Let the business in our example be X Trading. The 15 transactions are as follows: 1st April - X Trading started its business with Rs. 10,000 cash and furniture of Rs. 5,000. 5th April - Purchased 1,000 units of goods for Rs. 1,000 in cash from Ram. 10th April – Bought stationery for Rs. 100 in cash.Read more

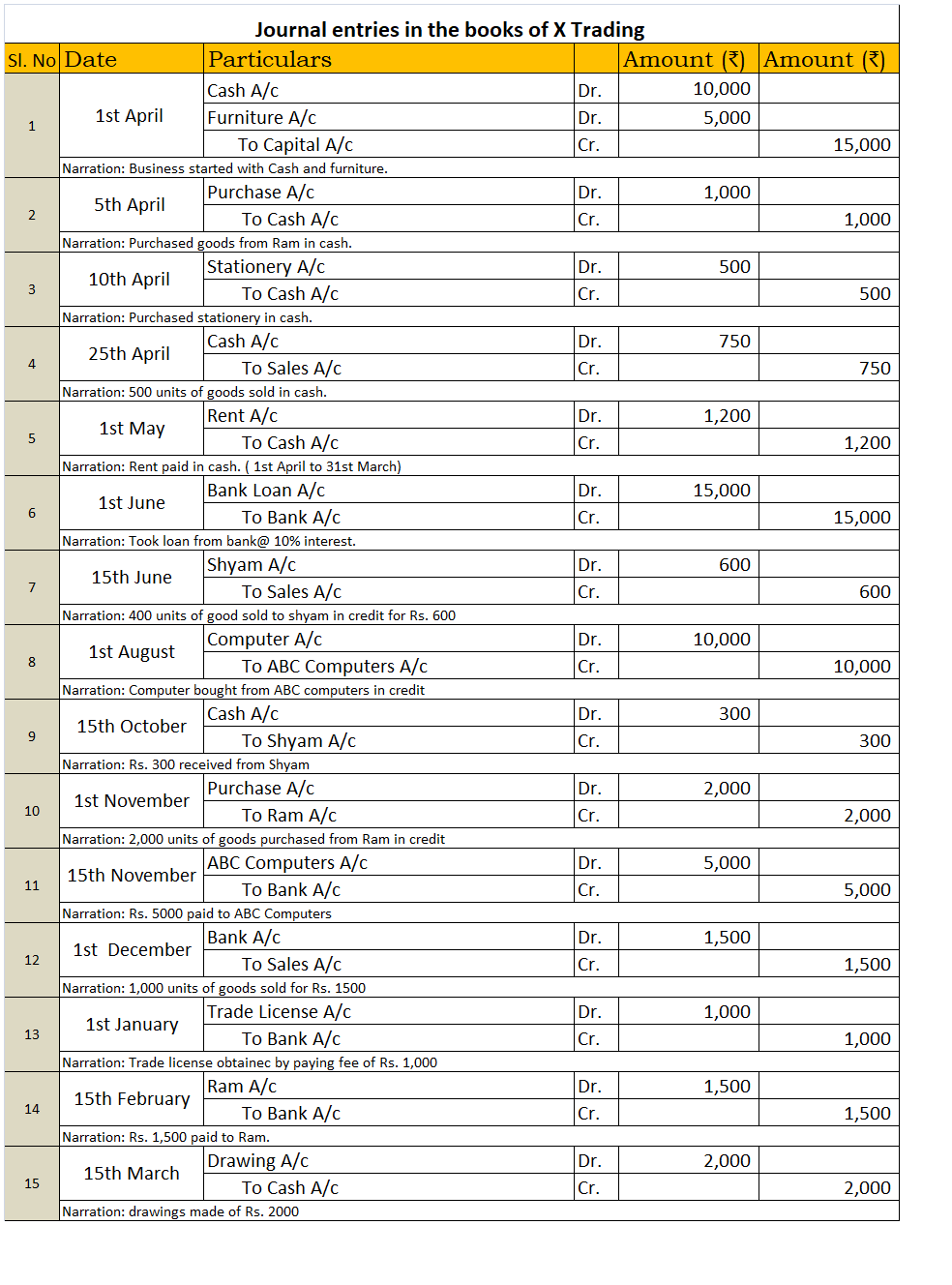

Let the business in our example be X Trading. The 15 transactions are as follows:

- 1st April – X Trading started its business with Rs. 10,000 cash and furniture of Rs. 5,000.

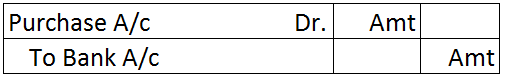

- 5th April – Purchased 1,000 units of goods for Rs. 1,000 in cash from Ram.

