TDS stands for Tax Deducted at Source It is the tax deducted on certain incomes as specified under sections 192 to 194N of the Income Tax Act,1961 by the person who is responsible to pay such income. For example, an employer is liable to deduct the TDS on the salary paid to the employee subject to tRead more

TDS stands for Tax Deducted at Source

It is the tax deducted on certain incomes as specified under sections 192 to 194N of the Income Tax Act,1961 by the person who is responsible to pay such income.

For example, an employer is liable to deduct the TDS on the salary paid to the employee subject to the provisions of the Income Tax Act, 1961.

TDS is deducted either,

- at the time of payment

OR

- At time of credit to the account of the payee or at the time of payment; whichever is earlier

We know that Income tax liability is calculated after the income for a year is earned. In the next year, which is called the Assessment Year, income tax payable is calculated on the income earned in the Previous Year

For example:

Year 2021-2022 – This year (Previous Year) – Income is earned here.

Year 2021-2022 – Next Year (Assessment Year) – Income tax is assessed here.

But, the government collects the income tax from the income of the assessee in the Previous Year itself by the following ways:

- TDS – Tax Deducted at Source

- TCS – Tax Collected at Source

- Advance Tax

Some of the most common sections are given below:

- Section 192 – Salary

- Section 194A – Interest other on securities deposits with the bank, post office etc) – @10%

- Section 194B and 194BB – Winning from lotteries, crossword puzzle – @30%

- Section 194 – DA – Payment in respect of Life Insurance Policy – @5%.

So, according to sections 192 to 194N, some amount of income tax is deducted from the income of the assessee in the Previous Year itself.

In the Assessment Year, the assessee also gets a tax credit for the TDS i.e. the Income Tax liability gets reduced by the amount of Tax Deducted at Source in the Previous Year.

See less

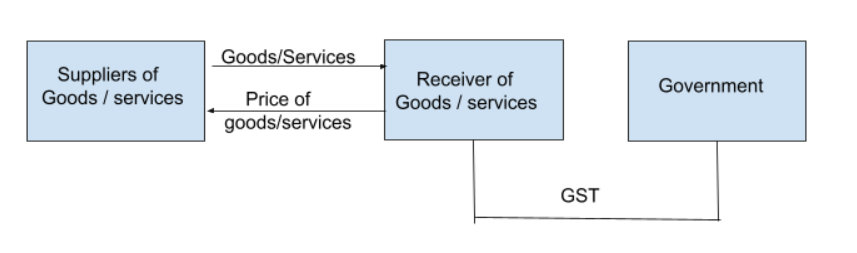

Under GST, Input Tax Credit (ITC) refers to the tax already paid by a person on input, which is available as a deduction from tax payable on output. This means that if you have paid tax on some purchases, then at the time of paying tax on the sale of goods, you can reduce it by the amount you alreadRead more

Under GST, Input Tax Credit (ITC) refers to the tax already paid by a person on input, which is available as a deduction from tax payable on output. This means that if you have paid tax on some purchases, then at the time of paying tax on the sale of goods, you can reduce it by the amount you already paid on purchase and pay only the balance amount.

EXAMPLE

Suppose Ashok purchased goods worth Rs 100 while paying tax at 10%, that is Rs 10. He now sold the goods for Rs 200, with a tax payable of Rs 20. Now, Ashok can avail input tax credit of Rs 10 that he already paid for the purchase and hence the net tax payable is Rs 10 (20-10).

METHOD OF UTILISATION OF ITC

The central government collects CGST, SGST, UTGST or IGST based on whether the transactions are done intrastate or interstate.

The amount of input tax credit on IGST is first used for paying IGST and then utilised for the payment of CGST and SGST or UTGST. Similarly, the amount of ITC relating to CGST is first utilised for payment of CGST and then for the payment of IGST. It is not used for the payment of SGST or UTGST. Meanwhile, the amount of ITC relating to SGST is utilised for payment of SGST or UTGST and then for the payment of IGST. Such amounts are not used for payment of CGST.

We can see how Input Tax Credit is used from the below example and table:

See less