Income and Expenditure A/c of Charitable Trust Income and Expenditure A/c is like the Profit and Loss A/c in the Balance Sheet of the Charitable Trust. All the income and expenses are, therefore, recorded in this. It is used to determine the surplus or deficit of income over expenditures over a specRead more

Income and Expenditure A/c of Charitable Trust

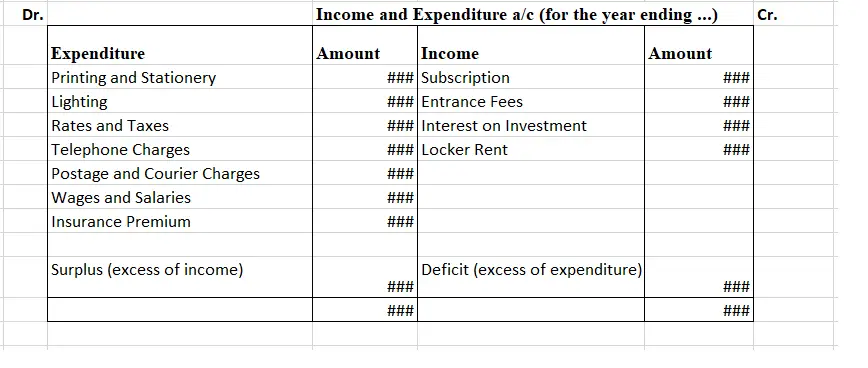

Income and Expenditure A/c is like the Profit and Loss A/c in the Balance Sheet of the Charitable Trust. All the income and expenses are, therefore, recorded in this. It is used to determine the surplus or deficit of income over expenditures over a specific accounting period.

It shows the summary of all the income and expenditures done by the charitable trust over an accounting year. All the revenue items relating to the current period are shown in this account, the expenses and losses on the expenditure side, and incomes and gains on the income side of the account.

- Therefore, as you can see here, how a charitable trust may use MS Excel for making their Income and Expenditure A/c, the Surplus and Deficit are the balancing figures used for balancing both the debit and credit sides.

