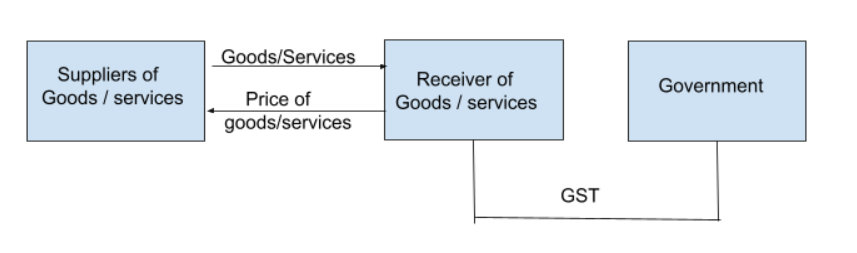

Under GST, Input Tax Credit (ITC) refers to the tax already paid by a person on input, which is available as a deduction from tax payable on output. This means that if you have paid tax on some purchases, then at the time of paying tax on the sale of goods, you can reduce it by the amount you alreadRead more

Under GST, Input Tax Credit (ITC) refers to the tax already paid by a person on input, which is available as a deduction from tax payable on output. This means that if you have paid tax on some purchases, then at the time of paying tax on the sale of goods, you can reduce it by the amount you already paid on purchase and pay only the balance amount.

EXAMPLE

Suppose Ashok purchased goods worth Rs 100 while paying tax at 10%, that is Rs 10. He now sold the goods for Rs 200, with a tax payable of Rs 20. Now, Ashok can avail input tax credit of Rs 10 that he already paid for the purchase and hence the net tax payable is Rs 10 (20-10).

METHOD OF UTILISATION OF ITC

The central government collects CGST, SGST, UTGST or IGST based on whether the transactions are done intrastate or interstate.

The amount of input tax credit on IGST is first used for paying IGST and then utilised for the payment of CGST and SGST or UTGST. Similarly, the amount of ITC relating to CGST is first utilised for payment of CGST and then for the payment of IGST. It is not used for the payment of SGST or UTGST. Meanwhile, the amount of ITC relating to SGST is utilised for payment of SGST or UTGST and then for the payment of IGST. Such amounts are not used for payment of CGST.

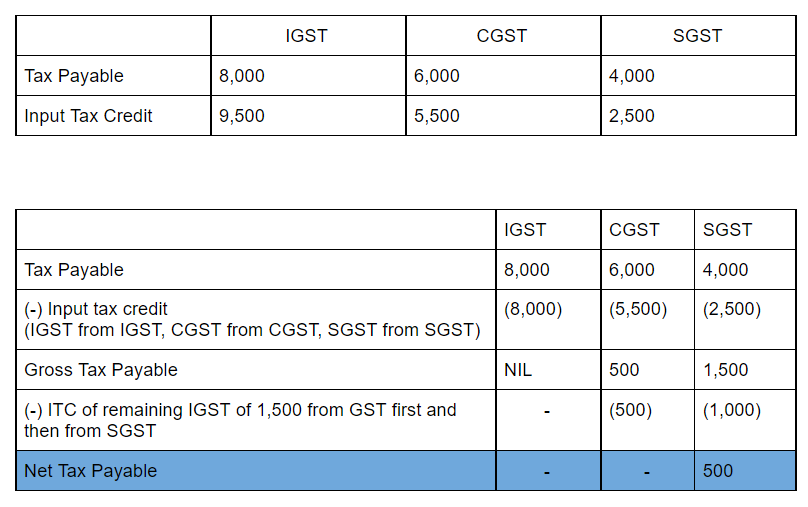

We can see how Input Tax Credit is used from the below example and table:

To determine if a person is a resident in India as per the Income Tax Act 1961, he has to fulfil any of the 2 following conditions; Condition A Stay in India for 182 days or more in the previous year, or Stay in India for 60 days or more in the previous year and another 365 days or more in the 4 yeaRead more

To determine if a person is a resident in India as per the Income Tax Act 1961, he has to fulfil any of the 2 following conditions;

Condition A

The second condition above is not applicable if he is an Indian citizen leaving India for the purpose of employment, or he is a member of the crew of an Indian ship, or he is only coming to India on a visit.

If he fails to fulfil either of the two conditions, then he is termed as a non-resident.

In India, a resident person can be classified into two:

Condition B

A resident is a resident and ordinarily resident if (B):

If a person satisfies any one condition of (A) but does not follow all conditions of (B), then he is termed as a resident but not ordinarily resident.

EXAMPLE

If Nithin is living in India for 190 days in the previous year and was a resident for the previous two years only staying for 400 days in the previous 7 years, then he fulfils condition (A) but not both conditions of (B) and hence he is a resident but not ordinarily resident.

See less