Explain Business entity, money measurement concept, Going concern concept etc.

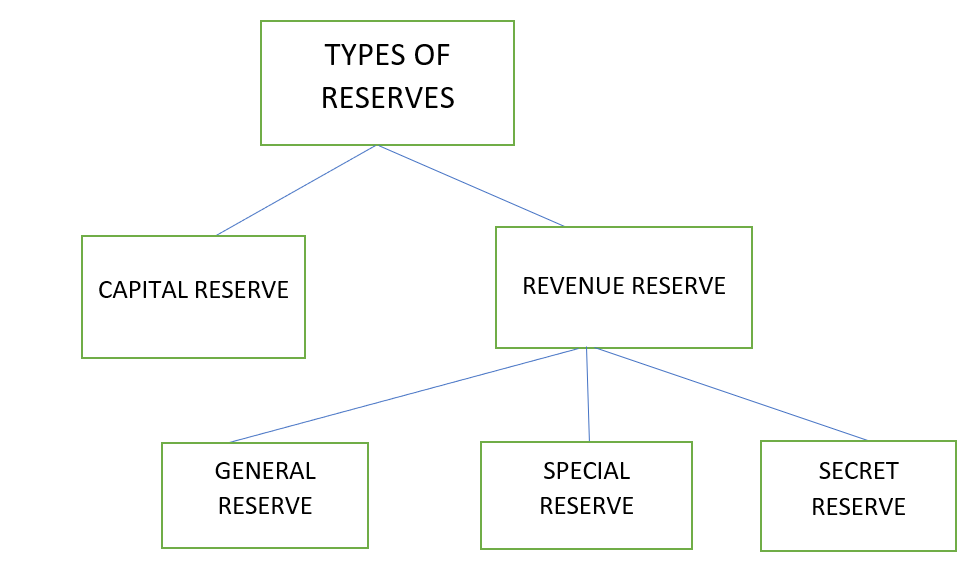

A revenue reserve is a type of reserve where a portion of the net profit is set aside for future requirements. It serves as a great source of internal finance for the company to meet its short term requirements. The funds put into this reserve are earned from the daily operations of a company. RevenRead more

A revenue reserve is a type of reserve where a portion of the net profit is set aside for future requirements. It serves as a great source of internal finance for the company to meet its short term requirements. The funds put into this reserve are earned from the daily operations of a company. Revenue reserves are shown on the liabilities side of a balance sheet under reserves and surplus. Some examples of revenue reserve are :

- General Reserve: This reserve is used for no specific purpose, but the general financial growth of the company. It is a free reserve which means the company is not compelled to make one. It helps to curb future losses which may arise in the future.

- Specific Reserve: These are those reserves that can only be used for specific purposes. This money cannot be used for any other requirement. It is not a free reserve. A reserve created to redeem debentures would be called a debenture redemption reserve.

- Secret Reserve: This is a type of reserve whose existence is not disclosed in the balance sheet. This type of reserve cannot be created by joint-stock companies. However, banks and financial institutions are allowed to create such secret reserves.

Retained Earnings is that part of the net profit which is left after the distribution of dividends to shareholders. This amount can be invested in the company to gain profits. It is not technically a reserve as it is held after distribution of dividends but it can still be used as one.

On the other hand, a capital reserve is not a part of the revenue reserve. It is created from capital profits to finance long term projects of a company. It is used for specific purposes only.

See less

Accounting Concepts Accounting concepts are the rules, assumptions and methods generally accepted by accountants in the preparation and presentation of financial statements of an entity. These concepts have been developed by the accounting profession for a long period. These concepts constitute theRead more

Accounting Concepts

Accounting concepts are the rules, assumptions and methods generally accepted by accountants in the preparation and presentation of financial statements of an entity. These concepts have been developed by the accounting profession for a long period.

These concepts constitute the foundation of accounting and one has to be aware of them to maintain correct and uniform financial statements.

I have listed and briefly explained the following accounting concepts.

#1 Entity Concept

As per this concept, the business and its owner are separate entities from the point of view of accounting. It means the assets and liabilities of the business and owner are not the same.

