Non-current assets are long-term investments that are not easily converted into cash within an accounting year. They are required for the long term in the business. They have a useful life of more than an accounting year. Non-current assets can be fixed assets and intangible assets. Fixed assets areRead more

Non-current assets are long-term investments that are not easily converted into cash within an accounting year. They are required for the long term in the business. They have a useful life of more than an accounting year.

Non-current assets can be fixed assets and intangible assets. Fixed assets are tangible assets that can be seen and touched. Whereas, intangible assets are those assets that can not be seen and touched.

You can correlate examples of Non-Current Assets with tangible and intangible assets as mentioned below:

Land and building – They are fixed assets that will give long-term benefits and will be classified as noncurrent assets.

Plant and Machinery – They are tangible assets will give future benefits and are thus mentioned under noncurrent assets.

Office Equipment – They are tangible assets that will give future economic benefits to the company, and comes under noncurrent assets.

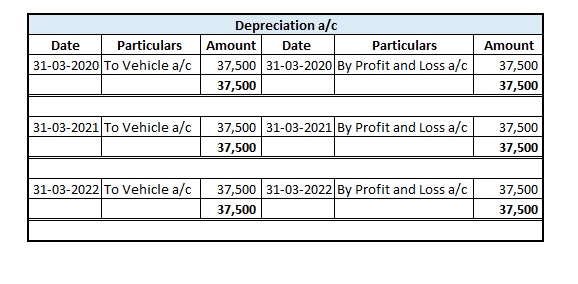

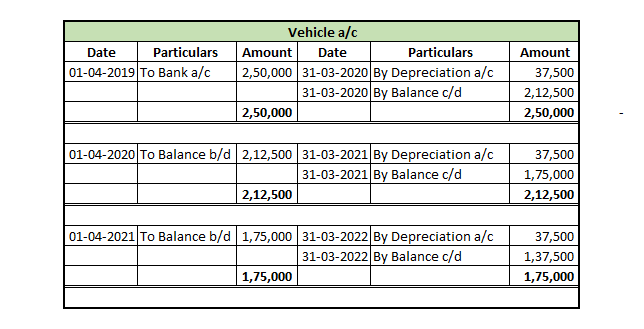

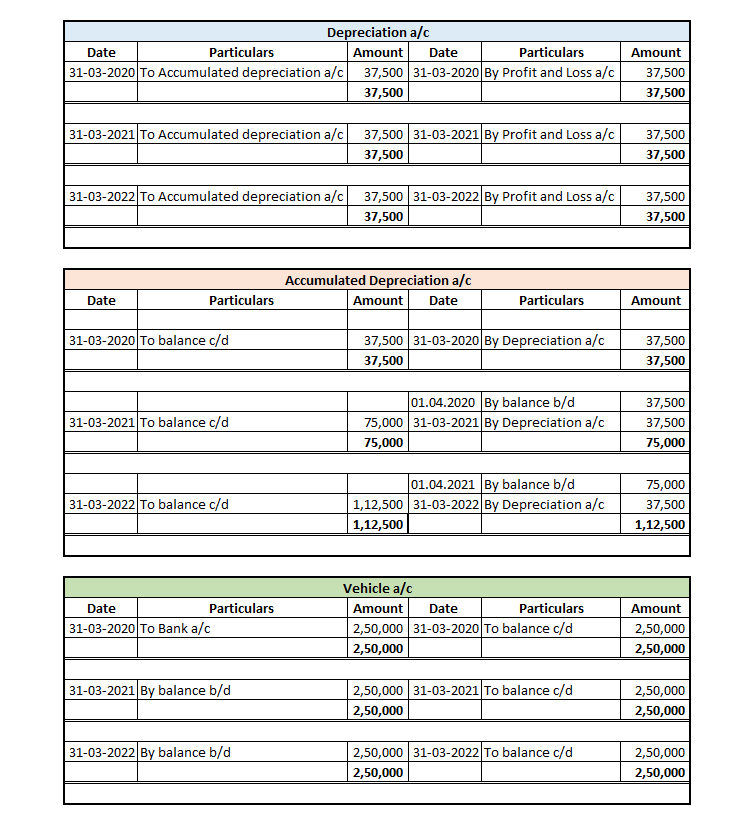

Vehicles – They are tangible assets that will give long-term benefits, and will be classified as noncurrent assets.

Furniture – They are also tangible assets that will give future benefits and are classified as non-current assets.

Trademarks – These are intangible assets that will not be easily converted into cash and will be classified as noncurrent assets.

Goodwill – They are intangible assets that can’t be easily converted into cash, and are classified as non-current assets.

Patents – They are intangible assets that will not be converted into cash within an accounting period, and are classified as non-current assets.

Copyrights – They are intangible assets that will not be converted into cash within an accounting period, and are classified as non-current assets.

Long-term Investments – They are long-term investments that will not be easily converted into cash within an accounting period and are classified as non-current assets.

Non-current Assets = Total Liabilities – Current Assets

Current Assets are the assets that will be converted into cash within an accounting year. They include cash, bank, debtors, etc.

