Let the business in our example be X Trading. The 15 transactions are as follows: 1st April - X Trading started its business with Rs. 10,000 cash and furniture of Rs. 5,000. 5th April - Purchased 1,000 units of goods for Rs. 1,000 in cash from Ram. 10th April – Bought stationery for Rs. 100 in cash.Read more

Let the business in our example be X Trading. The 15 transactions are as follows:

- 1st April – X Trading started its business with Rs. 10,000 cash and furniture of Rs. 5,000.

- 5th April – Purchased 1,000 units of goods for Rs. 1,000 in cash from Ram.

- 10th April – Bought stationery for Rs. 100 in cash.

- 25Th April – Sold 500 goods for Rs. 750 in cash.

- 1st May – Paid a rent of Rs. 1200 ( 1st April to 31st March)

- 1st June – Took a loan of Rs. 15,000 from the bank at interest@10%.

- 15Th June – Sold 400 goods for Rs. 600 to Shyam in credit.

- 1st August – Bought a computer for Rs. 10,000 in from ABC Computers in credit.

- 15th October – Received Rs. 300 from Shyam in cash.

- 1st November – Purchased 2,000 units of goods for 2,000 from Ram in credit.

- 15th November – Paid Rs. 5,000 to ABC Computers through cheque.

- 1st December – Sold 1,000 units of goods for Rs. 1,500. Received cheque as payment.

- 1st January – Obtained Trade license (valid for 5 years) by paying fees of Rs. 1000 through online bank transfer.

- 15Th February – Paid Rs. 1,500 to Ram. Through cheque.

- 15Th March – Drawings made of Rs. 2000 in cash.

We will prepare the journal, ledgers and the trial balance from the above transactions.

