Sometimes a business may earn an income by delivering the goods/services within the stipulated time. But the business may not have issued an invoice to the customer. Such a scenario is what is called unbilled revenue. Note that as per the accrual concept of accounting, sales are recognized on the daRead more

Sometimes a business may earn an income by delivering the goods/services within the stipulated time. But the business may not have issued an invoice to the customer. Such a scenario is what is called unbilled revenue.

Note that as per the accrual concept of accounting, sales are recognized on the day it was made, irrespective of whether the business receives cash or not.

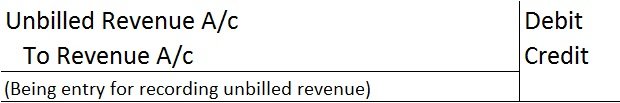

The business records unbilled revenue by passing the following journal entry:

Unbilled Revenue is treated as an asset because it is yet to be fully recognized as an income. Therefore it is debited. Revenue A/c is credited as there is an increase in income.

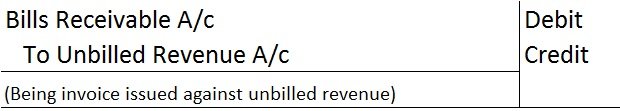

Once the bill/invoice has been issued to the customer, the following entry is passed to close the Unbilled Revenue A/c.

Let me explain this concept with an example,

Luca Traders, a business dealing in stationery and office supplies receives an order on August 5th for 1,000 pens worth 10 each. On August 8th they deliver the pens but they are yet to issue an invoice to the customer. They issue the invoice only on August 13th.

So the sales revenue of 10,000 (1,000*10) will be treated as an unbilled revenue for the period of August 8th – August 12th. On August 8th the following entry is made to record unbilled revenue.

| Unbilled Revenue A/c | 10,000 |

| To Revenue A/c | 10,000 |

| (Being entry for recording unbilled revenue worth 10,000) |

When the invoice is sent to the customer on August 13th, the following journal entry is posted to close the unbilled revenue A/c.

| Bills Receivable A/c | 10,000 |

| To Unbilled Revenue A/c | 10,000 |

| (Being invoice issued against unbilled revenue) |

Journal Entry for Interest on Drawings is- Particulars Amount Amount Drawings A/c Dr $$$ To Interest on Drawings A/c $$$ So as per the modern approach: From the point of view of business, Interest on Drawings is an Income. When there is an inRead more

Journal Entry for Interest on Drawings is-

So as per the modern approach: From the point of view of business, Interest on Drawings is an Income.

From the point of view of the proprietor, Interest on Drawings is a Liability.

So as per the modern approach:

So as per the modern approach, Interest on Drawings is credited because with Interest the income increases for the business. Whereas, the amount of such interest is a loss from the point of view of the owner/ Proprietor, as such the amount of drawings is increased by the amount of interest and hence the Drawings account is debited.

For Example, Harry charged interest on drawings on Rs 10,000 @ 12% for one year.

Explanation:

Step 1: To identify the account heads.

In this transaction, two accounts are involved, i.e. Drawings A/c and Interest on Drawings A/c.

Step 2: To Classify the account heads.

According to the modern approach: From the point of view of business, Interest on Drawings is a Revenue A/c and Drawings A/c is an Expense A/c.

Step 3: Application of Rules for Debit and Credit:

According to the modern approach: As Revenue increases because of interest on drawings received by the business, Interest on Drawings A/c will be Credited. (Rule – increase in Revenue is credited).

Drawings A/c is an expense account for the business and as expense increases, Drawings A/c will be debited. (Rule – increase in the expenses is debited).

So from the above explanation, the Journal Entry will be-

See less