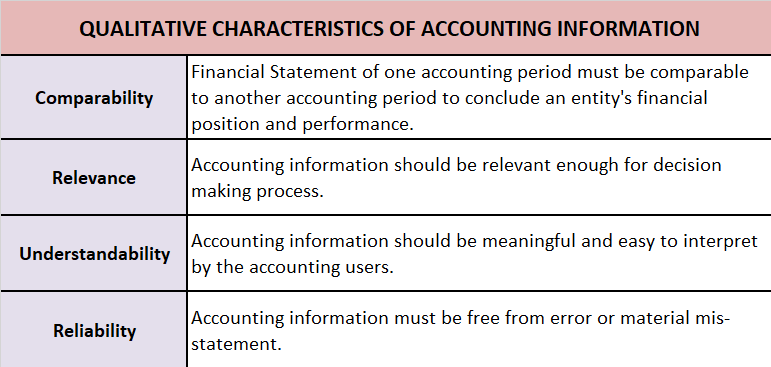

QUALITATIVE CHARACTERISTICS OF ACCOUNTING INFORMATION ARE AS FOLLOWS: 1. COMPARABILITY: Comparison of financial statements is one of the most frequently used and effective tools of financial analysis. It helps the users of accounting information to compare, analyze and take decisions accordingly. CoRead more

QUALITATIVE CHARACTERISTICS OF ACCOUNTING INFORMATION ARE AS FOLLOWS:

1. COMPARABILITY: Comparison of financial statements is one of the most frequently used and effective tools of financial analysis. It helps the users of accounting information to compare, analyze and take decisions accordingly. Comparability enables inter-firm and intra-firm comparisons. It helps to ascertain the growth and progress of the business over time and in comparison to other businesses.

For example, managers of ITC ltd want to know which business of his is performing well and which needs progress so they would compare the financial statement of its different businesses and make the decision accordingly.

2. RELEVANCE: It generally means that the essential information should be easily and readily available and any irrelevant information should be avoided. The user of accounting information needs relevant accounting information for a good decision-making process, planning, and predicting future circumstances.

For example, a firm is expected to provide the total amount owed by the debtors in the balance sheet, whereas the total number of debtors is not important.

3. UNDERSTANDIBILITY: The financial statement should be presented so that every user can interpret the information without any difficulty in a meaningful and appropriate manner. To be more precise it should be complete, concise, clear, and organized.

For example, mentioning note number in the financial statement for any items which needs disclosure. This helps the users of accounting to interpret the financial statement without any difficulty.

4. RELIABILITY: This means the accounting information must be free from material error and bias. All accounting information is verifiable and can be verified from the source documents basically, information should not be vague or false.

For example, any significant matters like amount due, damages, losses, etc. which impact the financial stability shall be mentioned as disclosure since it is useful for all the users of accounting to be aware of such facts and not to be misguided by incomplete information.

Yes, I agree with your statement that accounting information should be comparable. Comparability is one of the qualitative characteristics of accounting information. It means that users should be able to compare a company's financial statements across time and across other companies. Comparability oRead more

Yes, I agree with your statement that accounting information should be comparable.

Comparability is one of the qualitative characteristics of accounting information. It means that users should be able to compare a company’s financial statements across time and across other companies.

Comparability of financial statements is crucial due to the following reasons:

1. Intra-Firm Comparison:

Comparison of financial statements of two or more periods of the same firm is known as an intra-firm comparison.

Comparability of accounting information enables the users to analyze the financial statements of a business over a period of time. It helps them to monitor whether the firm’s financial performance has improved over time.

The intra-firm analysis is also known as Time Series Analysis or Trend Analysis.

To understand intra-firm analysis, I have provided an extract of the balance sheet of ABC Ltd. for two accounting periods.

2. Inter-Firm Comparison:

Comparison of financial statements of two or more firms is known as an inter-firm comparison.

Inter-firm comparison helps in analyzing the financial performance of two or more competing firms in an industry. It enables the firm to know its position in the market in comparison to its competitors.

Inter-firm comparison is also known as Cross-sectional Analysis.

I’ve provided the balance sheets of Co. A and Co.B to make an inter-firm comparison.

Here is a piece of bonus information for you,

Sector Analysis – it refers to the assessment of economical and financial conditions of a given sector of a company/industry/economy. It involves the analysis of the size, demographic, pricing, competitive, and other economic dimensions of a sector of the company/industry/economy.

One more important thing to note here is that comparability can only be achieved when the firms are consistent in the accounting principles and standards they adopt. The accounting policies and standards must be consistent across different periods of the same firm and across different firms in an industry.

See less