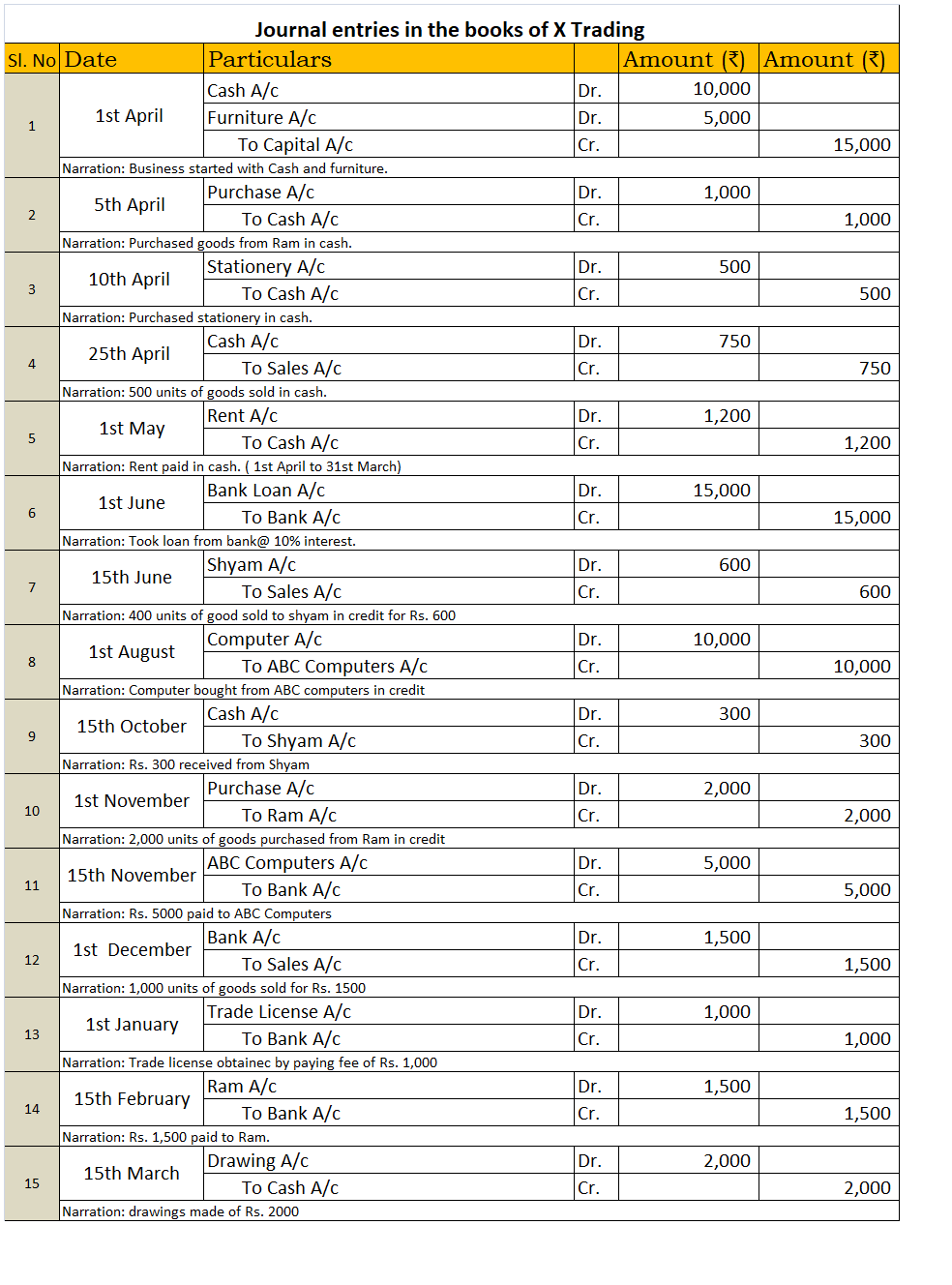

Journal

Journal is known as the book of primary entry or book of original entry. It is because every transaction is recorded in form of journal entries in the journal. Every journal entry affects at least two accounts (dual effect). A transaction has to be a monetary transaction otherwise it cannot be recorded as a journal entry.

The procedure of recording transactions as journal entries is simple if we follow the modern rules of accounting.

So first we have to identify which and what type of account does a transaction affect. The types of accounts are:

- Asset – Debit in case of increase Credit in case of decrease.

- Liabilities – Debit in case of decrease Credit in case of increase.

- Capital – Debit in case of decrease Credit in case of increase.

- Expense – Debit in case of increase Credit in case of decrease.

- Income – Debit in case of decrease Credit in case of increase.

