Yes, sure! But lets us first understand what a revaluation account is. A revaluation account is prepared to recognise the change in the book value of assets and liabilities of an entity. These changes happen when assets and liabilities are revalued to present their fair value. It is a nominal accounRead more

Yes, sure! But lets us first understand what a revaluation account is.

A revaluation account is prepared to recognise the change in the book value of assets and liabilities of an entity. These changes happen when assets and liabilities are revalued to present their fair value.

It is a nominal account because it represents gain or loss in value of assets and liabilities. However such gain or loss is unrealised because the assets and liabilities are not sold or discharged.

After revaluation of assets and liabilities, the balance of the revaluation account can be debit or credit. The debit balance means ‘loss on revaluation’ and credit balance means ‘gain on revaluation’.

The balance of revaluation is transferred to the capital account.

Journal Entries related to Revaluation Account

1. Increase in value of an asset upon revaluation:

| Asset A/c | Dr. | Amt |

| To Revaluation A/c | Cr. | Amt |

| (Being asset value increased upon revaluation) |

2. Decrease in value of an asset upon revaluation:

| Revaluation A/c | Dr. | Amt |

| To Asset A/c | Cr. | Amt |

| (Being asset value decreased upon revaluation) |

3. Increase in value of liabilities upon revaluation:

| Revaluation A/c | Dr. | Amt |

| To Liabilities A/c | Cr. | Amt |

| (Being liabilities value increased upon revaluation) |

4. Decrease in value of liabilities upon revaluation:

| Liabilities A/c | Dr. | Amt |

| To Revaluation A/c | Cr. | Amt |

| (Being liabilities value decreased upon revaluation) |

5. Transfer or distribution of the balance of revaluation account

| Revaluation A/c | Dr. | Amt |

| To Capital/ Partners’ capital A/c | Cr. | Amt |

| (Being profit on revaluation transferred to capital account. |

or

| Capital/ Partners’ capital A/c | Dr. | Amt |

| To Revaluation A/c | Cr. | Amt |

| (Being loss on revaluation transferred to capital account. |

Numerical example

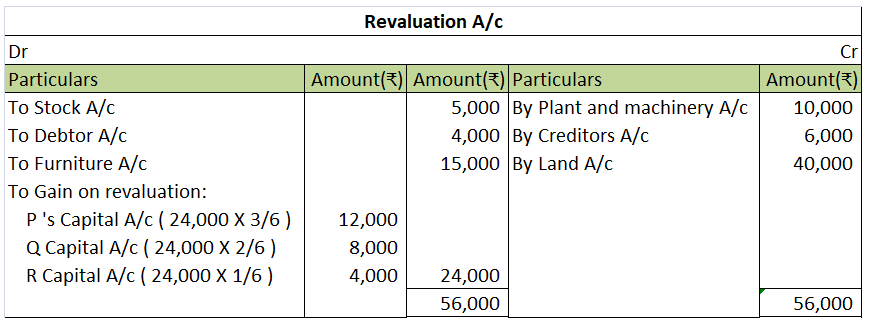

P, Q and R are partners of the firm ‘PQR Trading’. They share profits and losses in the ratio 3:2:1. On 1st May 20X1, they decided to admit S for 1/6th share in profits and losses of the firm. Upon the revaluation:

- Plant and machinery increased from Rs 1,20,000 to Rs. 1,30,000

- The stock decreased by Rs 5000

- Debtors and creditors both decreased by Rs 4,000 and Rs 6,000 respectively.

- Furniture decreased from Rs 25,000 to Rs 10,000

- Land increased by Rs 40,000.

Let’s prepare the revaluation account.

Credit balance means excess of credit side over debit side. For example, At the beginning of the year, the credit balance of trade payable is 3,000 and there is a debit of trade payable of 1,000 during the year and an increase(credit) of trade payable of 4,000 then at the end there will be a creditRead more

Credit balance means excess of credit side over debit side.

For example, At the beginning of the year, the credit balance of trade payable is 3,000 and there is a debit of trade payable of 1,000 during the year and an increase(credit) of trade payable of 4,000 then at the end there will be a credit balance of 6,000 of trade payable at the end

.A Credit balance signifies all income and gains and all liabilities and capital that is there in business.

Liabilities and Capital

Income and Gains

So after seeing all the above points we can conclude that the credit balance includes all the income in the P&L account and all the liabilities in the Balance sheet. So its balance increases when there is an increase in its account.

Debit Balance

Debit balance means excess of credit side over debit side.

For Example- At begining of the year the debit balance of trade receivables is 3,000 and there is a decrease(credit) of trade receivables of 1,000 during the year and an increase(debit) of trade receivables of 4,000 then at the end there will be a debit balance of 6,000 of trade receivables at the end

A Debit balance basically signifies all expenses and losses and all positive balances of assets. The debit balance increases when any asset increases and decreases when any asset decreases.

Asset

Expenses and Loses

- Rent

- Depreciation

- General Expenses

- Loss on Sale of asset

- Printing and stationery

- Audit fees

- Outstanding fees

- Salaries and Wages

- Insurance

- Advertising

- Promotional expenses

See less