However, in the eyes of law, the business and its owner may be a single entity.

#2 Money measurement concept

This concept states that the transaction which can be measured in terms of money shall only be recorded in the books of accounts.

Any transaction which cannot be measured in terms of money shall not be recorded.

#3 Going concern concept

Going concern concept is also a fundamental accounting assumption. It assumes that an enterprise will continue to be in business for the foreseeable future.

It means its accounts will also be prepared to take such assumptions that the business will continue in future.

#4 Periodicity concept

The periodicity concept states an entity needs to carry out accounting for a definite period, generally for a year known as the accounting period. The period can also be half-year or a quarter.

The cycle of accounting restarts at the start of every accounting period.

#5 Accrual concept

The word accrual comes from the word

As per the accrual concept, the expense and incomes are recorded in the books of accounts in the period in which they are expected to incur whether payment in cash is made or cash is received or not.

For example, the salary to be paid by a business is to be recorded as an expense in the year in which it is expected or liable to be paid.

#6 Cost concept

It is concerned with the purchase of the assets of a business. As per the cost concept, a business shall record any asset in its books at the acquisition cost or purchase cost.

#7 Realisation concept

This concept is concerned with the sale of assets. A business shall record the sale of the assets in its books only at the realised cost.

#8 Matching concept

As per this concept, revenue earned during a period should be matched with the expenses incurred in that period. In short, an entity needs to record the income and the expenses of the same period.

#9 Dual concept

This concept is the foundation of double-entry accounting. Dual concepts state that every transaction has two effects, debit and credit.

One or more accounts may be debited and other one or more accounts are credited so that the total amount of debit and credit equals.

#10 Conservatism concept

The conservatism concept states that an entity has to account for expected losses and expenses but not for future expected profits and gains.

#11 Materiality concept

As per this concept, only those items which are material should be shown in the financial statements of an entity. It says that items which are immaterial or insignificant in terms of value or importance to stakeholders can be ignored.

#12 Consistency concept

It says that an entity should follow consistent accounting policies every accounting period so that a comparison can be made among the financial statements of different accounting periods.

GAAP

Generally Accepted Accounting Principles or GAAP is a combination of authoritative standards which are set by policy boards and commonly accepted methods of recording and presenting accounting information.

GAAP or US GAAP is formulated by the Financial Accounting Standards Board or FASB and almost state in the USA is compliant with GAAP.

The main goal of the GAAP is to ensure that the financial statements of an entity are complete, consistent and comparable.

It can be said accounting concepts are part of GAAP.

Ten key principles of GAAP

#1 Principle of regularity

It states that an accountant has to comply with GAAP regulations as a standard.

#2 Principle of Consistency

Accountants should be committed to applying the same set of standards throughout the accounting and reporting process, from one period to another. This is to be done to ensure comparability of financial statements between periods.

Also, the accountants have to fully disclose and explain the reason behind any changed or updated standards in the note of accounts of financial statements.

#3 Principle of sincerity

It states that the accountant should strive to provide an accurate and unbiased view of the financial situation of a company.

#4 Principle of Permanence of Methods

As per this principle, a company should be consistent in procedures used in financial statements so that it allows the comparison of the company’s financial information.

#5 Principle of Non-Compensation

Both negative and positive should be reported with full transparency. There should be no debt compensation i.e. debt should not be set off against any asset or expenses against revenue.

#6 Principle of Prudence

It states that financial data presentation should be fact-based. This principle is similar to the conservatism concept.

#7 Principle of Continuity

This is as same the going concern concept. It states that while valuing assets, it should assume that the business will continue for the foreseeable future.

#8 Principle of Periodicity

It is the same as the matching concept. It states that the revenue and expenses should be recorded in the period in which they occur.

#9 Principle of Materiality

Accountants should disclose all the financial information that is significant in the decision-making of the users of financial statements.

#10 Principle of Utmost Good Faith

It states that all parties to a transaction should act honestly and not mislead or hide crucial information from one another.

See less