Debit Balance A debit accounting entry represents an increase in asset or expense account or a decrease in liabilities of an individual or enterprise. Debit balance is the amount in excess of debit entries over credit entries in the general ledger. The debit balance is shown as Dr. Credit Balance ARead more

Debit Balance

A debit accounting entry represents an increase in asset or expense account or a decrease in liabilities of an individual or enterprise.

Debit balance is the amount in excess of debit entries over credit entries in the general ledger. The debit balance is shown as Dr.

Credit Balance

A credit accounting entry represents a decrease in assets or an increase in liabilities or income accounts of an individual or enterprise.

The credit balance is the amount in excess of credit entries over debit entries in the general ledger. The credit balance is shown as Cr.

Credit Balance in the Passbook

A passbook is a record of a customer’s account transactions kept by the bank. The passbook is a copy of the bank account of the customer in the books of banks. “Credit balance in the passbook is also called bank balance”.

The bank balance is the amount available for withdrawal. A bank balance is an asset to the individual or an enterprise which can be used for the purchase of another asset or payment of liability or expenses.

All the transactions either debit or credit are recorded in the passbook. When the total amount of all credit entries in a passbook is more than the total of debit entries, it results in a credit balance. It means that the bank owes to an individual or enterprise.

The amount withdrawn by a customer from the bank is shown as a debit entry and the amount deposited by the customer is shown as a credit entry. The passbook’s credit balance is a positive or favourable balance while the passbook’s debit balance is a negative balance or unfavourable balance.

For example: An individual deposited $50,000 in a bank account and withdrew a total sum of $30,000. So here, the passbook will show a bank balance of $20,000 i.e. the credit balance of the passbook. It signifies the positive cash flow of the individual and that the bank owes $20,000 to the individual.

Debit balance in Pass Book

When the total amount of all debit entries in a passbook is more than the total of credit entries, it results in a debit balance. Debit balance in the passbook is also called “Overdraft”. It means that an individual or enterprise owes to the bank.

Reconciliation

It is the process of identifying and rectifying differences between the passbook and cashbook maintained by the bank and customer respectively. The aim is to ensure the accuracy of the transaction recorded in the cashbook and passbook.

Debit Balance Reconciliation

The debit balance in the cashbook and the credit balance in the passbook shows that some outstanding cheques are in the process of clearing and these cheques need to be adjusted for reconciliation of the balance of the passbook and cashbook.

Credit Balance Reconciliation

The credit balance in the cashbook and debit balance in the passbook shows that deposits already recorded in the cashbook are yet to be recorded in the passbook by the bank and these deposits need to be adjusted in the passbook for reconciliation of the balance of the passbook and cashbook.

Conclusion

The debit and credit balance of the passbook is the indicator of the financial position of an enterprise or individual. A credit balance signifies more deposits than withdrawals resulting in a positive bank balance.

See less

A profit and loss account is a financial statement which shows the net profit or net loss of an enterprise for an accounting period. It reports all the indirect expenses and indirect income including gross profit or loss derived from trading accounts for an accounting period. When the total revenueRead more

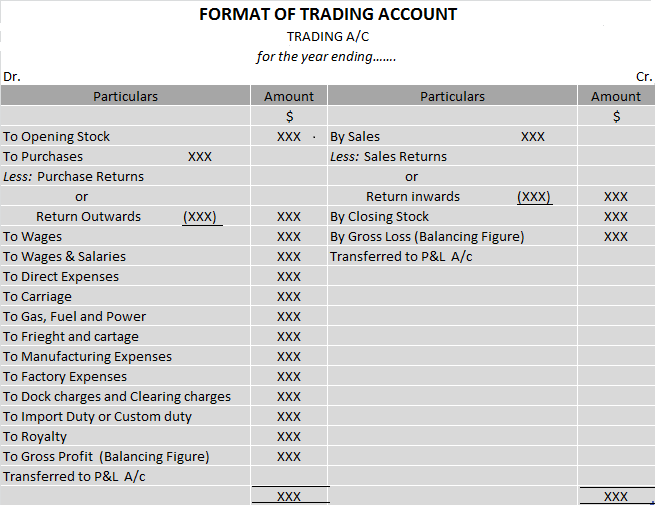

A profit and loss account is a financial statement which shows the net profit or net loss of an enterprise for an accounting period. It reports all the indirect expenses and indirect income including gross profit or loss derived from trading accounts for an accounting period.

When the total revenue i.e. credit side of profit and loss a/c is more than the total of expenses i.e. the debit side of profit and loss a/c, it results in net profit whereas when the total revenue is less than the total of expenses, it results in a net loss.

The debit balance of the profit and loss account is the net loss incurred during the accounting period by an enterprise. It is transferred to a capital account thereby reducing the capital or can be shown as a debit balance on the asset side.

Accounting entry for loss transferred is as follows :

Capital A/c …Dr.

To Profit & Loss A/c

(being net loss transferred to capital account)

Example

A Business has a total income of $50,000 in an accounting year and has expenses amounting to $60,000 in that particular year. The profit and loss account will show a net loss of $10,000 ($60,000-50,000). Net loss will be transferred to capital A/c. Capital of the business will be reduced by $10,000. This loss can also be shown on the asset side of the balance sheet.

Extract of a Profit and loss a/c showing net loss is as under:

Profit and loss A/c for the year ended …..

The debit balance for a non-corporate entity is shown as a reduction from the capital account

Extract of the Balance sheet showing the debit balance of Profit & Loss A/c is as under :

Balance Sheet as on…

Less: Profit & Loss A/c

While the Debit balance of profit and Loss A/c of a corporate entity is shown as a reduction in Reserves and surplus. If the business doesn’t have reserves then the debit balance is shown on the asset side.

Extract of the Balance sheet showing the debit balance of Profit & Loss A/c is as under :

Balance Sheet as on..

Less: Profit & Loss A/c

Conclusion: Debit balance of profit and loss a/c represents that expenses are more than the income of a business in an accounting period. Debit balance of profit and loss a/c indicates that company need to increase its income or cut down on unnecessary expenses.

The business needs to find out the reason of excessive expenses because accumulated losses are not good for the health of the company.

See less