- 10th April – Bought stationery for Rs. 100 in cash.

- 25Th April – Sold 500 goods for Rs. 750 in cash.

- 1st May – Paid a rent of Rs. 1200 ( 1st April to 31st March)

- 1st June – Took a loan of Rs. 15,000 from the bank at interest@10%.

- 15Th June – Sold 400 goods for Rs. 600 to Shyam in credit.

- 1st August – Bought a computer for Rs. 10,000 in from ABC Computers in credit.

- 15th October – Received Rs. 300 from Shyam in cash.

- 1st November – Purchased 2,000 units of goods for 2,000 from Ram in credit.

- 15th November – Paid Rs. 5,000 to ABC Computers through cheque.

- 1st December – Sold 1,000 units of goods for Rs. 1,500. Received cheque as payment.

- 1st January – Obtained Trade license (valid for 5 years) by paying fees of Rs. 1000 through online bank transfer.

- 15Th February – Paid Rs. 1,500 to Ram. Through cheque.

- 15Th March – Drawings made of Rs. 2000 in cash.

We will prepare the journal, ledgers and the trial balance from the above transactions.

Journal

Journal is known as the book of primary entry or book of original entry. It is because every transaction is recorded in form of journal entries in the journal. Every journal entry affects at least two accounts (dual effect). A transaction has to be a monetary transaction otherwise it cannot be recorded as a journal entry.

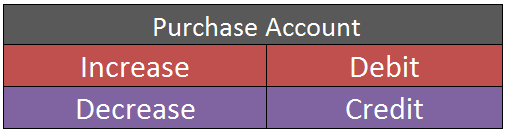

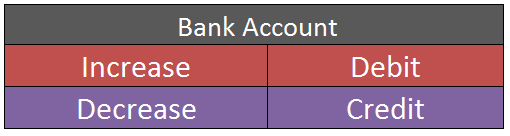

The procedure of recording transactions as journal entries is simple if we follow the modern rules of accounting.

So first we have to identify which and what type of account does a transaction affect. The types of accounts are:

- Asset – Debit in case of increase Credit in case of decrease.

- Liabilities – Debit in case of decrease Credit in case of increase.

- Capital – Debit in case of decrease Credit in case of increase.

- Expense – Debit in case of increase Credit in case of decrease.

- Income – Debit in case of decrease Credit in case of increase.

