A Profit and Loss (P&L) statement is a financial statement that records a summary of all expenses and incomes of a business during a period of time. It helps in determining the financial performance of the business. After recording all transactions in an account, if the debit side is greater thaRead more

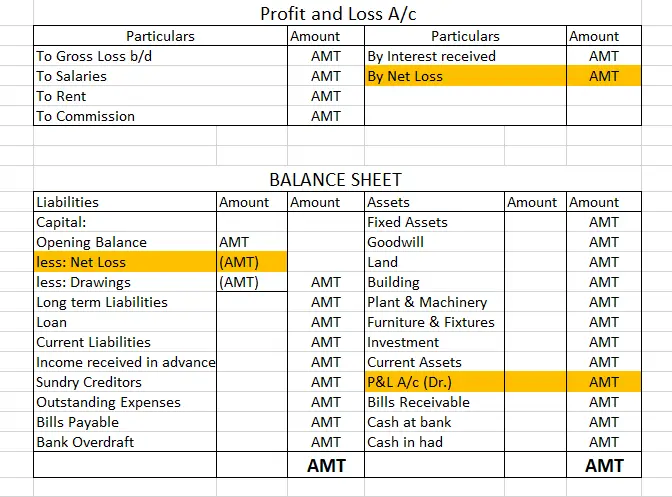

A Profit and Loss (P&L) statement is a financial statement that records a summary of all expenses and incomes of a business during a period of time. It helps in determining the financial performance of the business.

After recording all transactions in an account, if the debit side is greater than the credit side, then the account is said to have a debit balance. Similarly, if the credit side is greater than the debit side, then the account has a credit balance.

In a P&L account, when the expenses (debit) are greater than the incomes (credit), the business is said to be in a net loss. This loss is what we call the debit balance of a Profit and Loss account. A P&L account with a debit balance can be subtracted from Capital or be shown on the asset side of the Balance Sheet.

As you can see above, the net loss is shown on the right side of the P&L account. This represents the debit balance of P&L. Once it is transferred to the balance sheet, it is either subtracted from capital or shown on the asset side as shown in the second image. However, they cannot be shown on both sides of the balance sheet at the same time.

However, if the credit side is greater, that is if income is greater than expenses, then the P&L account shows a credit balance which is also known as net profit. This profit is added with Capital to show the final balance in the Balance Sheet.

Debit balance of Profit & Loss account is not preferable for a business. Hence they should put in efforts to either reduce costs or increase their income to gain profits.

See less

When a company earns profit, it distributes a proportion of its income to its shareholders, and such distribution is called the dividend. The dividend is allocated as a fixed amount per share and shareholders receive dividends proportional to their shareholdings. However, a company can only pay diviRead more

When a company earns profit, it distributes a proportion of its income to its shareholders, and such distribution is called the dividend. The dividend is allocated as a fixed amount per share and shareholders receive dividends proportional to their shareholdings.

However, a company can only pay dividends out of its current year profits or retained earnings (profits of the company that are not distributed as dividend and retained in the business is called retained earnings) of previous years but not out of capital.

Dividends can be paid to shareholders in the form of

For companies, payment of regular dividends boosts the morale of the shareholders, investors trust the companies more and it reflects positively on the share price of the company.

For example, Nestle in India paid an interim dividend of 1100.00% to its shareholders in 2021.

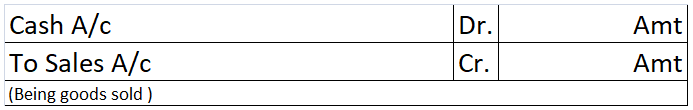

The journal entry for dividend paid is

According to the golden rules of accounting-

According to modern rules of accounting-

For example-

A company paid a dividend of 25 crores to its shareholders in cash, the journal entry according to golden rules will be-

(in crores)

(in crores)

See less