The correct option is D) Fewer entries in the general ledger To understand why option D is correct, we need to understand the concept. Petty cashbook is a special cashbook prepared for recording petty or small cash expenses. The benefit is that the chief cashier can focus on large cash and bank tranRead more

The correct option is D) Fewer entries in the general ledger

To understand why option D is correct, we need to understand the concept.

- Petty cashbook is a special cashbook prepared for recording petty or small cash expenses.

- The benefit is that the chief cashier can focus on large cash and bank transactions and there are fewer transactions in the main cashbook.

- The petty cashier is provided with a fixed amount for a month or week and is reimbursed the amount spent at the end of the period after he sends the details of expenses to the chief cashier.

- There are entries for the transfer of cash to the petty cashier in the main cashbook only.

Option A ‘No entries made at all in the general ledger for items paid by petty cash ‘ is wrong. It is not possible to omit entries of petty expense just because there is a petty cashbook. There will be entries related to:

- The cash is given to the petty cashier in a fixed amount or the amount spent as petty expenses during the month or week.

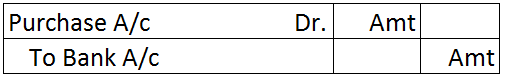

Petty cash A/c Dr. Amt

To Cash A/c Amt

Option (B) ‘The same number of entries in the general ledger is wrong because there can never be the same number of entries as all the petty expenses are recorded in the petty cashbook and only the entries for transfer of cash to the petty cashier is recorded in the main cash book.

Option D ‘More entries made in the general ledger’ is wrong because the number of entries actually reduce as only petty cash transfer entries are recorded in the main cashbook instead of numerous entries of petty cash transactions.

See less

AS-11: The effects of changes in foreign exchange rates deal with the issues in the translation of foreign currency transactions and foreign operations. Foreign operations of a reporting enterprise mean its subsidiary, associate, joint venture or branch which is based or conducted in a country otherRead more

AS-11: The effects of changes in foreign exchange rates deal with the issues in the translation of foreign currency transactions and foreign operations.

Foreign operations of a reporting enterprise mean its subsidiary, associate, joint venture or branch which is based or conducted in a country other than the country of the reporting entity

For simple understanding let’s consider foreign operation as a branch of a business that is based in a foreign country.

Foreign Integral operations

So, integral foreign operations will be a dependent branch that works on the directions of the head office and it is like an extension of the business. The head office consigns goods to it and it sells them and remits cash and reports to the head office.

It is dependent on head office for receiving goods to sell and to cover its expenses.

Further, the difference in foreign exchange rate affects the present and future cash flows to the head office.

Foreign Non-Integral operations

A non-integral foreign operation will be like an independent branch that can operate without the aid of the head office. Apart from selling goods of the head office, it also buys goods from the local market and sells them.

Also, it covers its expenses on its own. It doesn’t remit the cash from sales regularly like a dependent branch. It is like acts an investment of the main business.

The difference in the foreign exchange rate has little or no effect on the present or future cash flows of the head office

See less