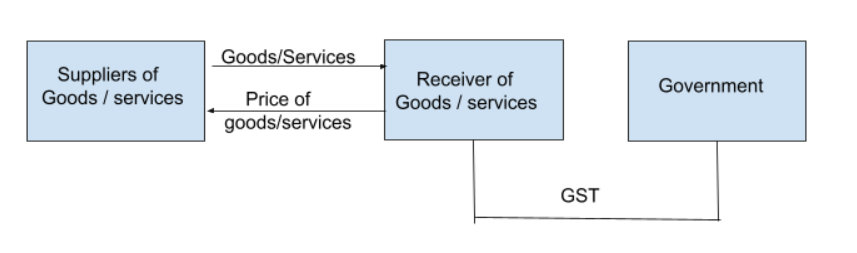

Under GST, Input Tax Credit (ITC) refers to the tax already paid by a person on input, which is available as a deduction from tax payable on output. This means that if you have paid tax on some purchases, then at the time of paying tax on the sale of goods, you can reduce it by the amount you alreadRead more

Under GST, Input Tax Credit (ITC) refers to the tax already paid by a person on input, which is available as a deduction from tax payable on output. This means that if you have paid tax on some purchases, then at the time of paying tax on the sale of goods, you can reduce it by the amount you already paid on purchase and pay only the balance amount.

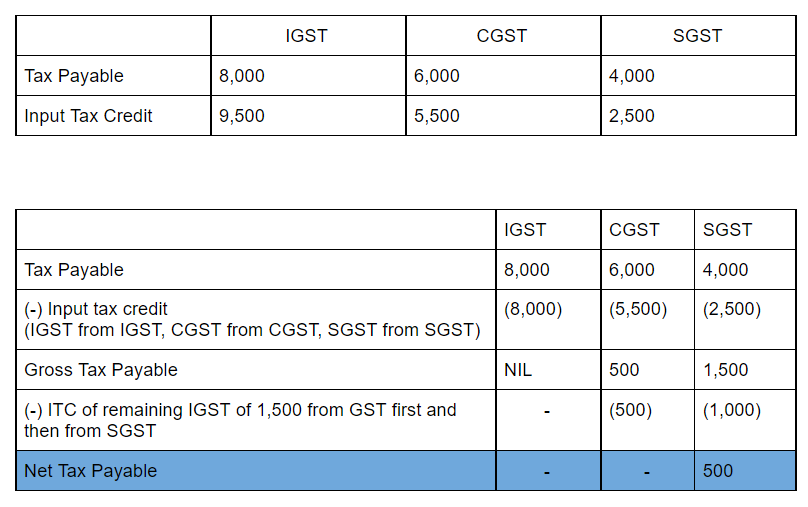

EXAMPLE

Suppose Ashok purchased goods worth Rs 100 while paying tax at 10%, that is Rs 10. He now sold the goods for Rs 200, with a tax payable of Rs 20. Now, Ashok can avail input tax credit of Rs 10 that he already paid for the purchase and hence the net tax payable is Rs 10 (20-10).

METHOD OF UTILISATION OF ITC

The central government collects CGST, SGST, UTGST or IGST based on whether the transactions are done intrastate or interstate.

The amount of input tax credit on IGST is first used for paying IGST and then utilised for the payment of CGST and SGST or UTGST. Similarly, the amount of ITC relating to CGST is first utilised for payment of CGST and then for the payment of IGST. It is not used for the payment of SGST or UTGST. Meanwhile, the amount of ITC relating to SGST is utilised for payment of SGST or UTGST and then for the payment of IGST. Such amounts are not used for payment of CGST.

We can see how Input Tax Credit is used from the below example and table:

Introduction Income tax means the tax charged on the income of a person which the person has earned during a financial year. As per the Income-tax act, 1961, the income tax on income earned during a financial year is assessed in the following financial year and tax is to be paid on the assessed incoRead more

Introduction

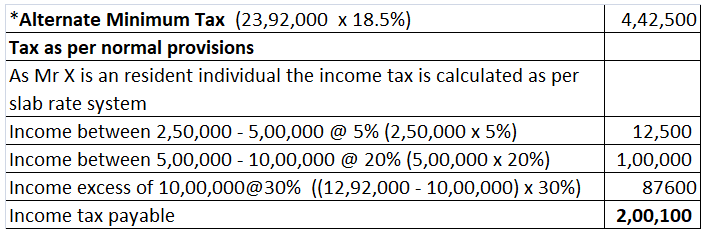

Income tax means the tax charged on the income of a person which the person has earned during a financial year. As per the Income-tax act, 1961, the income tax on income earned during a financial year is assessed in the following financial year and tax is to be paid on the assessed income if payable.

The year in which the income is earned is called the Previous Year and the following year in which the previous year’s income is assessed is known as the Assessment Year

Steps involved in the computation of Income-tax of a person:

