Before answering your question directly, let’s first understand the two terms, ‘Rent Outstanding’ and ‘Accounting Equation’. Accounting Equation Accounting Equation depicts the relationship between the following items of a business: Assets, Liabilities and Owner’s Equity ( Capital ) It is a simple fRead more

Before answering your question directly, let’s first understand the two terms, ‘Rent Outstanding’ and ‘Accounting Equation’.

Accounting Equation

Accounting Equation depicts the relationship between the following items of a business:

- Assets,

- Liabilities and

- Owner’s Equity ( Capital )

It is a simple formula that implies that the total assets of a business are always equal to the sum of its liabilities and Owner’s Equity (Capital).

ASSETS = LIABILITIES + CAPITAL OR A = L + E

It is also known as the balance sheet equation.

This equation always holds good due to the double-entry system of accounting i.e. every event has a dual effect on items of the balance sheet.

Outstanding Rent

We know rent is an expense for a business and rent outstanding means that rent is due, not paid which implies it is a liability which the business has to settle.

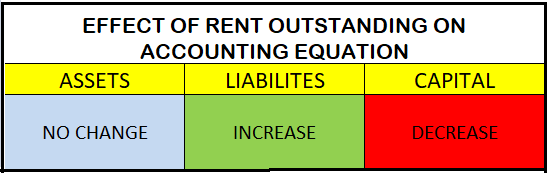

Hence Rent Outstanding is subtracted from the capital balance and added to liabilities.

Let’s take an example to see how rent outstanding affects the accounting equation. Suppose a business has the following figures:

Assets – Rs: 3,00,000

Capital – Rs: 2,00,000

Liabilities – Rs: 1,00,000

Assets = Liabilities + Capital

3,00,000 = 1,00,000 + 2,00,000

Now if Rent outstanding of Rs: 20,000 arises, this will happen:-

Assets – Rs: 3,00,000

Capital – Rs: 2,00,000 – Rs: 20,000 = Rs: 2,80,000

Liabilities – Rs: 1,00,000 + Rs: 20,000 = Rs: 1,20,000

Assets = Liabilities + Capital

3,00,000 = 1,20,000 + 2,80,000.

Hence, when rent outstanding arises, it increases the liability and decreases the Capital by the same amount. Therefore both the sides tally and the accounting equations holds good.

Rent Outstanding is shown on the liabilities side of the balance sheet. Also, the rent outstanding of the current year is shown in the debit side profit and loss account and we know the balance of the P/L account if profit, is added to Capital and in case of loss it is subtracted from Capital. Hence, the rent outstanding is subtracted from the capital.

I hope my answer was useful to you.

See less

Fictitious assets On seeing or hearing ‘fictitious’, the words which come to our mind are ‘not true, ‘fake’ or ‘fantasy’. So, fictitious assets are those items that appear on the assets side of the balance sheet but are actually not assets. In substance, fictitious assets are the expenses and lossesRead more

Fictitious assets

On seeing or hearing ‘fictitious’, the words which come to our mind are ‘not true, ‘fake’ or ‘fantasy’. So, fictitious assets are those items that appear on the assets side of the balance sheet but are actually not assets.

In substance, fictitious assets are the expenses and losses that are not completely written off in a financial year and are required to be carried forward to the next financial year.

The examples of fictitious assets are as follows:

Fictitious assets appear on the asset side of the balance sheet as expenses and losses have a debit balance.

*when the balance sheet is prepared as per Schedule III of Companies Act, the Net loss is shown as a negative figure under the head Reserve and Surplus.

Intangible Assets

Intangible assets mean the assets which don’t have any physical existence. They cannot be seen or touched but are assets because they do provide future economic benefits to the business. Like tangible assets (like machinery and building), they can be also created, purchased or sold.

Like tangible assets are depreciated, intangible assets are gradually written over by amortization over their useful lifespan to account for the economic benefits provided by them.

Following are the examples of intangible assets:

Intangible assets which are created by the business-like goodwill or brand recognition do not appear in the balance sheet.

Only acquired intangible assets can be shown in the balance sheet. Like purchased goodwill, patents, trademarks etc.

Intangible assets also face impairment if their fair value is less than their carrying value after deducting amortization expense. The difference between carrying value and fair value is shown in the Profit and loss A/c as impairment charge and the asset is valued at fair value in the balance sheet.

See less