The installation expenses for a new machinery will be debited to the "Machinery A/c". Installation expenses are the expense incurred to bring an asset to a working condition where it can be used. For example, installation charges are incurred on machinery to make it operational. Installation chargesRead more

The installation expenses for a new machinery will be debited to the “Machinery A/c“. Installation expenses are the expense incurred to bring an asset to a working condition where it can be used. For example, installation charges are incurred on machinery to make it operational.

Installation charges will be capitalized along with the cost of machinery. It is so because this expense is concerning the machinery and any expense directly related to an asset should be capitalized, as an asset will be with the business for a longer period of time.

This charge will be incurred only once as a part of bringing the machinery to its working condition, and hence it should be capitalized and should be added to the cost of the machine. The whole amount will be shown in the balance sheet on the asset side as a Fixed Asset.

This charge will not be shown in Profit and Loss A/c as it reflects all the revenue expenditure incurred in the period.

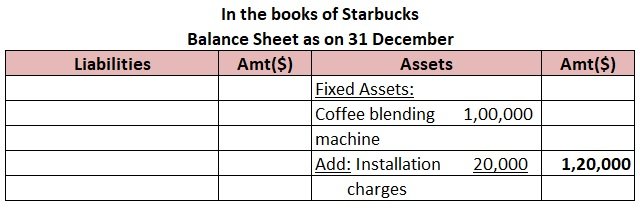

Example:

Starbucks purchased a coffee blending machine for the business purpose for $1,00,000. The installation expense incurred on it to make it operational was $20,000. How will Starbucks record this in the Balance Sheet on 31 December?

In the Balance Sheet, Starbucks will add the installation expense incurred on the machine to the cost of the machine as it is the cost incurred to make the machine operational for further business use. Hence, the cost of $20,000 will be shown along with the cost of the coffee blending machine ($1,00,000+$20,000=$1,20,000)

See less

To start with let me give you a brief explanation of what a subscription is After joining a not-for-profit organization, a member is required to pay a certain amount of money every year at periodical intervals in order to keep his membership activated, such an amount of money is the subscription. FoRead more

To start with let me give you a brief explanation of what a subscription is

After joining a not-for-profit organization, a member is required to pay a certain amount of money every year at periodical intervals in order to keep his membership activated, such an amount of money is the subscription.

For accounting purposes, subscription is always taken on an accrual basis which means the amount which is received during the current year is only taken into consideration.

Now, Subscription received in advance means the amount of money that has been received during the current year but which relates to the year that is yet to come. In other words, we can say it is the unearned income by the organization.

It is recurring in nature and liability for the organization as it does not relate to the current year.

Journal Entry for Subscription received in advance

Here, the Subscription received in advance is credited to the Subscription account for the current year.

This is the adjustment entry made during the current year.

Treatment of Subscription in Financial Statements

Receipts and Payment account: In the receipts and payment account, the entire amount of subscription is written on the receipts side. That is to say, subscription amount relating to the previous year, current year, and the year to come (outstanding subscription, current year subscription, advance subscription).

Income and Expenditure account: In the Income and Expenditure Account, the subscription comes on the Income side. It is shown as

Here, a subscription received in advance in the current year is deducted to find the actual amount because although the money is received in advance the benefits related to it are yet to be provided by the organization.

Balance sheet: In the balance sheet, a subscription received in advance comes in the liability side under current liabilities as the benefits related to it are yet to be derived.

For Example, Lionel club received subscription from its members for the year 2020 as follows-

The total subscription was received during the year – 10,000

Here,

Subscription of 2020 was received in 2019- It is an Outstanding Subscription.

Subscription of 2021 was received in 2020- It is an advance Subscription.

See less