A contra account is a general ledger account that is used to reduce the value of the account related to it. Basically, a contra account is the opposite of its associated account. If the associated account has a debit balance, then the contra account would have a credit balance. They are used to mainRead more

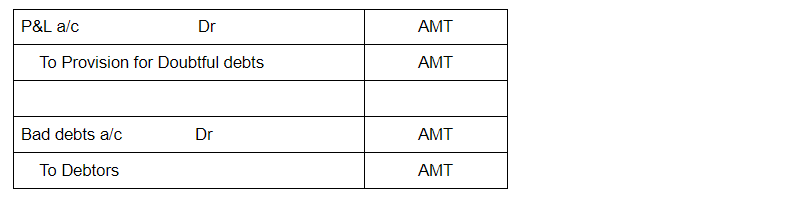

A contra account is a general ledger account that is used to reduce the value of the account related to it. Basically, a contra account is the opposite of its associated account. If the associated account has a debit balance, then the contra account would have a credit balance. They are used to maintain the historical value of the main account while all the deductions are recorded in the contra account, which when clubbed together show the net book value.

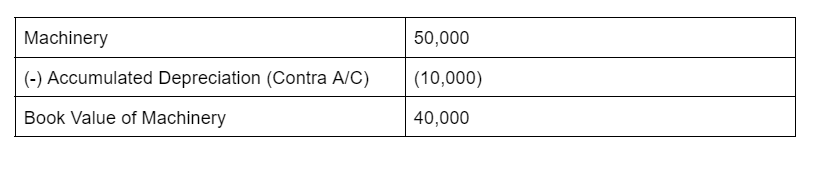

For example

if the cost of machinery was Rs. 50,000 and the company wants to preserve its original cost, then the accumulated depreciation of such machinery is recorded separately. Let’s say Rs 10,000 was the accumulated depreciation. Then such amount is recorded in the contra account named accumulated depreciation account. This makes the net value of the machinery Rs 40,000.

Types

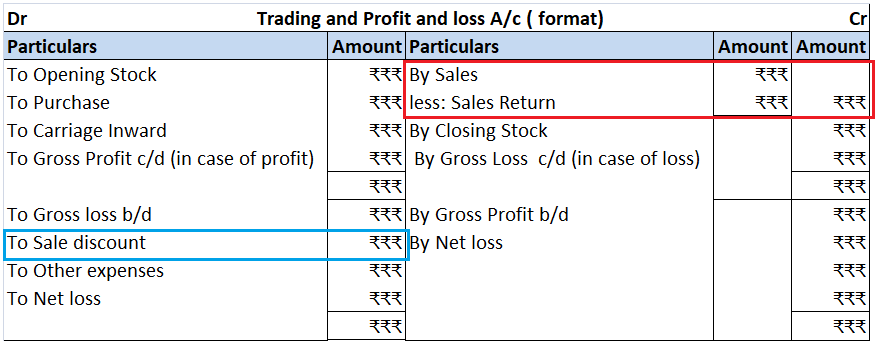

There are various types of contra accounts such as contra asset, contra equity, contra revenue, and contra liability.

- Contra asset: these accounts have credit balances and are used to reduce the balance of an asset. Eg, Accumulated depreciation.

- Contra Liability: These accounts have debit balances and are used to reduce the balance of liabilities. Eg, discount on notes.

- Contra equity: These accounts have a credit balance and are used to reduce the number of shares outstanding which in turn reduces equity. Eg treasury stock.

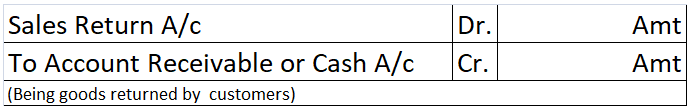

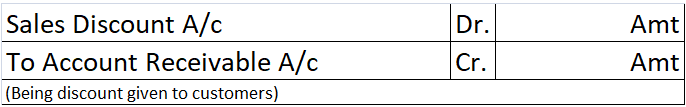

- Contra revenue: These accounts have a debit balance. They reduce gross revenue which results in net revenue. Eg sales return.

Accountants make use of contra accounts instead of reducing the value of the actual account to keep the financial statements clean.

See less

Land in the balance sheet The land is an asset and hence it is shown on the asset side of the balance sheet. On the asset side of the balance sheet, the land is stated under the heading long-term assets. Balance Sheet (for the year…) Explanation The land is a fixed asset and is supposed not to be caRead more

Land in the balance sheet

The land is an asset and hence it is shown on the asset side of the balance sheet.

On the asset side of the balance sheet, the land is stated under the heading long-term assets.

Balance Sheet (for the year…)

Explanation

The land is a fixed asset and is supposed not to be cashed, consumed, last, sold, or written off within one accounting year and is purchased for long-term use. The fixed assets are also called non-current assets and the reason behind it is that current assets are easily converted into cash within one year and they are not.

Why is it shown on the asset side?

The land is an asset, although it is not depreciable it is still considered to be an asset because just like other assets the business spends its own money to acquire it, and it gives them a long-term benefit while reselling it.

Therefore, the land is shown on the asset side under the fixed asset heading.

See less