Definition Bad debts are a debt owed to an enterprise that is considered to be irrecoverable or we can say that it is owed to the business that is written off because it is irrecoverable. Bad debts will be treated in the following ways : On the debit side of the profit and loss account. In the curreRead more

Definition

Bad debts are a debt owed to an enterprise that is considered to be irrecoverable or we can say that it is owed to the business that is written off because it is irrecoverable.

Bad debts will be treated in the following ways :

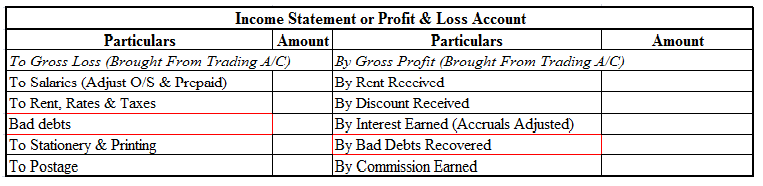

On the debit side of the profit and loss account.

In the current assets side of the balance sheet, these are deducted from sundry debtors.

For example loans from banks are declared as bad debt, sales made on credit and amounts not received from customers, etc.

Now I will show you an extract of the profit and loss account and balance sheet

Current assets are defined as cash and other assets that are expected to be converted into cash or consumed in the production of goods or the rendering of services in the ordinary course of business.

For example, debtors exist to convert them into cash i.e., receive the amount from them, bills receivable exist again for receiving cash against it, etc.

Current liabilities are defined as liabilities that are payable normally within 12 months from the end of the accounting period or in other words which fall due for payment in a relatively short period.

For example bills payable, short-term loans, etc.

Accounting treatment

Now let me try to explain to you the accounting treatment for bad debts which is as follows :

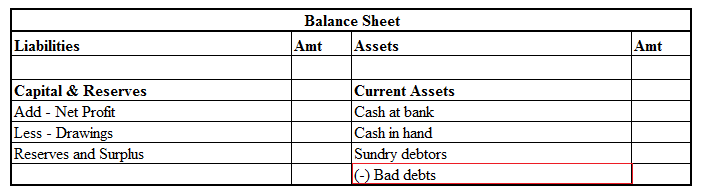

- Balance sheet

-

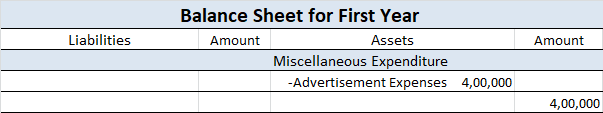

- In the balance sheet either it can be shown on the asset side under head current assets by reducing from that specific assets.

-

- For example, if credit sales are made to a customer who says it’s not recoverable or is partially recoverable then the amount is bad debt. It’s a loss for the business and credited to the personal account of debtors or we can say reduced from debtor those are current assets of the balance sheet.

- Profit and loss account

-

- Bad debts are treated as an expense and debited to the profit and loss account.

- For example, as I have explained above, but before transferring to the balance sheet, bad debt will be debited to the profit and loss account as an expense.

Reasons for bad debts

There are several reasons why businesses may have bad debts some of them are as follows:-

- Offered credit to customers who were unable to pay them back, or they may have been the victim of fraud.

- When there is conflicts or dispute arise with respect to product size, color, quality, delivery, credit term, price, etc therefore debts becomes bad.

- Debtors have poor financial management or they are not able to pay debts on time.

- Debtors’ unwillingness to pay is also a reason for debts to become bad.

- Or there can be more cases where debtors are unable to collect debts and debts turns out to be bad.

Accounting methods

There are two methods for accounting for bad debts which are mentioned below:-

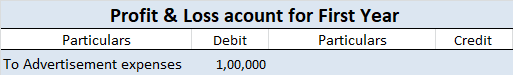

- First, is the direct written-off method which states that bad debts will be directly treated as expenses and expensed to the income statement, which is called the profit and loss account.

- Second, is the allowance method which means we create provisions for doubtful debts accounts and the debtor’s account remains as it is since the debtor’s account and provision for doubtful debts account are two separate accounts.

-

- Debts that are doubtful of recovery are provided estimating the debts that may not be recovered .amount debited to the profit and loss account reduces the current year’s profit and the amount of provision is carried forward to the next year.

-

- Next year, when debts actually become bad debts and are written off, the amount of bad debts is transferred ( debited ) to the provision for doubtful debts account.

-

- The amount of bad debts is not debited to the profit and loss account since it was already debited in earlier years.

-

- Provision for doubtful debts is shown in the debit side of the profit and loss account as well as shown as a deduction from sundry debtors in the assets side of the balance sheet.

