Introduction In GST, a supply is a taxable event. This means whenever there is a supply of goods or services or both, GST is charged. Supply includes the exchange of goods or services between supplier and recipient by way of sale, barter, lease etc for consideration and in the course or furtheranceRead more

Introduction

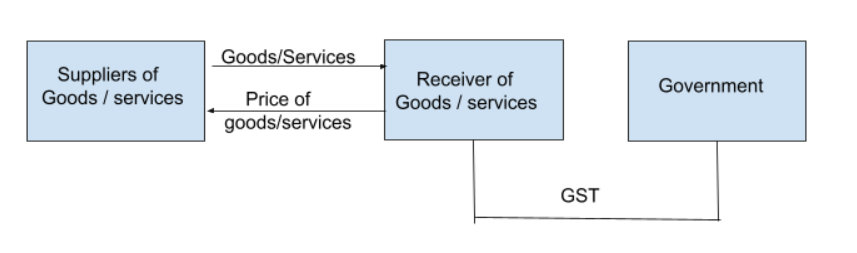

In GST, a supply is a taxable event. This means whenever there is a supply of goods or services or both, GST is charged. Supply includes the exchange of goods or services between supplier and recipient by way of sale, barter, lease etc for consideration and in the course or furtherance of business. The rate of GST on any supply depends on the type of good or service supplied.

Composite supply and mixed supply are two special types of supplies, in which two or more goods or services or both are offered together in a bundle. As two or more goods are supplied together, the question arises at which rate the GST is to be charged on such supplies as such goods or services may have different rates of GST applicable to them. Sections 8 of the CGST act, 2017 deals with the tax liability of such supplies.

Composite supply

A composite supply is a type of supply in which two or more goods or services or both are supplied together in the ordinary course of business. Such goods or services are natural bundles. By natural bundle, we mean the goods or services are complementary to each, they are naturally provided together and are to be used along with each other.

For example, mobile phones and chargers are supplied as a bundle. This concept of the natural bundle is the main determiner of a composite supply.

In such supplies, there is one main product which is called the principal supply. Like in the above example, the mobile phone is the principal supply. Other goods or services are dependent on the principal supply.

A composite supply will be taxable as the rate of GST applicable on the principal supply.

For example, suppose the rate of GST on mobile phones is 18% and that on the charger is 12%, then the whole supply will be taxable at the rate of 18%.

Mixed supply

A mixed supply is a type of supply in which two or more goods or services or both are supplied together but they do not complement each other and are not a natural bundle. They are not supplied in the ordinary course of business, For example, a combo of bottled honey and face cream.

In mixed supply, the good or service which attracts the highest rate of GST is considered the rate of supply for the whole supply.

For example, suppose bottled honey attracts 5% GST and face cream 18% GST, then the whole supply will be charged 18% GST.

See less

In Tally, it is possible to record credit sales entry in the following accounting vouchers: Sales Voucher Journal Voucher Generally, sale entries whether credit sales or cash sales are recorded in the Sales vouchers. Also, I strongly recommend you to record sales entries in the Sales voucher only aRead more

In Tally, it is possible to record credit sales entry in the following accounting vouchers:

Generally, sale entries whether credit sales or cash sales are recorded in the Sales vouchers. Also, I strongly recommend you to record sales entries in the Sales voucher only as it can record various aspects related to credit sales like the sales order number, delivery note number, particulars of creditor and much more.

In this answer, I have shown the steps to record a credit sales entry into the Sale voucher. My answer is based on Tally Prime, the latest version of Tally. If you are using Tally ERP 9, there will be only a few areas of differences which are not that significant.

Steps to record credit sales in Sales voucher

To record credit sales entry, you have to first open the Sales voucher creation window. To open the Sales creation window, the steps are as follows:

Gateway of Tally → Voucher → Press F8

The Sales voucher creation window will open and will look like this:

Now, there are three modes to the sales voucher which you can be accessed and changed from the ‘Change mode’ option in the right-hand side menu or by simply pressing Ctrl + H. Upon pressing Ctrl + H, the Change mode option will open.

I will recommend you to use ‘Item Invoice’ mode. It looks like an invoice and it is easier to use and understand. The image of the sale voucher given is in the item invoice only.

Now to have to fill in the following details:

This is a completed sales voucher:

Hence, this is how you have recorded a credit sales entry in the sales voucher.

See less