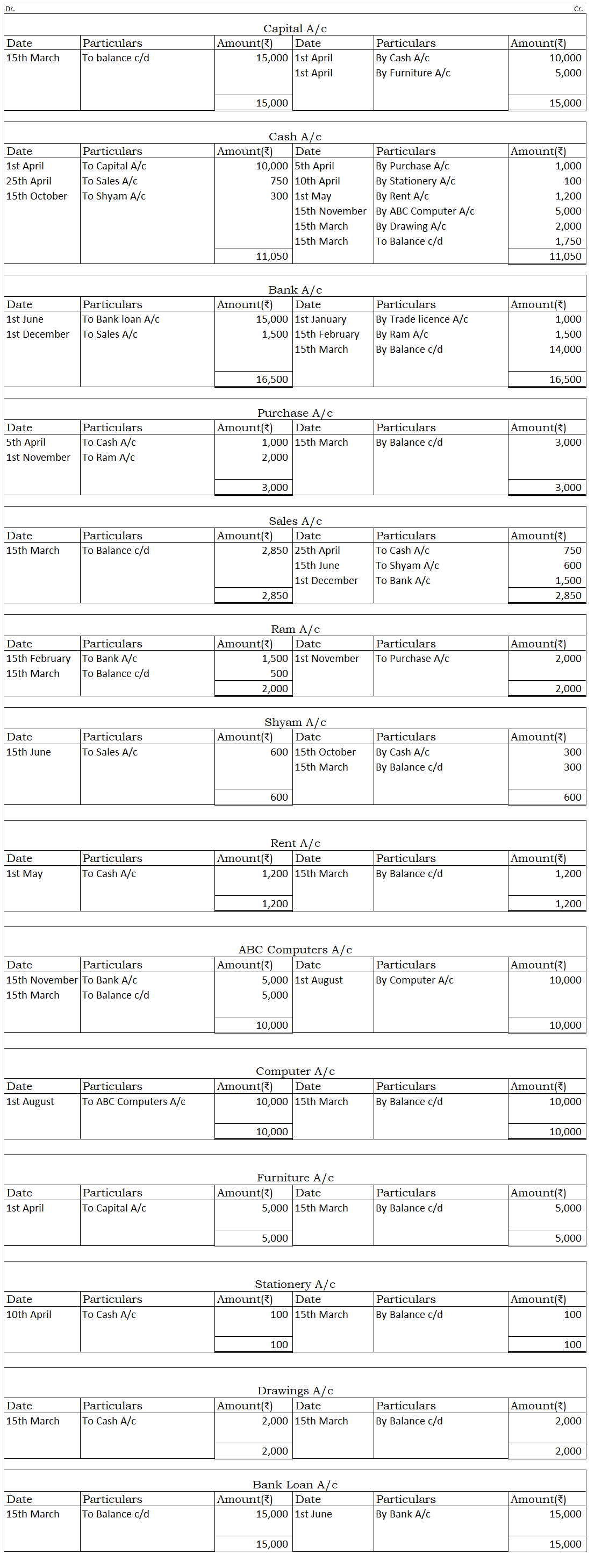

Ledger

Ledgers are known as the books of principal entry or book of final entry. All the journal entries recorded in the journal are posted to the ledgers. A Ledger is where the entries related to a particular account are recorded. For example, all the transactions related to salary will be recorded in the salary account ledger.

It is very important to prepare the ledger to arrive at the balance of each account in the books of concern so that it can prepare its trial balance.

The procedure of posting journal entries in the ledger account is done is as follows:

The ledgers are as follows:

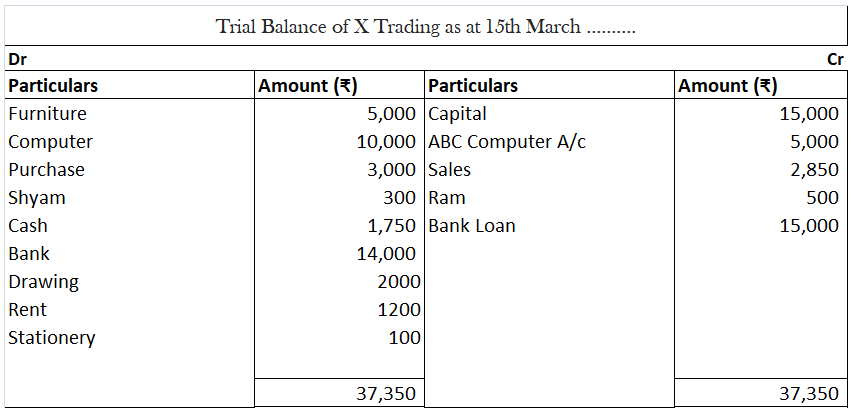

Trial Balance

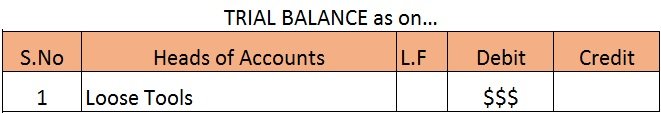

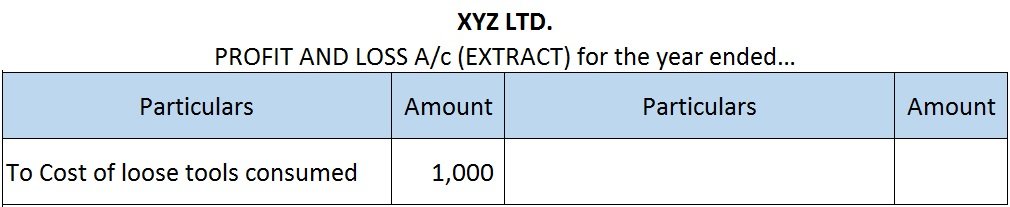

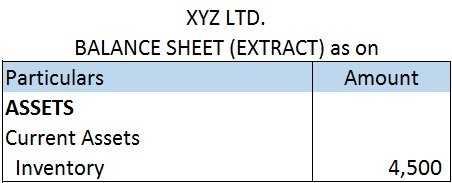

The trial balance is not a part of the books of accounts. It is just a statement prepared to check the arithmetical accuracy of the books of the accounts. It also helps to know about the omission and posting mistakes. It is prepared after the ledger accounts have been drawn and their balances have been ascertained.

The balance of all the ledger accounts is posted on either side of the trial balance. Debit balance of the account on the debit side and credit balance of the account on the credit side.

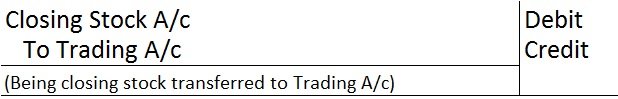

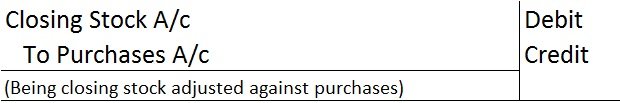

Also, the closing stock from the financial statements of the previous year is posted on the debit side of the trial balance as opening stock to account for the stock with the business at the beginning of the financial year.