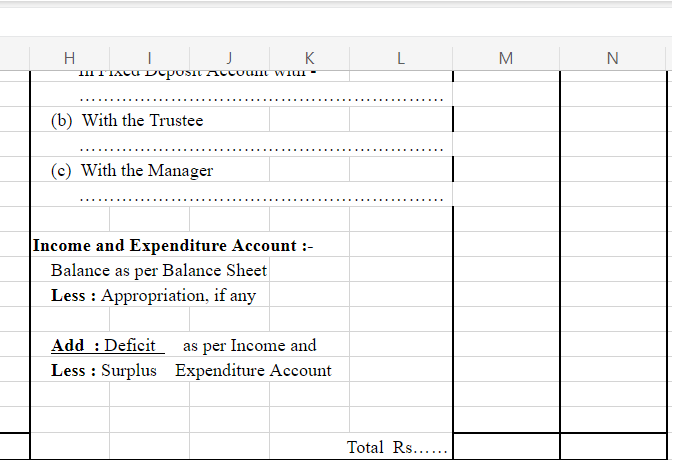

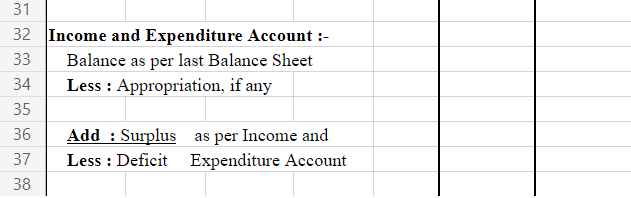

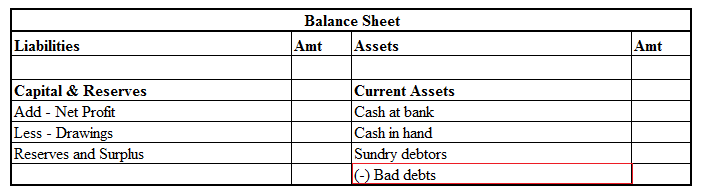

Later on, they are even used in the Balance Sheet. As follows-

On the Assets Side

On the Liability Side

See less

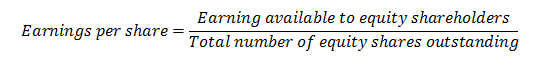

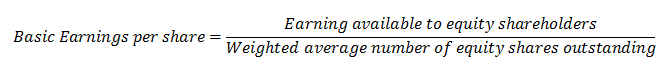

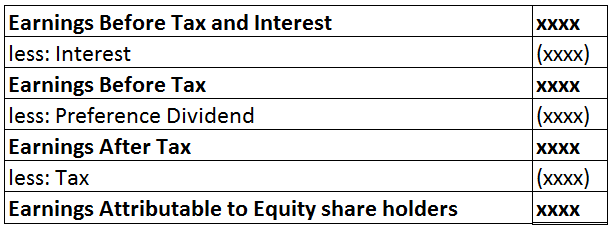

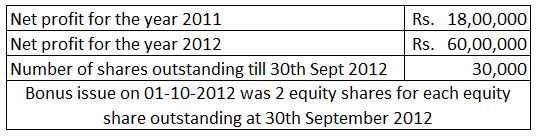

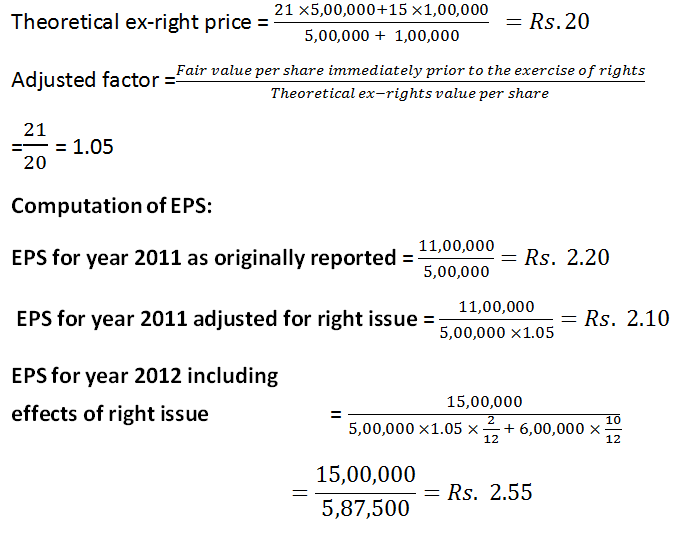

Earnings per share indicate the profit-generating capability of an enterprise and potential investors often compare the EPS of different companies to choose the best investment alternative.

Earnings per share indicate the profit-generating capability of an enterprise and potential investors often compare the EPS of different companies to choose the best investment alternative.

Capital Expenditure Capital expenditure refers to the money a business spends to buy, maintain, or improve the quality of its assets. Capital expenditures are the expenses incurred by an organization for long-term benefits, i.e on the long-term assets which help in improving the efficiency or capaciRead more

Capital Expenditure

Capital expenditure refers to the money a business spends to buy, maintain, or improve the quality of its assets. Capital expenditures are the expenses incurred by an organization for long-term benefits, i.e on the long-term assets which help in improving the efficiency or capacity of the company. These expenses are borne by the company to boost its earning capacity.

The investment done by the companies on assets is capital in nature and through capital expenditure, the company may use it for acquiring new assets or may use it in the maintenance of previous ones. These expenditures are added to the asset side of the balance sheet.

Example: Purchase of machinery, patents, copyrights, installation of equipment, etc.

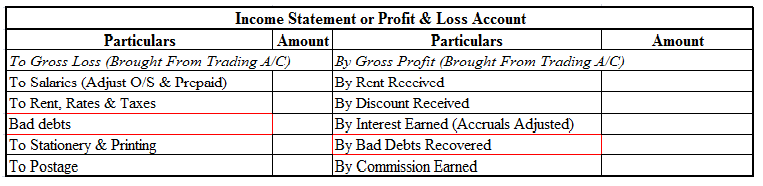

Revenue Expenditure

Revenue expenditure refers to the routine expenditures incurred by the business to manage day-to-day expenses. They are incurred for a shorter duration and are mostly limited to an accounting year. These expenses are borne by a company to sustain its profitability. These expenditures are shown in the income statement.

These expenditures do not increase the revenue but stay maintained. These expenses are not capitalized.

They are divided into two sub-categories:

Example: Wages, salary, insurance, rent, electricity, taxes, etc.

See less