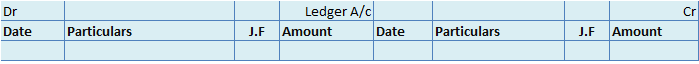

Specimen of Ledger account This is the specimen of a ledger account. J.F. here represents the journal folio. A Ledger account is an account that consists of all the business transactions that take place during the current financial year. For Example, cash, bank, machinery, A/c receivable account, etRead more

Specimen of Ledger account

This is the specimen of a ledger account. J.F. here represents the journal folio.

A Ledger account is an account that consists of all the business transactions that take place during the current financial year.

For Example, cash, bank, machinery, A/c receivable account, etc.

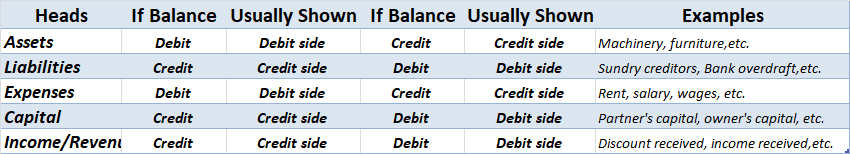

After the financial data is recorded in the Journal. It is then classified according to the nature of accounts viz. Asset, liability, expenses, revenue, and capital to be posted in the ledger account.

With this head, the identification as to whether the opening balance will come under the debit side or the credit side is done.

The table below would help to understand the concept of opening balance in the ledger.

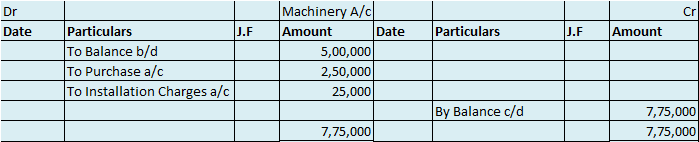

For further clarification of the concept let me give you a practical example.

Suppose, a manufacturing firm Amul purchased machinery for, say, Rs 2,50,000. The installation charges were Rs 25,000 and the opening balance of machinery during the year was Rs 5,00,000.

So as the machinery account comes under the category assets, its opening balance would come under the debit side of the ledger account.

And as purchase and installation charges mean expenses for the firm, they would also come under the debit side of the account.

And in case of any sale of a part of the machinery, it would be posted on the credit side of the account as the sales would generate revenue for the firm.

See less

Bank Reconciliation Statement or BRS is a statement prepared to reconcile the bank account balance as per the cashbook with the bank balance as per the passbook. This is done so because often the bank balance as per the cashbook does not match with the bank balance as per the passbook. BRS is usuallRead more

Bank Reconciliation Statement or BRS is a statement prepared to reconcile the bank account balance as per the cashbook with the bank balance as per the passbook. This is done so because often the bank balance as per the cashbook does not match with the bank balance as per the passbook.

BRS is usually prepared by the accountant of an entity to find out the causes of the difference between the bank balance as per cashbook and the bank balance as reported in the passbook. The frequency of preparation of BRS is usually monthly. Nowadays, many enterprises have computerised accounting systems which help in automatic bank reconciliation.

Sometimes, BRS is also prepared by auditors during the audit of financial statements.

The balance of the bank account column of the cashbook does not match the bank balance as per the passbook. This is due to many transactions like the following that go unnoticed by the accountant:

Differences also occur due to accounting errors like posting wrong amounts in the cashbook.

To prepare the BRS, we have to start either with the bank balance as per cashbook, then add or subtract amounts to arrive at the bank balance as per passbook. Or we can do the vice verse. Here, the amounts we add or subtract are the amounts of items that are causes for the difference between the two balances.

See less