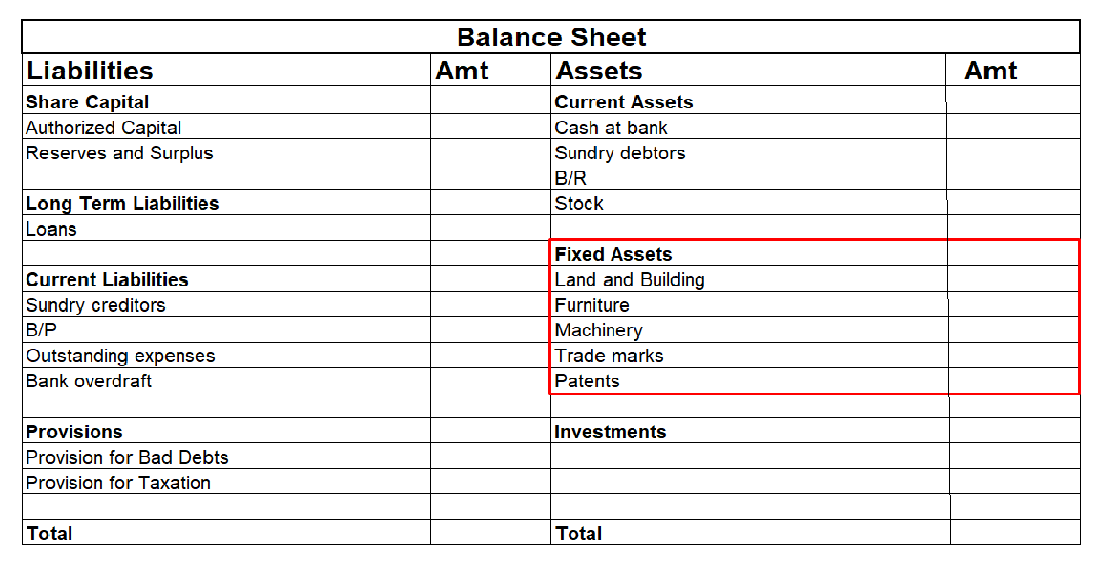

|

BALANCE SHEET |

|||||

| LIABILITIES | ASSETS | ||||

| Capital | xxx | Fixed Assets | |||

| Reserves and Surplus | xxx | Land and Building | xxx | ||

| Vehicle | xxx | ||||

| Current Liabilities | Furniture | xxx | |||

| Accounts Payable | xxx | ||||

| Bank Overdraft | xxx | Intangible Assets | |||

| Outstanding Expenses | xxx | Goodwill | xxx | ||

| Trademarks | xxx | ||||

| Long-term Investments | xxx | ||||

| Current Assets | |||||

| Cash | xxx | ||||

| Debtors | xxx | ||||

| Others | xxx | ||||

| xxx | xxx |

See less

Yes, non-current assets are also known as fixed assets. These are long-term assets that are not intended for sale but are used by a company in its business operations. Examples of non-current assets include property, plant, and equipment, as well as intangible assets like patents and trademarks. TheRead more

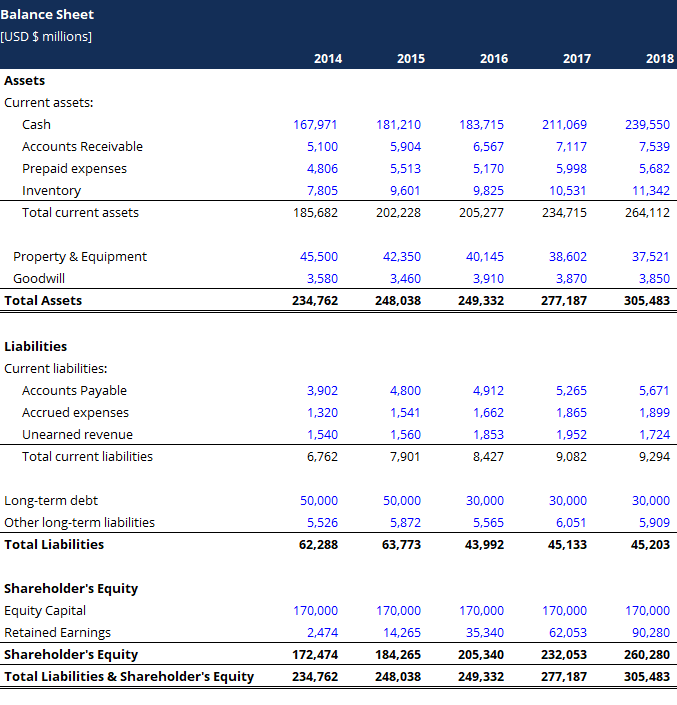

Yes, non-current assets are also known as fixed assets. These are long-term assets that are not intended for sale but are used by a company in its business operations.

Examples of non-current assets include property, plant, and equipment, as well as intangible assets like patents and trademarks. These assets are recorded on a company’s balance sheet and are reported at their historical cost or at their fair market value, depending on the type of asset.

See less