Related terms

So there are a few related terms whose meanings you should know

- Further bad debts :

- It means the amount of sundry debtors in the trial balance is before the deduction of bad debts. in this situation, entry for further bad debts is also passed into the books of account.

- That is bad debts are debited and the debtor’s account is credited. And the accounting treatment for them is the same as bad debts which I have shown you above.

- Bad debts recovered :

-

- It may happen that the amount written off as bad debts is recovered fully or partially.

- In that case, the amount is not credited to the debtor’s (personal) account but is credited to the bad debts recovered account because the amount recovered had been earlier written off as a loss.

- Thus amount recovered is a ‘gain’ and is credited to the profit and loss account.

See less

Subsidiary Books Introduction & Definition In large business organizations, it is practically impossible to keep a record of every single business affair, while neglecting them and not recording them wouldn't be an ideal choice, this is where subsidiary books come into the role. As we were introRead more

Subsidiary Books

Introduction & Definition

In large business organizations, it is practically impossible to keep a record of every single business affair, while neglecting them and not recording them wouldn’t be an ideal choice, this is where subsidiary books come into the role. As we were introduced to the basics of accounting in the 11th standard, we learned about different elements like journals, ledgers, trial balances, etc. It is practically impossible for a business to keep track of every single affair just through only those elements. Thus, the Subsidiary book is the next step here.

Subsidiary books are the books of original entry. They are a dedicated form of books that maintains an analysis of a specific account. It records financial transactions of a similar nature. They are sub-division of a journal.

In big business organizations, it’s very hard for a bookkeeper or accountant to record all the transactions in one journal and post them into various accounts. This is where special purpose books or subsidiary books may be required for more efficient bookkeeping. They are a subdivision of journals and for every type of transaction, there is a separate book.

Types of Subsidiary Books

There are eight types of subsidiary books that are required for recording transactions. The list of various subsidiary books is as follows:

Types of Subsidiary Books

Now, we’ll be taking a closer look at each and every subsidiary book.

Cash Book

The cash book is the most important subsidiary book, it’s a book of a prime entry recording all the cash spent or received by the business, either in cash form or from the bank. In simple words, recording all the transactions made by the business.

It is of three types i.e single-column cash book, double-column cash book, and triple-column cash book. As the name indicates, the column of cash, bank, and discount increases/decreases as per the column of the cash book stated.

Format

Note: this is a triple-column cash book format, for the double-column cash book format, we remove the discount column from both sides, and for the single column, we may remove the bank column as well.

Purchase Book

A purchase book is a subsidiary book that records all the transactions related to the credit purchase in a business. Thereby, the normal purchasing of assets is never recorded in the purchase book.

The credit purchases are directly recorded in the purchase book from the journals or the source documents. The source document indicates bills payable, invoices, etc.

Format

Sales Book

A sales book, similar to a purchase book, is a special book where all the credit sales are recorded. The sales book doesn’t record the transactions related to the normal sale of assets and hence, is a special type of book, just like the purchase book.

Format

Purchase Return Book

The purchase return book, also known as the return outwards book, is that book that records the goods that were returned by us to the supplier. Thereby, called purchase return book.

When the goods are returned, a debit note is issued against every return and hence, recorded in the purchase return book.

Format

Sales Return Book

The sales return book, also known as the return inwards book, refers to that subsidiary book that records the goods which were returned to us by the customer.

For every good returned to us, a credit note is issued to the customer. And thus, it is recorded in the sales return book.

Format

Journal Proper

Just like we recently learned in class 11th about what a journal entry is and how it is made, it’s a little different from the journal proper. Journal proper is a subsidiary book that records all the transactions which are not recorded in other subsidiary books.

A journal is an original book of entries that records all the business transactions, while a journal proper is a subsidiary book in which all types of miscellaneous credit business transactions are recorded that do not fit anywhere in the other subsidiary books. Its format is the same as the journal entries’ format. Therefore, it’s also known as a miscellaneous journal.

Format

Bills Receivable Book

The bills receivable book is the book that draws the bills favorable to the business i.e when the goods or services are provided to any customer on credit, they become a debtor, and bills receivable is a written note received from the customer indicating that they formally agree to pay the sum of money owed.

Therefore, it helps in recording these types of transactions. The sum total of the bills receivable book is posted to the bills receivable account.

Format

Bills Payable Book

The bills payable book is the subsidiary book that records all the bills that are drawn on the company. The bills payable is drawn on the company when we buy a good/service on credit and agrees to pay the amount to the supplier by signing a written note with the date we agree to pay.

It’s a liability of the business and the total of the bills payable book is posted on the credit side of the bills payable account.

Format

See less