Fictitious assets are expenses or losses not written off entirely in the profit and loss account during the accounting year in which they occur. Fictitious assets have no realizable value or physical existence. In the above, (C) preliminary expense is a fictitious asset. Preliminary expenses are theRead more

Fictitious assets are expenses or losses not written off entirely in the profit and loss account during the accounting year in which they occur. Fictitious assets have no realizable value or physical existence.

In the above, (C) preliminary expense is a fictitious asset. Preliminary expenses are the expenses incurred before the incorporation of a business. The word ‘fictitious’ means fake, these are not actually the assets of a company even though they are represented in the assets of the balance sheet.

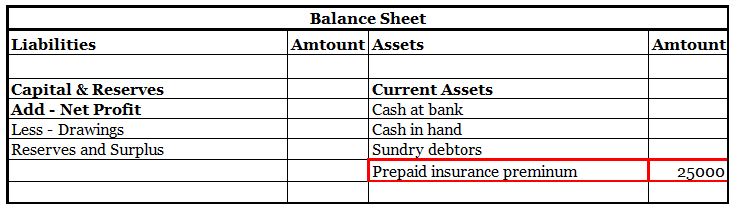

Since the benefit of a fictitious asset is received over a period of time, the whole amount is not charged to the profit and loss account. The amount is amortized over several years. These expenses are non-recurring in nature. These expenses are shown as assets under the head miscellaneous expenditure. Also known as deferred revenue expenditure.

For example: A company incurred $50,000 as promotion costs before the formation of the business. This promotion cost will be deferred over 5 years. In the first year, $10,000 will be charged to the profit and loss account and the remaining $40,000 will be shown as an asset under the heading miscellaneous expenditure. Subsequently, $10000 will be charged to profit and loss for the next 4 years. The amount of $50,000 will be deferred over a span of 5 years.

Some other examples of fictitious assets :

- Promotional expenses: Expenses incurred for the promotion of business before the formation of the company such as advertising expenditures are amortized over many years.

- Loss on the issue of shares or debentures: When a company issues shares or debentures at a discount, the discount is classified as a fictitious asset and is not treated as an expense or loss. It is amortized over several years.

- Incorporation costs: Costs incurred during the formation of a business are incorporation costs. These include registration costs, licensing fees, legal fees and other costs incurred in setting up the business. These are fictitious assets and are amortized over several years.

- Loss on Sale of Machinery: When a loss is incurred on the sale of machinery or equipment, that loss is also treated as a fictitious asset and is amortized over several years.

Goodwill

Goodwill is not a fictitious asset because goodwill has a realizable value and can be sold in the market. Goodwill is an intangible asset which does not have a physical existence but can be traded for monetary value. Goodwill has an indefinite life and is sold when the business is sold. Goodwill can be self-generated or purchased. Goodwill is shown as an intangible asset under the heading fixed asset in the financial statements.

Patents

Patents are intangible assets which do not have a physical existence but have realizable value and can be sold in the market. So, patents do not come under the category of fictitious assets. Patents are basically intellectual property. The purchase price of the patent is the initial purchase cost which is amortized over the useful life of the asset. Patents are shown as intangible assets under the heading fixed asset in the balance sheet of the company.

Claim receivable

Claim receivable is an asset if the claim has been authorized by the insurance company. Claim receivable has a monetary value, so does not come under the category of a fictitious asset. If the claim is not yet authorized by an insurance company, it will be shown as a footnote in the financial statements. Authorized claim receivable is shown as a current asset in the financial statement.

See less

Yes, Goodwill is a fixed asset because it adds to the value of the business over a long period. Goodwill can never be calculated for a short period. GOODWILL Basically, goodwill is a premium or you can say an additional price you are paying because of the reputation of a firm or a person. YouRead more

Yes, Goodwill is a fixed asset because it adds to the value of the business over a long period. Goodwill can never be calculated for a short period.

GOODWILL

Basically, goodwill is a premium or you can say an additional price you are paying because of the reputation of a firm or a person.

You may have seen some famous shop in your locality which usually charges a higher price as compared to the other local shops selling the same product.

You may have also noticed that bigger brands like Bata, Titan, Zara, etc. charge higher prices for their products as compared to the same products available in the local market and people are even willing to pay for them. Ever wondered why?

This is because of the goodwill created by them over the years by providing quality products and services, good employee relationships, a strong customer base, social service, a brand name and so on. Customers trust them and for this trust, they are even willing to pay higher prices.

Goodwill is the quantitative value (i.e. in monetary terms) of the reputation of the firm in the market.

FIXED ASSETS

An asset is any possession or property of the business that enables the firm to get cash or any benefit in the future.

Fixed Assets are assets which are purchased for long-term use. They are for continued use in the business for producing goods or services and are not meant for resale. For example- Plant, machinery, building, goodwill, patents etc.

Fixed assets can be tangible or intangible.

Tangible assets are those assets which can be seen and touched and have physical existence like Plant and machinery, building, stock, furniture etc.

Intangible assets are those assets which cannot be seen or touched i.e. they don’t have any physical existence like goodwill, patent, trademark, prepaid expenses etc. Even though they can’t be seen or touched by they have value and are not fictitious assets.

Goodwill as a Fixed Asset

Goodwill is an intangible asset as it cannot be seen or touched but has value and adds value to the business over a long period. Thus, goodwill is a fixed asset.

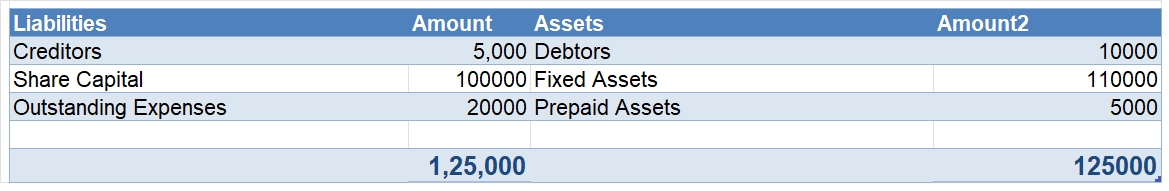

It is shown in the balance sheet as a Fixed asset under the head Intangible asset.

Goodwill can be

Self-generated goodwill is created over a period due to the good reputation of the business. It is the difference between the value of the firm and the fair value of the net tangible assets of the firm.

Goodwill = Value of the firm – Fair value of net tangible assets

Here, F.V of net tangible assets = Fair value of tangible assets- Fair value of tangible liabilities

Purchased goodwill arises when one business purchases another business. It is the difference between the price paid for the purchased firm and the sum of the fair market value of the assets received and liabilities to be paid by them on behalf of the purchased firm.

Goodwill = Purchase price – (F.V of assets received + F.V of liabilities to be paid)

Only purchased goodwill is recorded in the books of accounts because it is difficult to correctly calculate the value of self-generated goodwill as the future is uncertain, also its valuation depends on the judgement of the person calculating it, which defers from person to person. Since there is no fixed standard to calculate self-generated goodwill only purchased goodwill is recorded as the price paid for it at the time of acquiring another business.

Suppose Firm A acquired Firm B.

Purchase price= $100,000

Assets received=$60,000

Liabilities (to be paid by Firm A on behalf of Firm B) = $10,000

Goodwill = $100,000 – ($60,000 + $10,000) = $30,000

This, goodwill of $30,000 will be recorded under the head Fixed Asset, subhead Intangible Assets in the balance sheet of Firm A (that is in the balance sheet of the acquiring firm)

See less