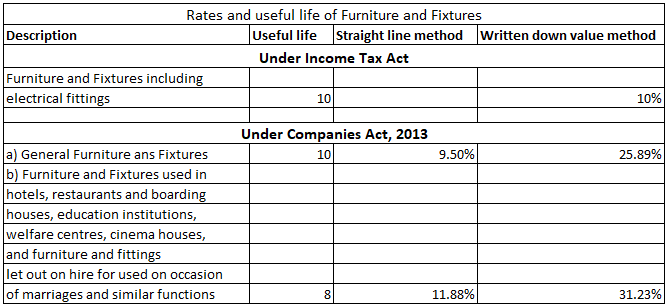

The Furniture and Fixture is depreciated @10% according to the income tax act and as per the companies act, 2013 @9.50% under Straight line method and @25.89% under written down value method. Furniture and fixture form a major part to furnish an office. For Example, the chair, table, bookshelves, etRead more

The Furniture and Fixture is depreciated @10% according to the income tax act and as per the companies act, 2013 @9.50% under Straight line method and @25.89% under written down value method.

Furniture and fixture form a major part to furnish an office. For Example, the chair, table, bookshelves, etc. all comes under Furniture and Fixture. The useful life of Furniture and Fixtures is estimated as 5-10 years depending upon the kind of furniture.

Rate of depreciation in reference to days

- If Furniture is bought and put to use for more than 180 days, then the full rate of depreciation will be charged.

- If the furniture is bought and put to use for less than 180 days, then half the rate of depreciation will be charged.

- If the furniture is bought but is not put to use, then no depreciation will be charged.

The rate of depreciation on a car as per the Income Tax Act depends upon the purpose for which it has been purchased and the year on which it was acquired. As per the Income Tax Act, cars come under the Plant and Machinery block of assets. The Act classifies cars into two categories, Group 1 - MotorRead more

The rate of depreciation on a car as per the Income Tax Act depends upon the purpose for which it has been purchased and the year on which it was acquired.

As per the Income Tax Act, cars come under the Plant and Machinery block of assets.

The Act classifies cars into two categories,

Group 1:

Group 2:

Here is a summarised version of the rates applicable to cars,

The rates can also be found on the Income Tax India website.

See less