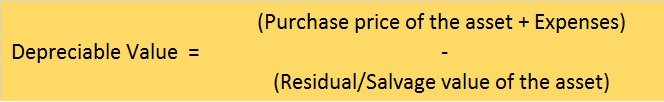

Depreciation is the systematic and periodic reduction in the cost of a fixed asset. It is a non-cash expense. Mostly, depreciation is charged according to the straight-line method or written down method as per the policy of the company. It is calculated as-

Depreciation = Cost of the asset – Scrap value / Expected life of the asset.

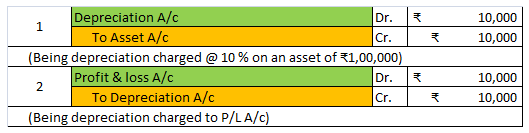

For Example, ONGC bought machinery at the beginning of the year for Rs 10,00,000

It charges depreciation @10% at the end of the year.

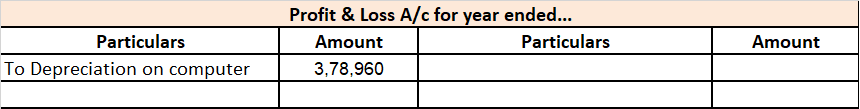

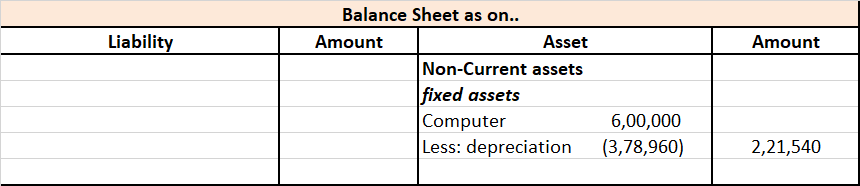

10,00,000 x 10/100 = 1,00,000 will be depreciation for the year and will be shown on the debit side of Profit & Loss A/c.

As the fixed assets are used in the day-to-day activities of the firm and hence the depreciation charged on it on the daily basis would be revenue in nature. so depreciation is said to be an item of revenue expenditure.

See less