The profits earned by a company are distributed to its shareholders monthly, quarterly, half-yearly, or yearly in the form of dividends. The dividend payable by the company is transferred to the Dividend Account and is then claimed by the shareholders. If the dividend is not claimed by the members aRead more

The profits earned by a company are distributed to its shareholders monthly, quarterly, half-yearly, or yearly in the form of dividends. The dividend payable by the company is transferred to the Dividend Account and is then claimed by the shareholders.

If the dividend is not claimed by the members after transferring it to the Dividend Account, it is called Unclaimed Dividend. Such a dividend is a liability for the company and it is shown under the head Current Liabilities.

The dividend is transferred from the Dividend Account to the Unclaimed Dividend Account if it is not claimed by the shareholders within 37 days of declaration of dividend.

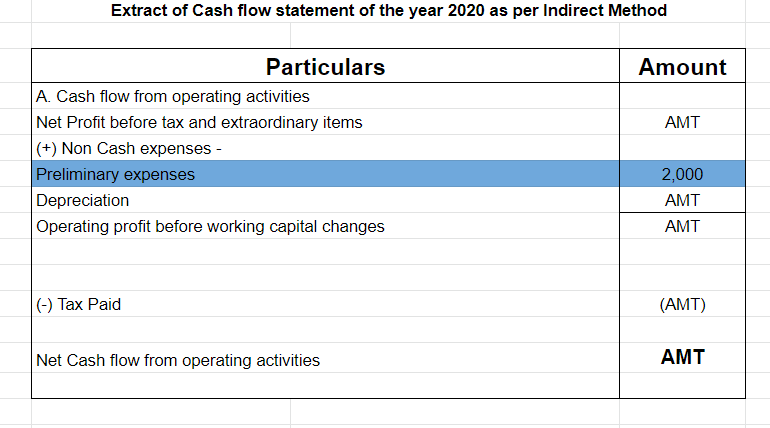

For the Cash Flow Statement, unclaimed dividend comes under the head Financing Activities.

Items shown under the head Financing Activities are those that are used to finance the operations of the company. Since, money raised through the issue of shares finances the company, any item related to shareholding or dividend is shown under the head Financing Activities.

However, there are two approaches to deal with the treatment of Unclaimed Dividend:

First, since there is no inflow or outflow of cash, there is no need to show it in the cash flow statement.

Second, the unclaimed dividend is deducted from the Appropriations, that is, when Net Profit before Tax and Extraordinary Activities is calculated.

Then, it is added under the head Financing Activities because the amount of dividend that has to flow out of the company (that is Dividend Paid amount which has already been deducted from Financing Activities) remained in the company only since it has not been claimed by the members.

The second approach to the treatment of an Unclaimed Dividend is used when the company has not transferred the unclaimed dividend amount from the Dividend Account to a separate account.

See less

Yes, sure! But lets us first understand what a revaluation account is. A revaluation account is prepared to recognise the change in the book value of assets and liabilities of an entity. These changes happen when assets and liabilities are revalued to present their fair value. It is a nominal accounRead more

Yes, sure! But lets us first understand what a revaluation account is.

A revaluation account is prepared to recognise the change in the book value of assets and liabilities of an entity. These changes happen when assets and liabilities are revalued to present their fair value.

It is a nominal account because it represents gain or loss in value of assets and liabilities. However such gain or loss is unrealised because the assets and liabilities are not sold or discharged.

After revaluation of assets and liabilities, the balance of the revaluation account can be debit or credit. The debit balance means ‘loss on revaluation’ and credit balance means ‘gain on revaluation’.

The balance of revaluation is transferred to the capital account.

Journal Entries related to Revaluation Account

1. Increase in value of an asset upon revaluation:

2. Decrease in value of an asset upon revaluation:

3. Increase in value of liabilities upon revaluation:

4. Decrease in value of liabilities upon revaluation:

5. Transfer or distribution of the balance of revaluation account

or

Numerical example

P, Q and R are partners of the firm ‘PQR Trading’. They share profits and losses in the ratio 3:2:1. On 1st May 20X1, they decided to admit S for 1/6th share in profits and losses of the firm. Upon the revaluation:

Let’s prepare the revaluation account.

See less