One of the main purposes of accounting is to provide financial data to its users so that decisions are taken at an appropriate time. These users of accounting information are broadly classified into (a) internal users and (b) external users. Since the question concentrates on internal users I’ll beRead more

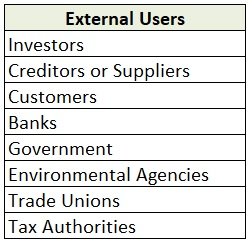

One of the main purposes of accounting is to provide financial data to its users so that decisions are taken at an appropriate time. These users of accounting information are broadly classified into (a) internal users and (b) external users. Since the question concentrates on internal users I’ll be explaining internal users of accounting information in detail.

Internal users are people within an organization/business who need accounting information to make day-to-day decisions.

The various internal users of accounting information include:

- Owners/Promoters/Directors:

Owners are the people who contribute capital to the business and therefore they are interested to know the profit earned or loss incurred by the business as well as the safety of their capital. In the case of a Sole Proprietorship, the proprietor is the owner of the business. In the case of a Partnership, the partners are considered as the owners of the firm.

The use for them: To know how the business is doing financially, owners need to know the profit and loss reflected in the financial statements.

- Management:

Management is responsible for setting objectives, formulating plans, taking informed decisions, and ensuring that pre-planned objectives are met within the stipulated time period.

The use for them: To achieve objectives, management needs accounting information to make decisions related to determining the selling price, budgeting, cost control and reduction, investing in new projects, trend analysis, forecasting, etc.

- Employees/Workers:

Employees and workers are the ones who implement the plans set by the management. Their well-being is dependent on the profitability of the business.

The use for them: They are interested to check the financial statements so that they can get a better knowledge of the business. Some organizations also give their employees a share in their profits in the form of a bonus at the year-end. This also creates an interest in the employees to check the financial statements.

See less

Debtors and Creditors Points of Distinction Debtors Creditors Meaning A debtor is a person or entity that owes money to the other party (the other party is also known as the creditor). A creditor is a person or entity to whom money is owed or who lends money. Nature The debtors will have a debit balRead more

Debtors and Creditors

Example:

Mr. A purchases raw materials from its supplier Mr. D on credit.

Here for Mr. D, Mr. A will be a debtor because the amount is receivable from him.

Similarly, for Mr. A, Mr. D will be his creditor because the amount is payable to him.

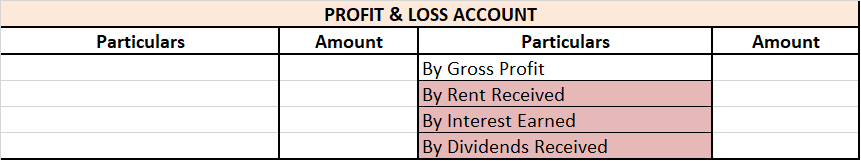

Profit and Gain

Profit = Total Income-Total Expenses

Net profit

Operating profit

Capital gain

Long term capital gain

Short term capital gain

Example: A company’s sales for the period are $60,000 and expenses incurred are $40,000. Here the profit calculated will be $20,000 because revenue exceeds expenses.

Profit = Total Income-Total Expenses

= 60,000 – 40,000

= $20,000

Mr. X owned land worth $10,00,000 and after 10 years he sold it at a current market value of $14,00,000. So the gain he earned is $4,00,000. This gain of $4,00,000 will be termed as a capital gain since land is a capital asset.

See less