Miscellaneous expenditure in the balance sheet The expenses that are written off in the current financial year are shown on the debit side of the profit and loss account. However, those that are not written off during the current financial year are shown in the balance sheet on the Assets Side as MiRead more

Miscellaneous expenditure in the balance sheet

The expenses that are written off in the current financial year are shown on the debit side of the profit and loss account. However, those that are not written off during the current financial year are shown in the balance sheet on the Assets Side as Miscellaneous expenditure.

Miscellaneous expenditure are those expenses that are not categorized as Operating expenses i.e. these are not classified as manufacturing, selling, and administrative expenses.

For example, BlackRock has spent 5,00,000 which will be written of in 5 consecutive years as an Advertisement expense. During the current financial year, only 1,00,000 will be written off and the rest will be carried to the next year and year thereafter.

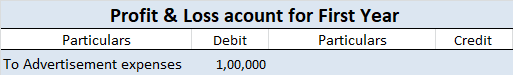

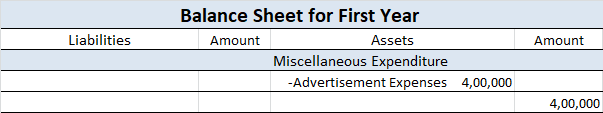

Treatment in the first year:

- 1,00,000 which is written off during the current financial year will be shown on the debit side of the Profit and Loss account.

- 4,00,000 which is carried forward will be shown on the assets side of the balance sheet as miscellaneous expenditure because all assets and expenses have a debit balance.

Treatment in the second year:

- 1,00,000 which is written off during the current financial year will be shown on the debit side of the Profit and Loss account.

- 4,00,000 which is carried forward will be shown in the assets side of the balance sheet as a miscellaneous expenditure.

The same will be done in the third, fourth, and fifth years.

Conclusion

Deferred revenue expenditure is also a long-term expenditure the benefit of which cannot be derived within the same year. So the amount that is written off during the current year is shown on the debit side of the profit and loss account and the amount which is not written off during the current financial year is shown on the assets side under the head Miscellaneous expenditure.

See less

Let us begin with a short explanation of what Calls-in-Advance is: Whenever a company accepts money from its shareholders for calls not yet made, then we call it calls-in-advance. To put it in even simpler terms, it is the amount not yet called up by the company but paid by the shareholder. An imporRead more

Let us begin with a short explanation of what Calls-in-Advance is:

Whenever a company accepts money from its shareholders for calls not yet made, then we call it calls-in-advance. To put it in even simpler terms, it is the amount not yet called up by the company but paid by the shareholder. An important thing to note here is that a company can accept calls-in-advance from its shareholders only when authorized by its Articles of Association.

Calls-in-advance is treated as the company’s liability because it has received the money in advance, which has not yet become due. Till the amount becomes due, it will be treated as a current liability of the company.

The journal entry for recording calls-in-advance is as follows:

The money received from the shareholder is an asset for the company and therefore Bank A/c is debited with the amount received as calls-in-advance. The calls-in-advance A/c is credited because it is a liability for the company.

Since Calls-in-Advance is a liability, it is shown in the Equities and Liabilities part of the Balance Sheet under the head Current Liabilities and sub-head Other Current Liabilities.

For better understanding, we will take an example,

ABC Ltd. made the first call of 3 per share on its 10,00,000 equity shares on 1st May. Max, a shareholder, holding 5,000 shares paid the final call amount 2 along with the first call money. Now let me show the journal entry to record calls-in-advance.

In the Balance Sheet, I will show calls-in-advance in the following manner,

The calls-in-advance of 10,000 is shown under the Equities and Liabilities side of the balance sheet under the head current liabilities and sub-head other current liabilities. It will be shown as a liability till the final call money becomes due. The amount received by the company from Max is shown on the Assets side of the balance sheet under head current assets and under the sub-head cash and cash equivalents.

See less