Outstanding Income is the income that is due and is being earned but not yet received. The person/ firm has the legal rights to receive that part of the income which it has earned. Outstanding Income is an Asset Account for the business/ the person. According to the modern approach, for Asset AccounRead more

Outstanding Income is the income that is due and is being earned but not yet received. The person/ firm has the legal rights to receive that part of the income which it has earned.

Outstanding Income is an Asset Account for the business/ the person.

According to the modern approach, for Asset Account:

- When there is an increase in the Asset, it is Debited.

- When there is a decrease in Asset, it is Credited.

So the journal entry will be-

For Example, Mr. Rashid works as a laborer in a factory and he earns wages @Rs 500/day.

So by the end of the week, he receives a payment of Rs 3000 of Rs 3500 i.e. he receives payment of 6 days instead of 7 days. So here Rs 500 would be an outstanding income of Mr. Rashid as he has earned that income but has not received it yet.

Journal Entry –

Another example, Yes Bank gave a loan of Rs 10,00,000 to company Ford @ 10% as interest payable monthly. The interest for one month i.e. Rs 1,00,000 has not been received by Yes Bank which is being due. So it will be outstanding income for Yes Bank since it is due but not yet received.

Journal entry-

Accounting Treatment for Outstanding Income-

- Treatment in Income Statement

The Outstanding Income is shown on the credit side of the income statement as the income is earned for the current year but not yet received.

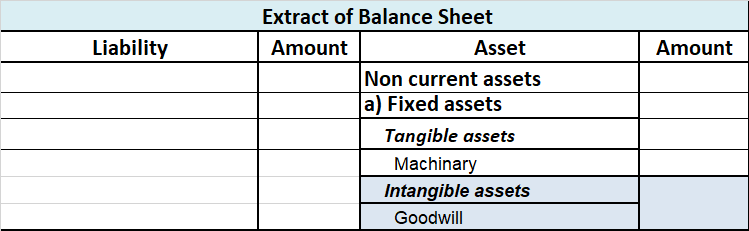

- Treatment in Balance Sheet

Outstanding Income is an Asset for the business and hence shown on the Assets side of the balance sheet.

See less

Outstanding expenses are those expenses that have been incurred during the accounting period but are yet to be paid. Basically, any expense which has become due for payment but is not paid will be called an outstanding expense. Outstanding expenses are treated as a liability as the business is yet tRead more

Outstanding expenses are those expenses that have been incurred during the accounting period but are yet to be paid. Basically, any expense which has become due for payment but is not paid will be called an outstanding expense.

Outstanding expenses are treated as a liability as the business is yet to make payment against them. Examples of outstanding expenses include outstanding rent, salary, wages, etc.

At the end of the accounting year, outstanding expenses have to be accounted for in the book of accounts so that the financial statements reflect the accurate profit/loss of the business.

Journal entry for recording outstanding expenses:

The concerned expense A/c is debited as there is an increase in expenses. Outstanding expenses are a liability, hence they are credited.

Let me give you a simple example,

Max, a sole proprietor pays 1,00,000 as salary for his employees at the end of every month. Due to the Covid-19 lockdown, he could not pay his employees’ salaries for March month. So the salary for March (1,00,000) will be treated as an outstanding expense. The following entry is made to record outstanding salaries for the year.

At the end of the year, outstanding salary will be adjusted in the P&L A/c and it will be shown as a Current Liability in the Balance Sheet.

See less