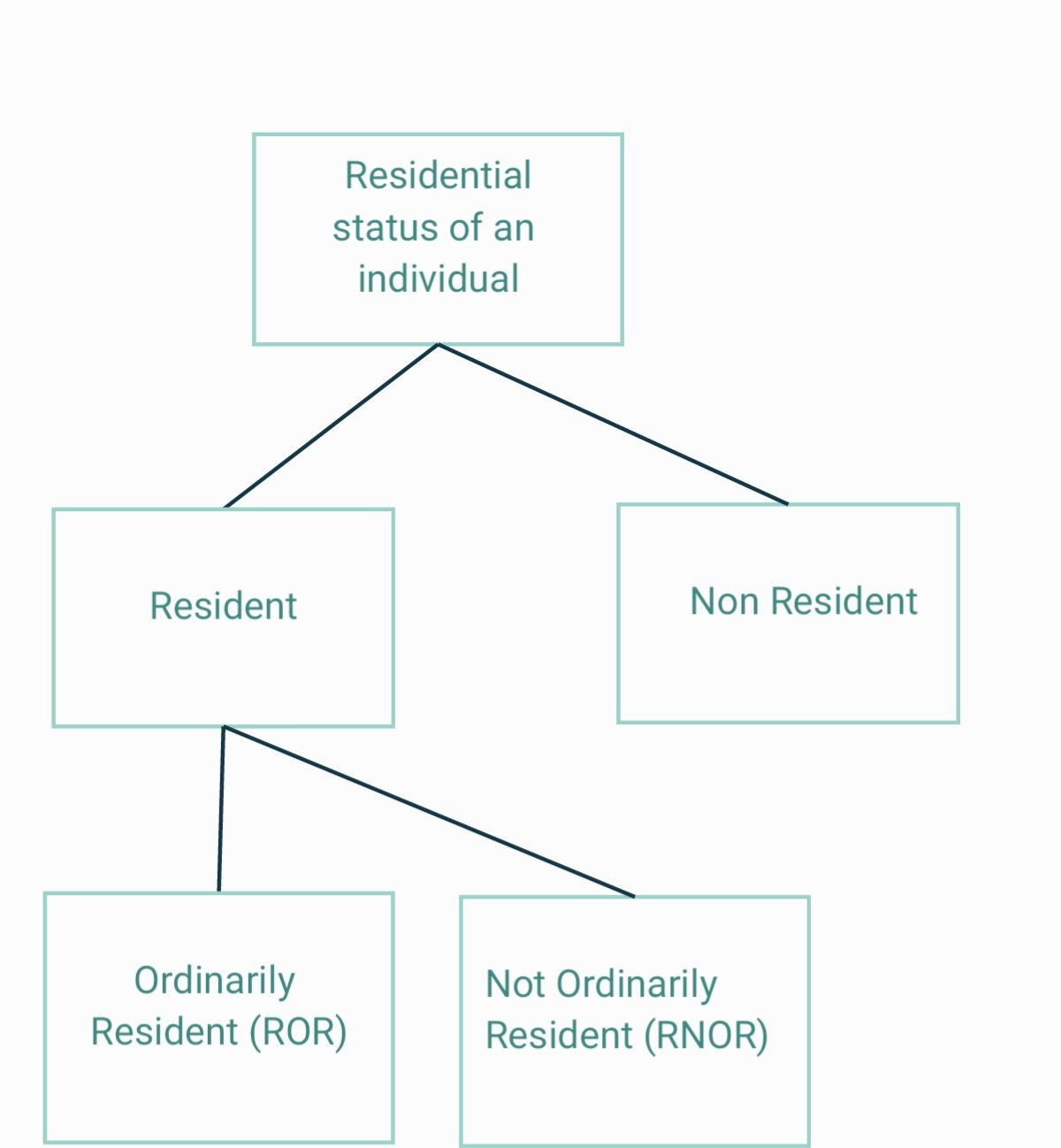

Determination of residential status of the person

The residential status of a person is of great significance for ascertaining the taxability of a person’s income as per the Income-tax act, 1961. As per the act, a person can fall into one of the following criteria:-

Classification and computation of income under the five heads of income

Now, a person’s income can be from various sources. As per section 14 of the Income-tax act, there are five main heads of income for computation of income tax:

Income under each head is to be computed as per provisions of the Income-tax Act, 1961.

Clubbing of income of spouse, minor child etc

Some individual taxpayers divert some portion of their income to their spouses and minor child in order to reduce their tax liability as the slab rate of income tax for individuals is progressive.

Such diverted income is to be clubbed with the income of the assessee as per the provisions of the Income-tax act.

Set-off and carry forward of losses

Losses suffered under the heads of the income like ‘Profit and Gains from Business and Profession’, ‘Income from House property’ can be set off against the income earned under other heads as per provision of the act.

If set off is not possible in the current assessment year then the loss can be carried forward to the next assessment year.

Computation of Gross Total Income

Gross Total Income is arrived at by computing the total of income under all five heads of income after giving necessary deductions as applicable under each head of income.

Deductions from Gross Total Income to arrive at Total Income

Income tax act, 1961 allows specific deduction from the Gross Total Income under sections 80C to 80U. These deductions are provided to encourage certain kinds of investments like life insurance premiums etc and provide relief on certain spending like medical expenses, interest expenses on home loans etc which leads to the overall welfare of the people.

After allowing the deductions from Gross Total Income, we arrive at Total Income.

Application of the rates of taxes on total income

Tax is calculated at a rate on the total income. The rate and calculation of income tax depend on the type of assessees.

Individuals and HUFs

For individuals who are below the age of 60 years and HUFs:

For individuals over 60 years and 80 years of age, the basic exemption limit is ₹3,00,000 and ₹5,00,000 respectively.

Also, as per section 115BAC, individuals and HUFs have the option to choose an alternative slab rate of tax as per which the income tax is charged at concessional rates. But, the various exemptions and deductions like housing rent allowance, leave travel concession, standard deduction on salary income cannot be availed. This slab rate system was introduced recently to reduce the complexity of filling IT returns by small taxpayers.

Rates of tax related to other types of assessees is not provided for sake of simplicity.

Advance tax and tax deducted at source

After calculating the tax on total income as per specified rates, the income tax amount is to be reduced by the advance tax and tax deducted at the source.

Tax payable/ Tax refundable

After performing all the steps above, we arrive at Income tax payable or tax refundable.

See less