Consignment is "goods sent by its owners to his agent for the purpose of sale". In simple language, the word consignment means to send goods to another person for sale on his behalf without transfer of ownership. In accounting terms, consignment is the process where the owner (consignor) transfers tRead more

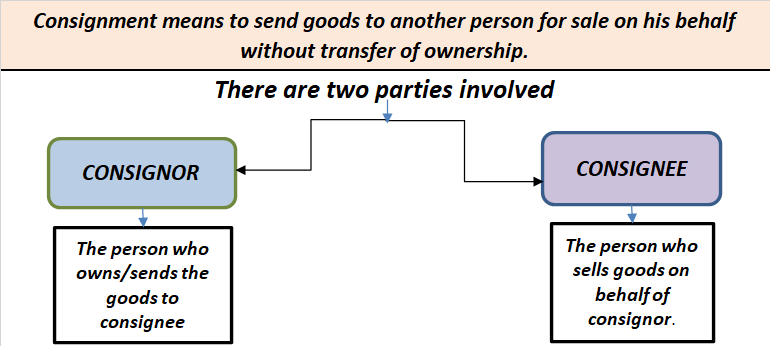

Consignment is “goods sent by its owners to his agent for the purpose of sale”. In simple language, the word consignment means to send goods to another person for sale on his behalf without transfer of ownership.

In accounting terms, consignment is the process where the owner (consignor) transfers the possession of the goods to the agent (consignee) to make a sale on his behalf while the ownership of goods remains with the owner until the sale is made by the agent. In return, the agent receives an agreed percentage of the sum in the form of commission.

Generally, there are two parties involved in consignment, those are as follows:

- CONSIGNOR: the person who is the owner and sender of goods.

- CONSIGNEE: the person who receives goods for sale/resale from the consignor in exchange for a percentage of the sale or on an agreed sum known as commission.

The relationship between consignor and consignee is that of principal and agent.

Let me give you a simple example of how consignment works.

Mr. John (consignor) sends goods to Mr. Jeh (consignee) worth Rs 20,000 to sell these goods at a cost plus 10%. Mr. Jeh agrees to sell these goods on his behalf for a commission of 1% on the sale. Therefore Mr. Jeh sold these goods at the agreed amount i.e Rs 22,000 [20,000+ 10% of 20,000] and charges Rs 220 [1% of Rs 22,000] as commission made on such sale and remit the remaining balance to the owner Mr. John.

There is a lot of confusion regarding “is consignment the same as the sale of goods?“. The answer is NO.

The reason what makes it different from the sale is

a) In sale the ownership gets transferred from seller to buyer but in case of consignment the ownership remains with the consignor until the sale is made by the agent.

b) In sale the risk gets transferred with the transfer of goods, whereas in consignment the risk remains with the owner till the sale is made.

c) Also goods once sold cannot be returned on damages /defaults, but in case of consignment goods that come to be faulty can be returned to the consignor.

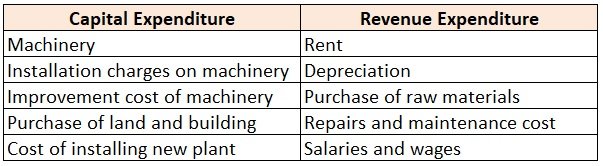

The installation expenses for a new machinery will be debited to the "Machinery A/c". Installation expenses are the expense incurred to bring an asset to a working condition where it can be used. For example, installation charges are incurred on machinery to make it operational. Installation chargesRead more

The installation expenses for a new machinery will be debited to the “Machinery A/c“. Installation expenses are the expense incurred to bring an asset to a working condition where it can be used. For example, installation charges are incurred on machinery to make it operational.

Installation charges will be capitalized along with the cost of machinery. It is so because this expense is concerning the machinery and any expense directly related to an asset should be capitalized, as an asset will be with the business for a longer period of time.

This charge will be incurred only once as a part of bringing the machinery to its working condition, and hence it should be capitalized and should be added to the cost of the machine. The whole amount will be shown in the balance sheet on the asset side as a Fixed Asset.

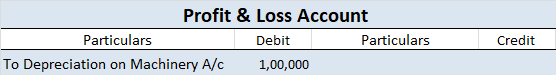

This charge will not be shown in Profit and Loss A/c as it reflects all the revenue expenditure incurred in the period.

Example:

Starbucks purchased a coffee blending machine for the business purpose for $1,00,000. The installation expense incurred on it to make it operational was $20,000. How will Starbucks record this in the Balance Sheet on 31 December?

In the Balance Sheet, Starbucks will add the installation expense incurred on the machine to the cost of the machine as it is the cost incurred to make the machine operational for further business use. Hence, the cost of $20,000 will be shown along with the cost of the coffee blending machine ($1,00,000+$20,000=$1,20,000)

See less