Following is the trial balance of X trading:

20 Journal Entries Journal is the book of initial entry, hence the transactions are at first recorded in the journal by the way of journal entries. Journal entries are made as per the double entry system of accounting, where for each transaction one account is debited and another account is creditedRead more

20 Journal Entries

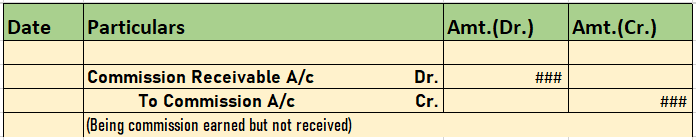

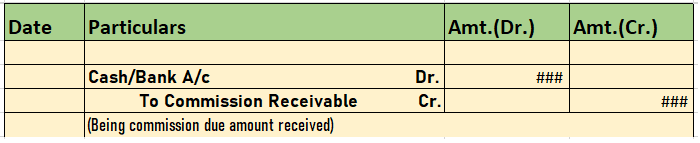

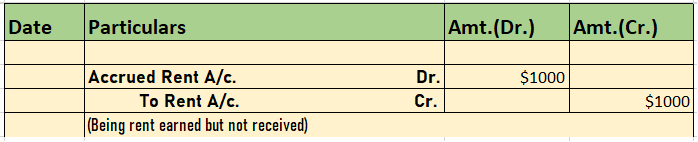

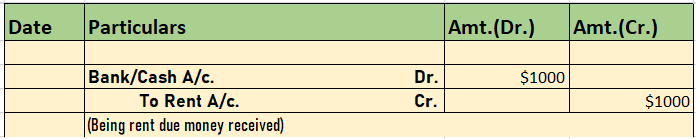

Journal is the book of initial entry, hence the transactions are at first recorded in the journal by the way of journal entries.

Journal entries are made as per the double entry system of accounting, where for each transaction one account is debited and another account is credited.

In the case of compound journal entries, one set of accounts is debited and one set of accounts is credited.

The amount of debit and credit always remains the same.

For example, when cash is introduced into a business, it affects two accounts: Cash A/c and Capital A/c. The accounts are debited and. credited as per the golden rules of accounting.

The journal entries which I have provided are based on the following transactions and events:

Journal Entries

The journal entries based on the above are as follows:

Ledgers

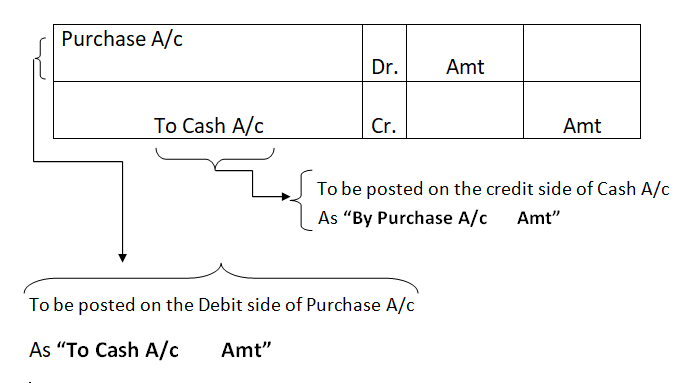

Ledger is known as the book of final entry. It is the book where the transactions related to a specific account are posted. This posting of transactions is done from journal entries.

The posting of journal entries into the ledger is performed in the following way:

The journal entry of cash sales is :

Here, Cash A/c is debited to Sales A/c. So, in the Cash A/c ledger, posting will be made on the debit side as “To Sales A/c”

In the Sales A/c ledger, the posting will be made on the credit as “By Cash A/c” because Sales A/c is credited to Cash A/c

For creating ledgers, journal entries are a prerequisite.

Now, the ledgers to be created as per the journal entries made above are as follows:

The account ledgers are as follows:

Trial Balance

A trial balance is a statement that is prepared to check the arithmetical accuracy of books of accounts.

In this statement, the total of all accounts having debit balance and the total of all accounts having credit balance is computed. If the total of debit and credit matches, then it can be said that the books of accounts are arithmetically accurate.

Here also we have prepared the trial balance by computing the total of accounts having debit balances and the total of accounts having credit balances

The debit column total and credit column total are matching. Hence, we can say that the books of accounts we have prepared are arithmetically accurate.

Note: Matt A/c and Uday A/c have not appeared in the trial balance because they do not have any carrying balance.

See less