You must have knowledge of what depreciation is. Depreciation is the process of allocating the value of an asset over its useful life. It reduces the carrying value of the asset year by year till it is scraped. It is an expense (expense of using the asset for business purposes) and it is charged toRead more

You must have knowledge of what depreciation is. Depreciation is the process of allocating the value of an asset over its useful life. It reduces the carrying value of the asset year by year till it is scraped.

It is an expense (expense of using the asset for business purposes) and it is charged to profit and loss account.

Depreciation can be reported in the financial statement in two ways:

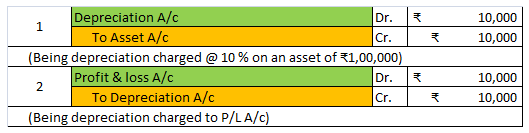

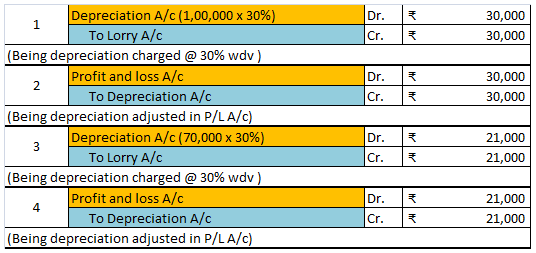

- Deduct depreciation from the asset account and show the asset at “depreciation less” value. See the journal entries below:

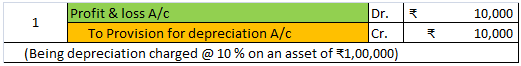

- Maintain a provision for depreciation account and show the asset account at original cost. In this method, no entry is passed through the asset account. See the journal entries below:

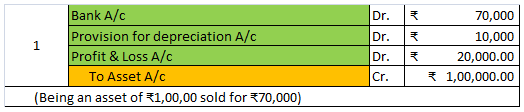

Provision for depreciation account represents the collection of total depreciation till date on an asset. That’s why it is also called accumulated depreciation account. When an asset is sold, its accumulated depreciation is credited to the asset account. See the journal entry below:

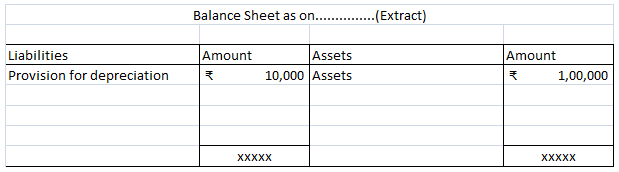

It is shown on the liabilities side of the balance sheet. It is a nominal account because it is shown as an expense in the statement of profit or loss.

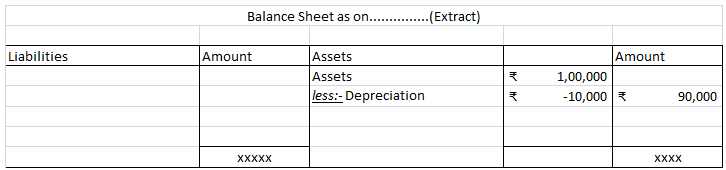

In case provision for depreciation account is not maintained then the balance sheet looks like this:

Journal Entry Prepaid Rent A/c Dr. To Cash A/C (Being rent paid in advance) "Prepaid Account" is treated as an asset and as per the modern rules debit the increase in the asset. "Cash Account" is an asset and as per the accounting rules credit the decrease in the asset. Adjustment entry: TheRead more

Journal Entry

Prepaid Rent A/c Dr.

To Cash A/C

(Being rent paid in advance)

“Prepaid Account” is treated as an asset and as per the modern rules debit the increase in the asset.

“Cash Account” is an asset and as per the accounting rules credit the decrease in the asset.

Adjustment entry: The prepaid rent entry has an adjustment entry when the rent expense account is due. The journal entry for that is

Rent Expense A/c

To Prepaid Rent A/c

(Being the rent expense due and adjusted from the prepaid expense)

Example: ABC.Ltd signs a one-year lease on an office floor for Rs 10,000 a month. The landlord requires that the Company pays the annual amount Rs 120,000 at the beginning of the year.

The journal entry for Company would be as follows:

At the beginning

Prepaid Rent A/c – 1,20,000

To Cash A/c – 1,20,000

(Being rent paid in advance for the year)

At the time rent was due (Month 1)

Rent Expense A/c – 10,000

To Prepaid Rent A/c – 10,000

(Being the rent expense due and adjusted from the prepaid expense)

The same entry done in month 1 will be repeated in the next 11 months.

See less