Fluctuating Capital Fluctuating capital is a capital that is unstable and keeps changing frequently. In the fluctuating capital, the capital of each partner changes from time to time. In partnership firms, each partner will have a separate capital account. Any additional capital introduced during thRead more

Fluctuating Capital

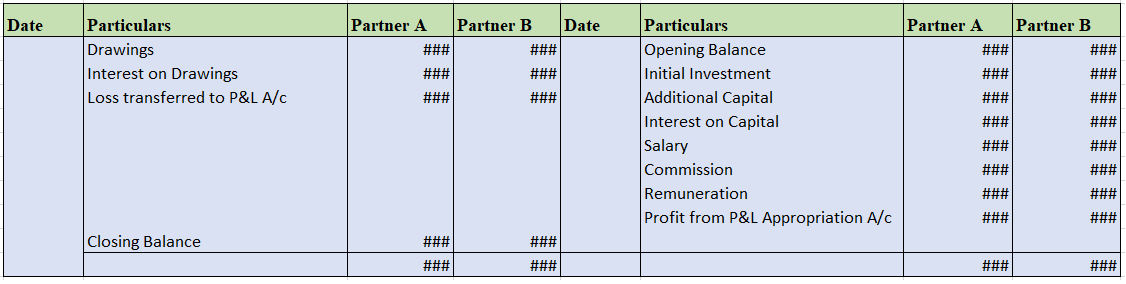

Fluctuating capital is a capital that is unstable and keeps changing frequently. In the fluctuating capital, the capital of each partner changes from time to time. In partnership firms, each partner will have a separate capital account. Any additional capital introduced during the year will also be credited to their capital account. In the fluctuating capital method, only one capital a/c is maintained i.e no current accounts like in the fixed capital a/c method. Therefore, all the adjustments like interest on capital, drawings, etc. are completed in the capital a/c itself.

It is most commonly seen in partnership firms and it is not essential to mention the Fluctuating Account Method in the partnership deed.

- All the adjustments resulting in a decrease in the capital will be debited to the partner’s capital, such as drawings made by each partner, interest on drawings, and share of loss.

- Similarly, the activities or adjustments that lead to an increase in the capital are credited to the partner’s capital account, such as interest on capital, salary, the share of profit, and so on.

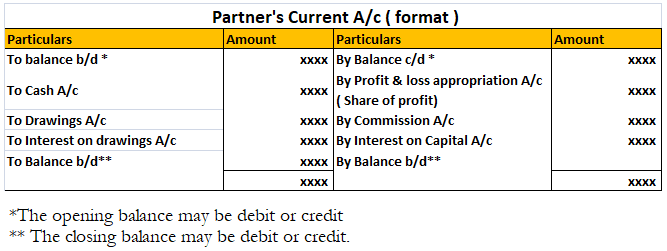

Fluctuating Capital Account Format

See less

Realisation account A realisation account is a nominal account prepared at the time of dissolution of a business. All the assets and liabilities except cash and bank balance are transferred to the realisation account. A realisation account is prepared to calculate the profit or loss on the dissoluRead more

Realisation account

A realisation account is a nominal account prepared at the time of dissolution of a business. All the assets and liabilities except cash and bank balance are transferred to the realisation account. A realisation account is prepared to calculate the profit or loss on the dissolution or closing of the firm.

All the assets are transferred to the debit of the realisation account and all the liabilities are transferred to the credit of the realisation account. When assets are sold, Cash A/c is debited and Reliastion A/c is credited and when liabilities are paid off, Cash A/c is credited and Realisation A/c is credited.

If the credit side exceeds the debit side of the realisation account, it results in profit. In contrast, if the debit side exceeds the credit side of the realisation account, it results in a loss. in case of profit, the Capital account is credited and in case of loss, the Capital account is debited.

The debit side of the realisation account

All the assets including Land and building, Plant and machinery, furniture, stock, debtor and investment are transferred to the debit of the realisation account and payment of outside liabilities is also recorded on the debit side of the realisation account. Payment made for dissolution expenses is also recorded on the debit side of the realisation account.

Realisation A/c Dr…..

To Assets A/c …..

(All the assets transferred to the realisation account)

Realisation A/c Dr…..

To Cash A/c …..

(Payment made for liabilities)

Realisation A/c Dr…..

To Capital A/c …..

(Being profit transferred to the capital account)

Credit side of realisation account:

All the liabilities and provisions are transferred to the credit side of the realisation account. Capital account of partners, profit and loss balance and loans from partners are not transferred. Sale proceeds of all the assets including Land and building, Plant and machinery, furniture, stock, debtor and investment are transferred to the credit side of the Realisation account.

Format for realisation Account is as under: