Journal entry for commission earned but not received Commission earned but not received is called accrued income. As we know there are two types of accounting, cash basis of accounting, in which the transaction is recorded only when cash is received or paid, and accrual basis of accounting, in whichRead more

Journal entry for commission earned but not received

Commission earned but not received is called accrued income. As we know there are two types of accounting, cash basis of accounting, in which the transaction is recorded only when cash is received or paid, and accrual basis of accounting, in which even if money is yet to be accepted or paid, the transactions are still recorded.

E.g of accrual income- rent earned but not collected, interest on the investment earned but not received, etc.

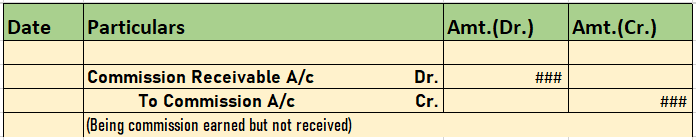

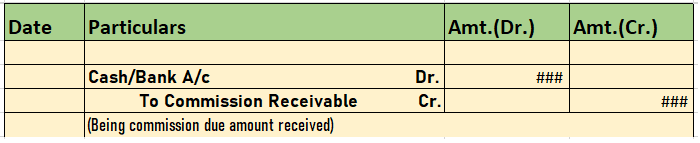

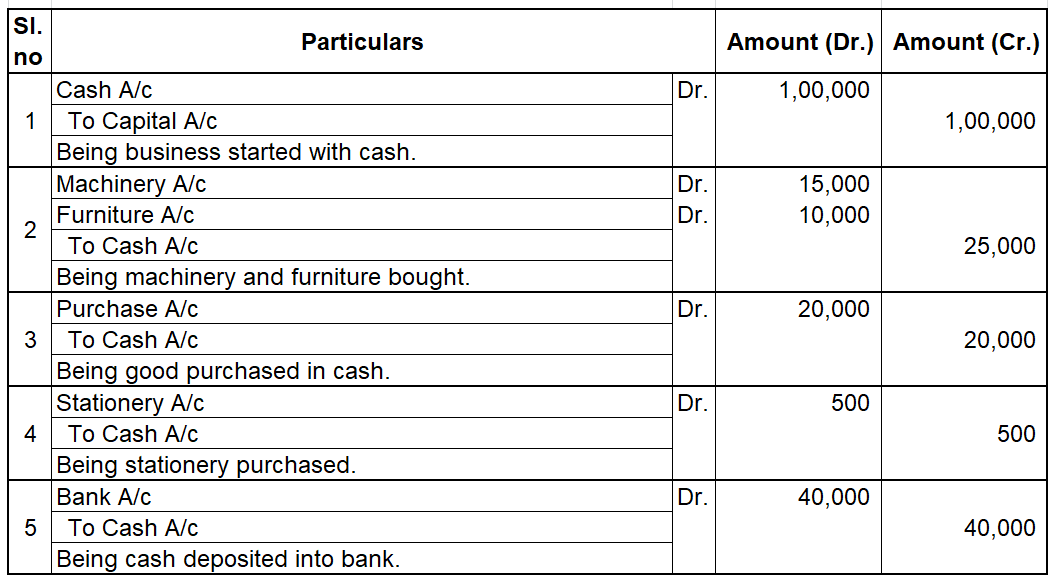

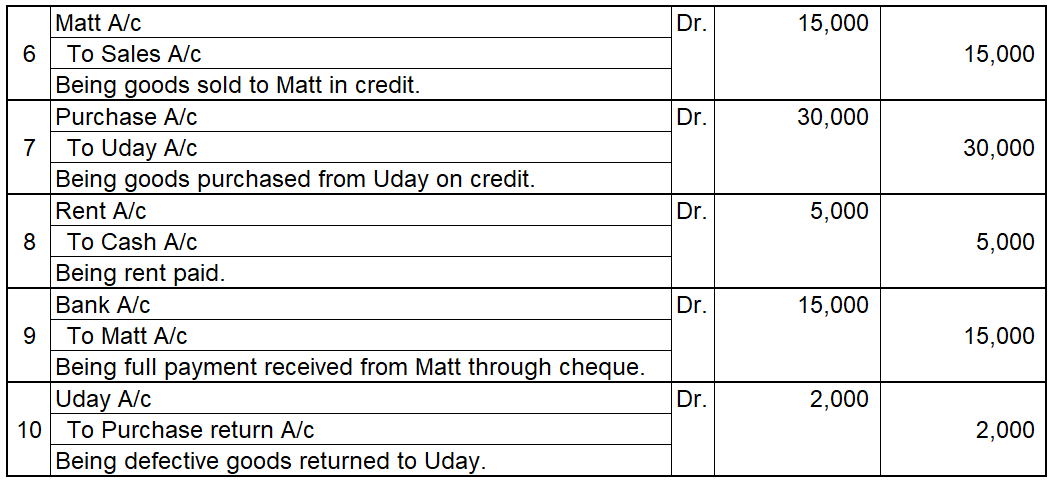

Journal entry

- The commission that is to be received is debited, indicating the increase in assets whereas, the commission account (which will be giving you the commission) is credited.

- Later on, upon receiving the cash an entry is passed crediting the commission receivable as shown below:

- These are adjusted while making the final accounts for the business.

Simplifying with an example

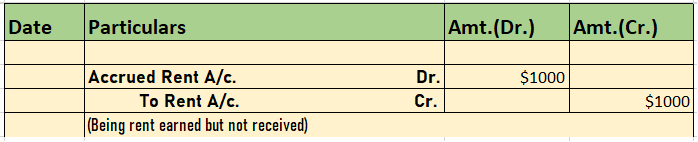

If the rent earned was $1,000 and it’s yet to be received, we’ll be passing this entry-

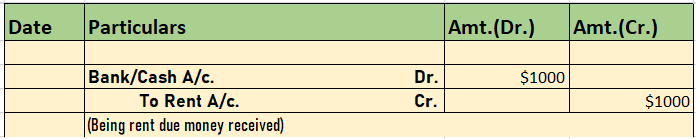

When it’s received, this entry is passed

See less

Interest on drawings Drawings refer to the money withdrawn by owners/partners for personal use from the business. The drawings, in accounting terms, can be of any type. It can be cash withdrawn from business or furniture or car etc. Drawings are money or assets that are withdrawn from a company by iRead more

Interest on drawings

Drawings refer to the money withdrawn by owners/partners for personal use from the business. The drawings, in accounting terms, can be of any type. It can be cash withdrawn from business or furniture or car etc. Drawings are money or assets that are withdrawn from a company by its owners for personal use and must be recorded as a reduction of assets. It’s paid back to the business with some interest.

Interest on drawings is an income for the business and reduces the capital of the owner. Interest on drawings is the amount of interest paid by the partners, calculated concerning the period for which the money was withdrawn.

Formulae for Interest on drawings

There are three formulae used for calculating the interest on drawings. They are:

1. Simple Method: In this method, as the name suggests, the amount of interest on drawings is calculated simply for the time the amount has been utilized.

Interest on Drawings = Amount of drawings × Rate/100 × No. of Months/12

2. Product Method: This method is used when-

Interest on Drawings = Total of Products × Rate/100 × 1/12

Interest on Drawings= Total amount of drawings × Rate/ 100 × Average Period/12

Also, note-

Average Period = (No. of months left after first drawings+ No. of months left after last drawings)/2

Example:

Harish withdrew equal amounts at the beginning of every month for 9 months. Total drawings amounted to ₹6,000. Calculate the interest on drawings charged if the rate was 6% p.a.

Solution:

Average period = (No. of months left after first drawings+ No. of months left after last drawings)/2 = (9+1)/2 = 5 months

Interest on Drawings = Total of drawings × Rate/100 × 5/12

Journal entry for interest on drawings:

Interest transferred to Profit & Loss A/c:

See less