Introduction Internal reconstruction refers to the process of restructuring a sick company’s balance sheet by certain methods to turn it financially healthy, thus saving it from potential liquidation. Explanation When a company has been making losses for many years, it has a huge amount of accumulatRead more

Introduction

Internal reconstruction refers to the process of restructuring a sick company’s balance sheet by certain methods to turn it financially healthy, thus saving it from potential liquidation.

Explanation

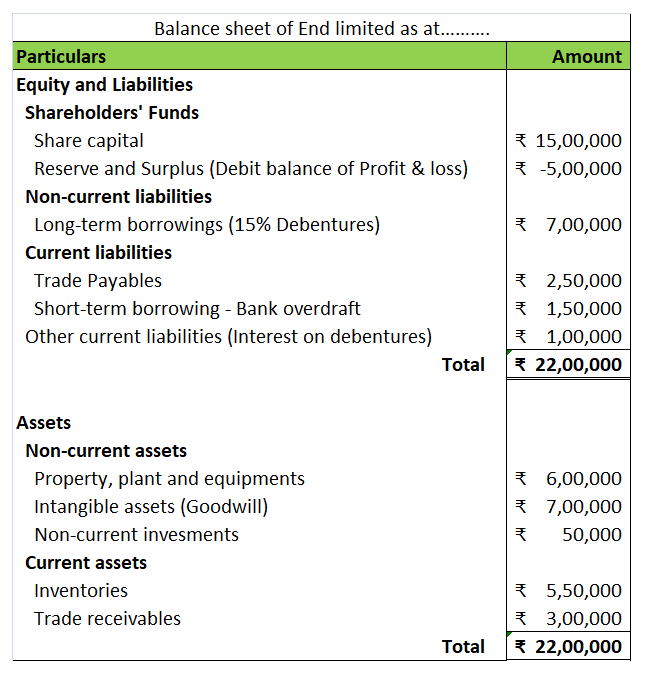

When a company has been making losses for many years, it has a huge amount of accumulated losses due to which the reserve and surplus appear at a very low or negative amount in the balance sheet.

Also, such a company is said to be overcapitalised as it is not able to generate enough returns to its capital.

As the company is overcapitalised, the assets are also overvalued. The balance sheet also contains many fictitious assets and unrepresented intangible assets.

The balance sheet of such a ‘sick’ company looks like the following:

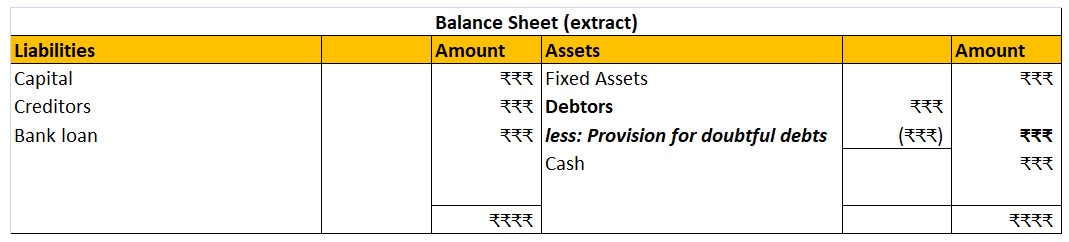

Hence, to save the company from liquidation,

- its assets and liabilities are revalued and reassessed,

- its capital is reduced by paying off part of paid-up capital to shareholders or cancelling the paid-up capital.

- the right of shareholders related to preference dividends is altered,

- agreements are made with creditors to reduce their claims and

- fictitious assets and accumulated losses are written off.

In this way, its balance sheet gets rid of all undesirable elements and the company gets a new life without being liquidated. This process is known as internal reconstruction.

Legal compliance

The internal reconstruction of a company is governed by the provisions of the Companies Act, 2013.

See less

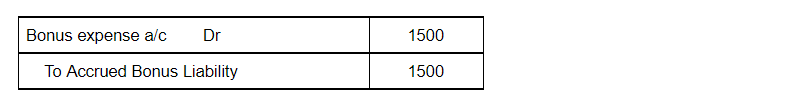

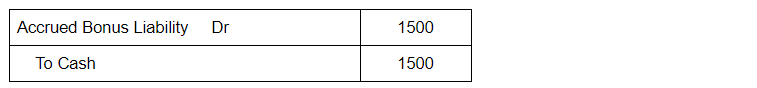

The bonus expense account is debited because according to the modern rule of accounting “Increase in expense is debited”. Accrued bonus liability is credited because according to the rule of accounting, “Increase in liability is credited”.

The bonus expense account is debited because according to the modern rule of accounting “Increase in expense is debited”. Accrued bonus liability is credited because according to the rule of accounting, “Increase in liability is credited”.

Introduction As per SA 530, audit sampling refers to the application of auditing procedures to less than 100% of items within a population relevant under audit such that all the sampling units have an equal chance of selection. In simple words, sampling in auditing refers to the practice deriving aRead more

Introduction

As per SA 530, audit sampling refers to the application of auditing procedures to less than 100% of items within a population relevant under audit such that all the sampling units have an equal chance of selection.

In simple words, sampling in auditing refers to the practice deriving a conclusion by the auditor about a population of data by evaluation of only a part or sample of the whole data. Population means a set of data.

Concept of sampling

We know, an audit involves inspection of financial information of an entity by an auditor to form an opinion on its financial statements. Now the financial information of a firm usually contains large volumes of data. For example, a firm may have entered into 50,000 purchase transactions in a year.

Now, checking each and every purchase transaction will cost both time and money. Also, nowadays, almost every enterprise have internal controls and automated accounting systems that are established to ensure accuracy and prevention of errors. Hence, a full-fledged inspection of each and every transaction is not worth the time and effort.

Instead, a wise thing to do is to take a sample from the whole volume of transactions or accounts and apply the auditing procedures to the sample. The results derived from the sample are then projected upon the whole volume of data. Samples are often taken using statistical methods to ensure that sample is taken randomly and represents the whole population of data in a true and unbiased manner.

Consideration regarding the population before audit sampling:

Irrespective of the method of sampling, the sample must represent the whole population closely.

Approaches to sampling

There are two approaches to sampling:

- Statistical Approach: It is a scientific way of ensuring that the sample is chosen randomly from data and represents the data in a true and unbiased way. It employs mathematical and statistical tools like the theory of probability and also considers sampling risk characteristics.

- Non-Statistical Approach: Under this approach, the auditor employs his personal experience to collect sample from the population. No mathematical tools are used but the personal judgement of the auditor regarding sampling. Sometimes, this approach may give satisfactory results depending upon the capability of the auditor. But in most cases, reliability is less compared to the statistical approach.

See less