No, Goodwill cannot be called a fictitious asset. A fictitious asset does not have any physical existence or realizable value. Although it is recorded in the assets column, it is not really an asset, rather it is an expense that is incurred during the accounting period. Its benefit, however, is realRead more

No, Goodwill cannot be called a fictitious asset.

A fictitious asset does not have any physical existence or realizable value. Although it is recorded in the assets column, it is not really an asset, rather it is an expense that is incurred during the accounting period. Its benefit, however, is realized for extended periods. This is why they are recorded as assets. They are recorded in a single year and are amortized over the years. A fictitious asset is neither tangible nor intangible.

Examples of Fictitious Assets

- Preliminary expenses

- Promotional expenses

- Discount on issue of shares/debentures etc.

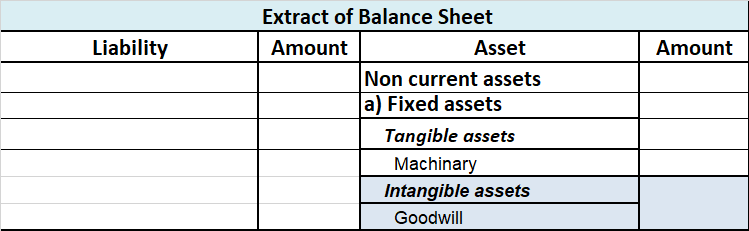

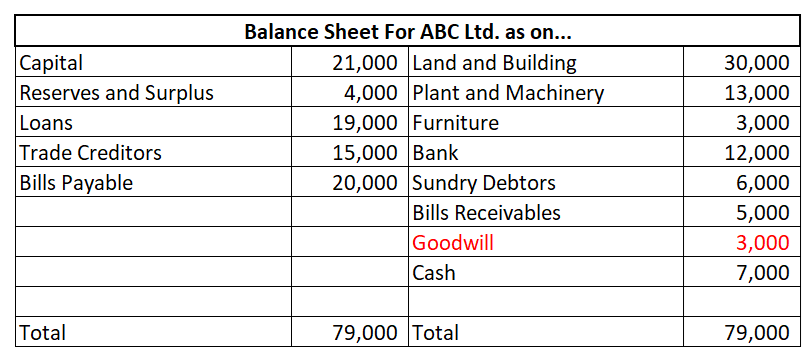

Now, goodwill is an intangible asset that relates to the purchase of a company. It is the amount that a company pays over the net worth of the company being purchased. This can be because of its brand value, good customer base, etc. As a company’s reputation improves, its goodwill increases accordingly. Therefore, It does not have a tangible existence but it does have a monetary value. They are also recorded on the asset side of the balance sheet under the head “Intangible assets”.

Reason for not being a fictitious asset

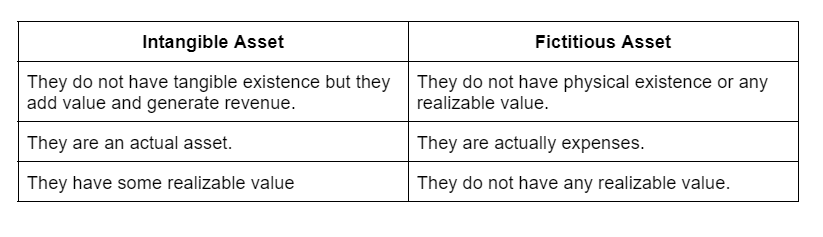

Since goodwill is an asset and not an expense, it cannot be called a fictitious asset. Moreover, goodwill has a realizable value. Unlike fictitious assets, goodwill can be purchased or sold. Therefore, goodwill is termed as an intangible asset but not a fictitious asset. The major difference between an intangible asset and a fictitious asset is:

Definition Goodwill is an intangible asset that places an enterprise in an advantageous position due to which the enterprise is able to earn higher profits without extra effort. For example, if the enterprise has rendered good services to its customers, it will be satisfied with the quality of its sRead more

Definition

Goodwill is an intangible asset that places an enterprise in an advantageous position due to which the enterprise is able to earn higher profits without extra effort.

For example, if the enterprise has rendered good services to its customers, it will be satisfied with the quality of its services, which will bring them back to the enterprise.

Features

The value of goodwill is a subjective assessment of the valuer.

• It helps in earning higher profits.

• It is an intangible asset.

• It is an attractive force that brings in customers to the business.

• It has realizable value when the business is sold out.

Need for goodwill valuation

The need for the valuation of goodwill arises in the following circumstances :

• When there is a change in profit sharing ratio.

• When a new partner is admitted.

• When partner retires or dies.

• When a partnership firm is sold as a going concern.

• When two or more firms amalgamate.

Classification of goodwill

Goodwill is classified into two categories:

• Purchased goodwill

• Self-generated goodwill

Purchased goodwill :

Is that goodwill acquired by the firm for consideration whether paid or kind?

For example: when a business is purchased and purchase consideration is more than the value of net assets the difference amount is the value of purchase goodwill.

Self-generated goodwill

It is that goodwill that is not purchased for consideration but is earned by the management’s efforts.

It is an internally generated goodwill that arises from a number of factors ( such as favorable location, efficient management, good quality of products, etc ) that a running business possesses due to which it is able to earn higher profits.

Methods of valuation

1. Average profit method

2. Super profit method

3. Capitalization method

Average profit method: goodwill under the average profit method can be calculated either by :

• Simple average profit method or

• Weighted average profit method

See less