Fictitious assets are the expenses and losses which are yet to be written off, so they appear in the Asset side of the balance sheet of the relevant financial year because expenses and losses have a debit balance. They are not assets in substance. Examples: Business loss ( debit balance of Profit anRead more

Fictitious assets are the expenses and losses which are yet to be written off, so they appear in the Asset side of the balance sheet of the relevant financial year because expenses and losses have a debit balance. They are not assets in substance.

Examples:

- Business loss ( debit balance of Profit and loss A/c )*

- Prepaid expenses

- Discount on the issue of debentures.

- Huge promotional expenditure.

*business loss is shown as a negative figure under the head Reserve and Surplus, when the balance sheet is prepared as per Schedule III of The Companies Act, 2013.

Deferred revenue expenditures are the expenses incurred for which the benefits are expected to flow to the enterprise beyond the current year. Such expenses are huge and are not written off completely in a financial year. The part of the expenditure which is not written off is shown on the assets side of the balance sheet.

Examples:

- Huge advertisement expense.

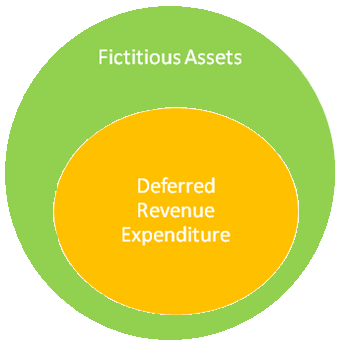

As you can see, there is some similarity between the two. Deferred revenue expenditure can be called a type of fictitious asset as it is shown in the asset side of the balance sheet but it isn’t an asset.

The term ‘fictitious asset’ has a broader meaning than deferred revenue expenditure and also includes the losses such as discounts on the issue of debenture and business loss.

The difference between fictitious assets and deferred revenue expenditure are as follows:

| Fictitious Assets | Deferred Revenue Expenditure | |

| 1 | These are no real assets but expenses and losses that are not completely written off in an F.Y. | These are expenses incurred from which benefits are expected to flow for more than one accounting period. |

| 2 | It has a broader meaning. | It has a narrower meaning. |

| 3 | Examples:- business loss, discount on issue of debentures, prepaid expenses etc. | Examples:- huge promotional expenditure etc. |

IND AS 102: ‘Share-based payments’ in its actual text is considerably lengthy and very detailed. The objective of my answer is to provide a basic understanding of what IND AS 102 is all about. Further reading of the actual text is suggested for a more detailed understanding. IND AS 102 is the IndiaRead more

IND AS 102: ‘Share-based payments’ in its actual text is considerably lengthy and very detailed.

The objective of my answer is to provide a basic understanding of what IND AS 102 is all about. Further reading of the actual text is suggested for a more detailed understanding.

IND AS 102 is the India specific version of IFRS 2 which deals with the accounting of Share-based payments. IND AS 102 and IFRS are almost similar.

It deals with the financial reporting of the share-based payment transactions entered into by an enterprise in the following cases:

Share-based payments are of three types:

Example: A business acquires an asset for Rs. 1,00,000 and makes payment by the issue of its equity shares.

Example: A business acquires an asset for Rs. 1,00,000 and makes payment in amounts of case based upon its share price.

Things that are not under the scope of IND AS-102

Recognition

In a share-based transaction,

Measurement

The amount at a share-based transaction is to be recorded depending upon the type of counterparty:

I hope this is enough for a basic understanding of the IND AS 102.

See less