Cash Stock in trade Furniture Advance Payment

Introduction The term 'gain ratio' is related to partnership accounting. Gain ratio refers to the ratio in which existing partners of a partnership firm, divide among themselves, the share of profit and loss of the outgoing partners. There is a method of calculating this gain ratio. The method alongRead more

Introduction

The term ‘gain ratio’ is related to partnership accounting. Gain ratio refers to the ratio in which existing partners of a partnership firm, divide among themselves, the share of profit and loss of the outgoing partners.

There is a method of calculating this gain ratio. The method along with the concept behind gain ration is discussed below.

Concept behind gain ratio

A partnership firm is a form of business organisation which is conducted and carried on by members known as partners. It requires at least two partners to start a firm and the maximum limit is 50.

The partners share the profit and loss of a business in a ratio known as Profit and loss sharing ratio.

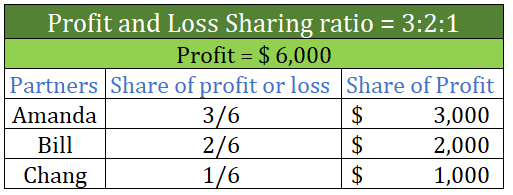

For example, Amanda, Bill and Chang are partners, having a P/L sharing ratio of 3:2:1 i.e. Amanda is getting 3/6, Bill is getting 2/6 of the same and Chang is getting ⅓ of the profit and loss

If the profit is $6,000 , then Amanda will get $3,000 (3/6 of $6,000) and Bill will get $2,000 (2/6 of $6,000) and Chang will get $1,000 (1/6 of $6,000).

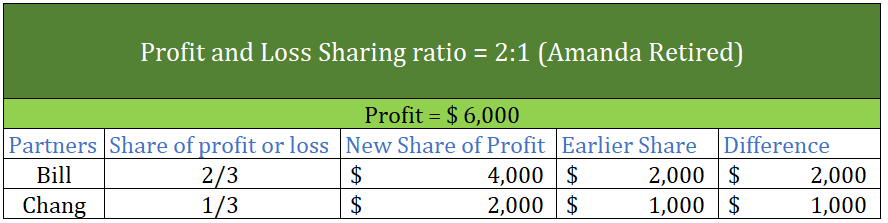

Now if Amanda retires from the firm, then naturally, Bill and Chang’s share of profit will increase.

The profit and loss sharing ratio will now be 2:1 (earlier it was 3:2:1) and the share of profit of Bill will be $4,000 and of Chang will be $2,000.

Calculation of gain ratio

The formula for calculating gain ratio = New ratio – Old Ratio

As per the above case:

- Gain ratio of Bill = 2/3 – 2/6 = 2/6

- Gain ratio of Chang = 1/3 – 1/6 = 1/6

Therefore the gain ratio in which Bill and Chang gained the share of profit of Amanda is 2/6 : 1/6 or simply 2:1

This is how we can calculate the gain ratio. But one thing to notice is that the gain ratio is equal to the P/L sharing ratio of the partnership between Bill and Chang.

Hence, whenever a partner retires and the existing partner keep the P/L sharing ratio unchanged among themselves then, the gain ratio will be equal to their P/L sharing ratio. In that case, there is no need to calculate the gain ratio from the formula given above.

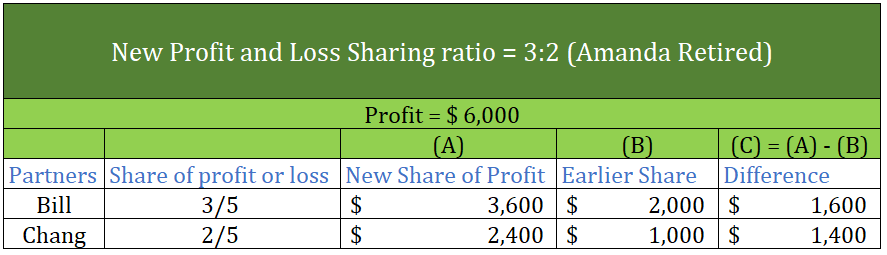

But, when the remaining partners change the P/L sharing ratio among themselves after a partner retires, then the gain ratio is to be calculated using the formula given above.

Suppose, upon retirement of Amanda, Bill and Chang change the P/L sharing between them to from 2:1 to 3:2

In that case,

- The gain ratio of Bill = 3/5 – 2/6 = 8/30

- The gain ratio of Chang = 2/5 – 1/6 = 7/30

Therefore the gain ratio in which Bill and Chang will gain the share of profit of Amanda is 8/30 : 7/30 or simply 8:7

The correct option is 3.) The term current assets do not include furniture. Explanation A current asset is any asset that can reasonably be expected to be sold, consumed, or exhausted through the normal operations of a business within one accounting year. Thus, current assets don't have life for morRead more

The correct option is 3.)

The term current assets do not include furniture.

Explanation

A current asset is any asset that can reasonably be expected to be sold, consumed, or exhausted through the normal operations of a business within one accounting year. Thus, current assets don’t have life for more than a year.

Example: Cash and cash equivalent, stock, liquid assets, etc.

Furniture is expected to have a useful life for more than a year and they are bought for a long term by a company.

Cash is a more liquid asset of a company making it a more “current” asset. It requires no conversion and is spendable as it is. Thus, making it a vital current asset.

Stock in trade is a current asset because it can be converted into cash within one year and all the stock in trade of a company is expected to be sold within one accounting period and should not stick for a longer period.

Advance payment, on the other hand, is an amount paid to an employee, essentially a short-term loan by the employer. It’s recorded on the asset side of the balance sheet and as these assets are used, they are expended and recorded on the income statement for the period in which they are incurred, making it a short-term asset ending within an accounting year.

Thus, on the asset side of the balance sheet, we can clearly see which current assets are and which are not included in the current asset

Balance Sheet (As at…..)

Therefore, (3) Furniture, won’t be included in current assets.

See less