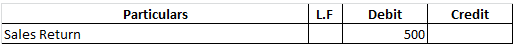

Ledger

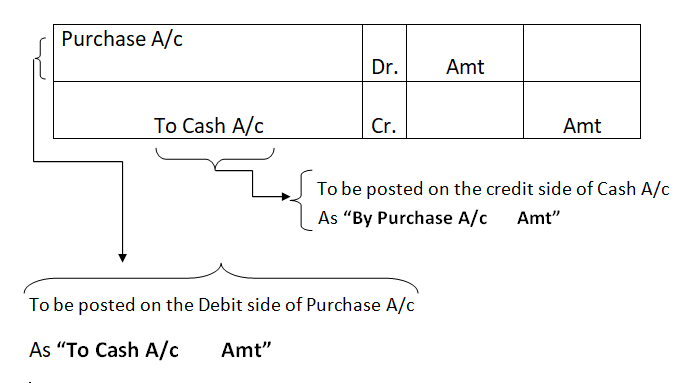

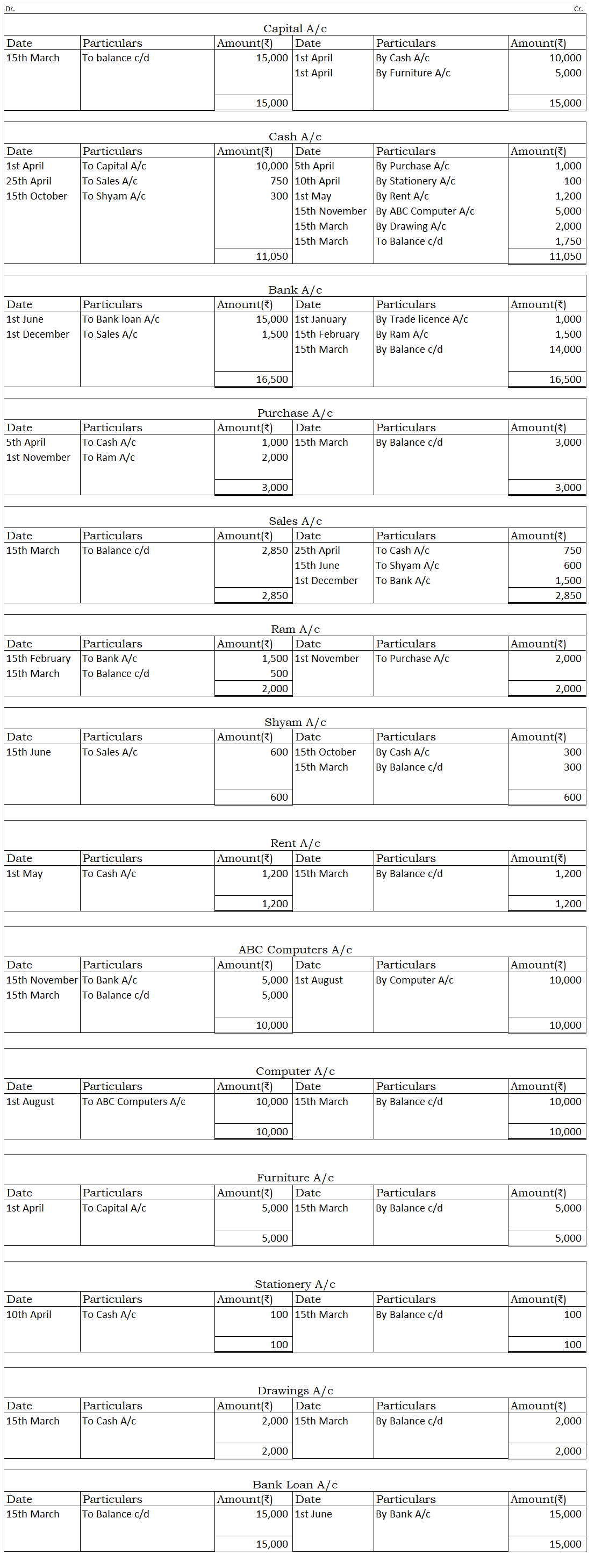

Ledgers are known as the books of principal entry or book of final entry. All the journal entries recorded in the journal are posted to the ledgers. A Ledger is where the entries related to a particular account are recorded. For example, all the transactions related to salary will be recorded in the salary account ledger.

It is very important to prepare the ledger to arrive at the balance of each account in the books of concern so that it can prepare its trial balance.

The procedure of posting journal entries in the ledger account is done is as follows:

The ledgers are as follows:

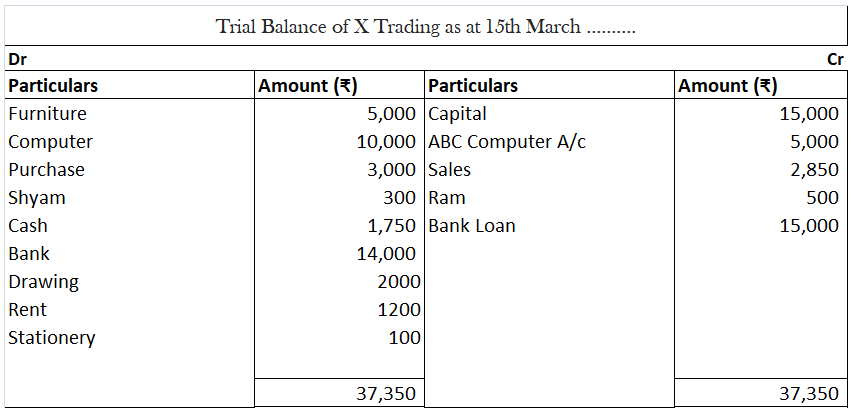

Trial Balance

The trial balance is not a part of the books of accounts. It is just a statement prepared to check the arithmetical accuracy of the books of the accounts. It also helps to know about the omission and posting mistakes. It is prepared after the ledger accounts have been drawn and their balances have been ascertained.

The balance of all the ledger accounts is posted on either side of the trial balance. Debit balance of the account on the debit side and credit balance of the account on the credit side.

Also, the closing stock from the financial statements of the previous year is posted on the debit side of the trial balance as opening stock to account for the stock with the business at the beginning of the financial year.

Following is the trial balance of X trading:

The provision for doubtful debts is the estimated amount of bad debts which will be uncollectible in the future. It is usually calculated as a percentage of debtors. The provision for a doubtful debt account has a credit balance and is shown in the balance sheet as a deduction from debtors. It is aRead more

The provision for doubtful debts is the estimated amount of bad debts which will be uncollectible in the future. It is usually calculated as a percentage of debtors. The provision for a doubtful debt account has a credit balance and is shown in the balance sheet as a deduction from debtors. It is a contra asset account which means an account with a credit balance.

When a business first sets up a provision for doubtful debts, the full amount of the provision should be debited to bad debts expense as follows.

In subsequent years, when provision is increased the account is credited, and when provision is decreased the account is debited. This is so because provision for doubtful debts is a contra account to debtors and has a credit balance, and is treated as a liability.

Effects of Provision for Doubtful Debts in financial statements:

For example, ABC Ltd had debtors amounting to Rs 50,000. It creates a provision of 5% on debtors.

Provision for Doubtful Debts = 50,000*5%

= 2,500

Journal entry for provision will be:

Effect on financial statements will be:

See less