Introduction A capital reduction account is an account used to pass entries related to the internal reconstruction of a company. During reconstruction, paid-up capital reduced is credited to this account; hence its name is capital reduction account. It is also known as the reconstruction account. TyRead more

Introduction

A capital reduction account is an account used to pass entries related to the internal reconstruction of a company. During reconstruction, paid-up capital reduced is credited to this account; hence its name is capital reduction account. It is also known as the reconstruction account.

Type of account

A capital reduction account is a temporary account open just to carry out internal reconstruction. It represents the sacrifices made by the shareholders, debenture holders and creditors. Also, any appreciation in the value of assets is credited to this account. It is closed to capital reduction when internal reconstruction is completed.

Entries passed through capital reduction account

When paid-up capital is cancelled.

When paid-up capital is cancelled, the share capital account is debited and the capital reduction account is debited as share capital is getting reduced.

| Share Capital A/c | Dr. | Amt |

| To Capital Reduction A/c | Cr. | Amt |

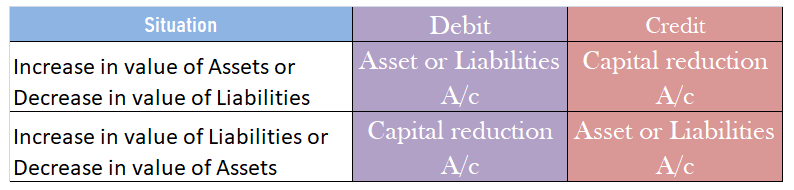

When assets and liabilities are revalued

At the time of internal reconstruction, the gain or loss on revaluation is transferred to the capital reduction account instead of the revaluation reserve.

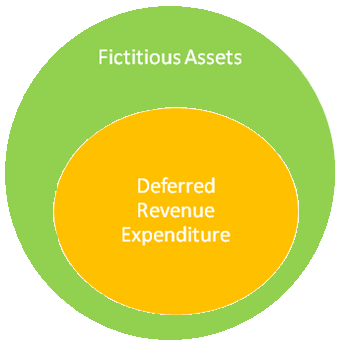

Writing off of accumulated losses and intangible assets

The credit balance of the capital reduction account is used to write off the accumulated losses and intangible assets like goodwill, patents etc which are unrepresented by capital. The capital reduction account is debited and profit and loss account and intangible assets accounts are credited.

| Capital Reduction A/c | Dr. | Amt |

| To Profit and loss A/c | Cr. | Amt |

| To Goodwill/ Patents A/c | Cr. | Amt |

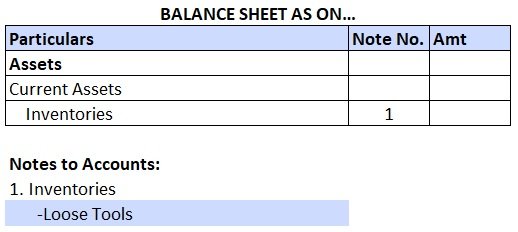

Treatment in books of account

The balance in the capital reduction account, whether debit or credit, it is transferred to the capital reduction account. Hence, it doesn’t appear on the balance sheet.

See less

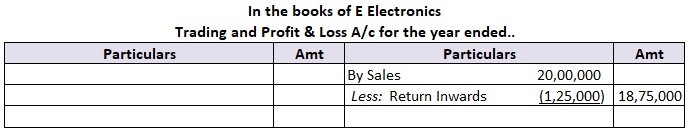

Before answering your question directly, let’s first understand the two terms, ‘Rent Outstanding’ and ‘Accounting Equation’. Accounting Equation Accounting Equation depicts the relationship between the following items of a business: Assets, Liabilities and Owner’s Equity ( Capital ) It is a simple fRead more

Before answering your question directly, let’s first understand the two terms, ‘Rent Outstanding’ and ‘Accounting Equation’.

Accounting Equation

Accounting Equation depicts the relationship between the following items of a business:

It is a simple formula that implies that the total assets of a business are always equal to the sum of its liabilities and Owner’s Equity (Capital).

ASSETS = LIABILITIES + CAPITAL OR A = L + E

It is also known as the balance sheet equation.

This equation always holds good due to the double-entry system of accounting i.e. every event has a dual effect on items of the balance sheet.

Outstanding Rent

We know rent is an expense for a business and rent outstanding means that rent is due, not paid which implies it is a liability which the business has to settle.

Hence Rent Outstanding is subtracted from the capital balance and added to liabilities.

Let’s take an example to see how rent outstanding affects the accounting equation. Suppose a business has the following figures:

Assets – Rs: 3,00,000

Capital – Rs: 2,00,000

Liabilities – Rs: 1,00,000

Assets = Liabilities + Capital

3,00,000 = 1,00,000 + 2,00,000

Now if Rent outstanding of Rs: 20,000 arises, this will happen:-

Assets – Rs: 3,00,000

Capital – Rs: 2,00,000 – Rs: 20,000 = Rs: 2,80,000

Liabilities – Rs: 1,00,000 + Rs: 20,000 = Rs: 1,20,000

Assets = Liabilities + Capital

3,00,000 = 1,20,000 + 2,80,000.

Hence, when rent outstanding arises, it increases the liability and decreases the Capital by the same amount. Therefore both the sides tally and the accounting equations holds good.

Rent Outstanding is shown on the liabilities side of the balance sheet. Also, the rent outstanding of the current year is shown in the debit side profit and loss account and we know the balance of the P/L account if profit, is added to Capital and in case of loss it is subtracted from Capital. Hence, the rent outstanding is subtracted from the capital.

I hope my answer was useful to you.

See less