To understand why we do not record self-generated goodwill in accounting, let us first understand what goodwill is and its accounting treatment. What is Goodwill? Goodwill is an intangible asset of a business. It represents the reputation and brand value of a business built over time. It is a valueRead more

To understand why we do not record self-generated goodwill in accounting, let us first understand what goodwill is and its accounting treatment.

What is Goodwill?

Goodwill is an intangible asset of a business. It represents the reputation and brand value of a business built over time. It is a value over and above the tangible assets of the business.

Goodwill often arises when a business purchases another business and pays a premium, which means a price higher than the fair value of the business.

Characteristics of Goodwill

Goodwill has the following characteristics:

- It is an Intangible asset, meaning it has no physical existence and cannot be seen or touched.

- It is generally recognized during transactions in mergers and acquisitions.

- It is the value attributed to the brand value and reputation of the business.

- It adds value to a business beyond its tangible assets.

Example of Goodwill

Let us take an example to understand the concept of goodwill better.

Suppose there is a company ABC Ltd. It is planning to acquire XYZ Ltd. The fair value of the assets of XYZ is calculated to be 600,000. However, ABC has agreed to pay a sum of 650,000 to acquire the company. This difference of 50,000 is goodwill.

Impact on Financial Statements

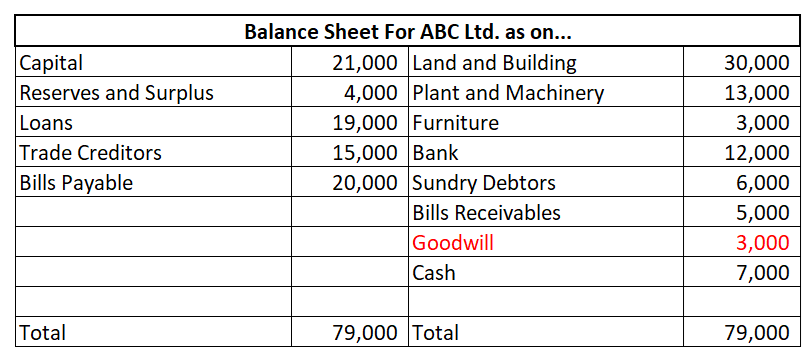

Goodwill is shown under the assets side of the Balance Sheet.

What is self-generated goodwill?

Self-generated goodwill in simple words means the positive reputation or trust that a business earns over time through their own hard work and decisions. It’s not something bought or inherited but something built from scratch internally, like a brand’s reputation, loyal customers, strong relationships, or unique ideas.

For example, a small business that goes the extra mile to offer great customer service or always delivers high-quality products over the years will naturally build goodwill.

It is also known as internally generated goodwill.

Why do we not record sef-generated goodwill?

Self-generated goodwill is not recorded in the financial statements because of the following reasons:

- Measurement may not be reliable: The measurement of self-generated goodwill is majorly based on the judgment of the managers. It is based on the value creation because of a good reputation or consumer base of the business, which might not be measured accurately.

- Conservatism principle: As per the conservatism principle, a business shall not overstate its assets or liabilities. However, self-generated goodwill might be overstated.

- Lack of market transaction: There is a lack of a market transaction that ensures verification of the value of goodwill as in the case of purchased goodwill.

- Manipulation: There are higher chances of manipulation of financial statements through self-generated goodwill.

Conclusion

On a concluding note, self-generated goodwill is something that adds real value to a business, but it’s not something that can easily be measured or captured in financial statements. Accounting is all about providing clear, reliable information, and including goodwill would make things murky and open to manipulation. Even though it doesn’t show up on the books, you can still see its effects in a company’s reputation and success. Maybe in the future, businesses will find a way to highlight it better, but for now, leaving it out helps keep financial reports honest and straightforward.

See less

Deferred Tax Liability A deferred tax liability represents an obligation to pay taxes in the future. These taxes are owed by a company but are not due to be paid until a future date. Companies that incur such an obligation prepare and maintain two financial reports every year: a tax statement and anRead more

Deferred Tax Liability

A deferred tax liability represents an obligation to pay taxes in the future. These taxes are owed by a company but are not due to be paid until a future date.

Companies that incur such an obligation prepare and maintain two financial reports every year: a tax statement and an income statement.

This is because companies maintain their books as per book accounting rules (GAAP/IFRS), but they have to pay taxes according to tax accounting rules, and they each have to follow their own guidelines.

For example, a tax statement follows the cash basis of accounting, and an income statement follows the accrual basis of accounting.

Companies calculate their profit as per the accounting rules as well as tax laws known as accounting income and taxable income, respectively. Some differences arise due to the application of different provisions of law.

These temporary differences are accounted for, recognized, and carried forward in the books of accounts and create deferred tax.

Example

Here is an example of deferred tax liability.

In the given example, tax as per income statement is 70,000, whereas as per tax statement it is 56,000. This temporary difference is termed as deferred tax liability of 14,000.

When accounting income is more than taxable income, it creates Deferred Tax Liability. It will be adjusted in the books of accounts during one or more subsequent year(s).

How Does it Arise?

There are several instances under which a company creates a deferred tax liability. Some other instances are:

Depreciation Methods

Treatment of Revenue & Expenses

Impact on Financial Statements

Recognising deferred tax liability and its subsequent effect on the company’s financial statement is important as it simplifies the process of auditing and analysing financial reports.

Balance Sheet

Cash Flow Statement

- The deferred tax liability is added back to the net income in calculating cash flow from operating activities to show the actual cash flow.

See less