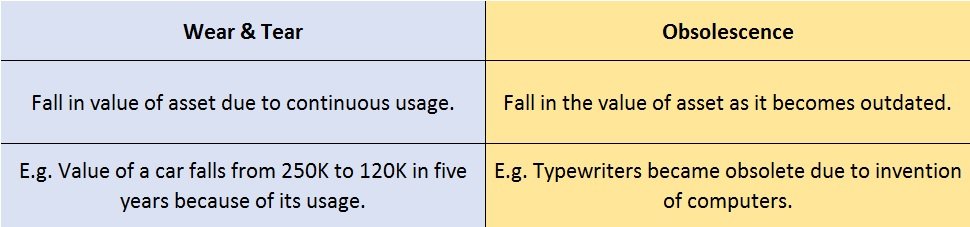

Depletion Amortization Depression

The correct answer is 4. Not shown in Branch Account. The value of depreciation of fixed assets will be not shown in the branch accounting because the opening value of the asset is recorded at the start of the period on the debit side and the closing value of the asset is shown on the credit side atRead more

The correct answer is 4. Not shown in Branch Account.

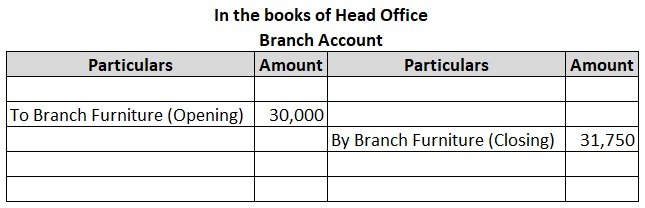

The value of depreciation of fixed assets will be not shown in the branch accounting because the opening value of the asset is recorded at the start of the period on the debit side and the closing value of the asset is shown on the credit side at the end of the period.

The difference between the opening and closing values of the asset is the value of depreciation which is automatically charged. In this case, if depreciation is also shown it will be counted twice.

Example:

XYZ Ltd purchased furniture for one of its branches on 1st January. Following are the details of the purchase:

| Furniture as on 1st January | $30,000 |

| Furniture purchased on 1st June | $5,000 |

Depreciation is provided on furniture at @10% per annum on the straight-line method.

| Woking Notes: | Amt |

| i. Depreciation on furniture: | |

| On $30,000 @10% p.a for full year | 3,000 |

| On $5,000 @10% p.a for 6 months | 250 |

| 3,250 | |

| ii. Branch Furniture as of 31 Dec: | |

| Furniture as of 1 January | 30,000 |

| Add: Addition made during the year | 5,000 |

| 35,000 | |

| Less: Depreciation | (3,250) |

| 31,750 |

As additional furniture was purchased after 6 months, depreciation will be charged on that and the total depreciation of 3,250 will be charged on the furniture of $35,000 ($30,000+$5,000) and the difference will be the closing balance which will be shown in the branch account on the credit side.

The depreciation amount will not be shown in the Branch Account as the difference between the opening and closing values of the furniture reflects the value of depreciation. If depreciation is shown in the account it will be counted twice.

See less

The correct option is 2. Amortization. Depreciation in spirit is similar to Amortization because both depreciation and amortization have the same characteristics except that depreciation is used for tangible assets and amortization for intangible assets. To make it clear, intangible assets are thoseRead more

The correct option is 2. Amortization.

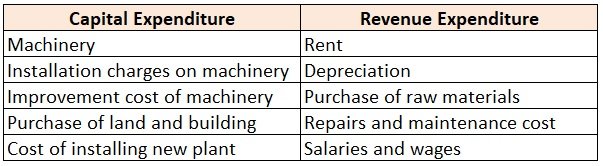

Depreciation in spirit is similar to Amortization because both depreciation and amortization have the same characteristics except that depreciation is used for tangible assets and amortization for intangible assets.

To make it clear, intangible assets are those assets that cannot be touched i.e. they are not physically present. For example, goodwill, patent, trademark, etc. Hence, these assets are amortized over their useful life and not depreciated.

Example for Amortizing intangible assets: A manufacturing company buys a patent for Rs 80,000 for 8 years. Assuming that the residual value of the patent after 8 years to be zero.

The depreciation to be written off will be

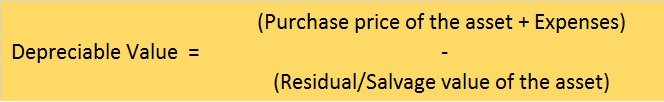

Yearly Depreciation = Cost of the patent – Residual value / Expected life of the asset.

= 80,000 – 0 / 8

= Rs 10,000 every year.

Whereas, tangible assets are those assets that can be touched i.e. they are physically present. For example, building, plant & machinery, furniture, etc. Hence, these assets are depreciated over their useful life and not amortized.

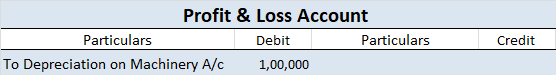

Example of Depreciating tangible asset: A manufacturing company bought machinery for Rs 8,10,000 and its estimated life is 8 years, scrap value being Rs 10,000.

The depreciation to be written off will be

Yearly Depreciation = Cost of machinery – Scrap value / Expected life of the asset.

= 8,10,000 – 10,000 / 8

= 8,00,000 / 8

= Rs 1,00,000 every year.

See less