First, let us understand the meaning of a provision of depreciation. It is nothing but the total collection of all the depreciation over the years. This account is not like a normal account but a contra asset account. It is also called accumulated depreciation. Annual depreciation charged is an expeRead more

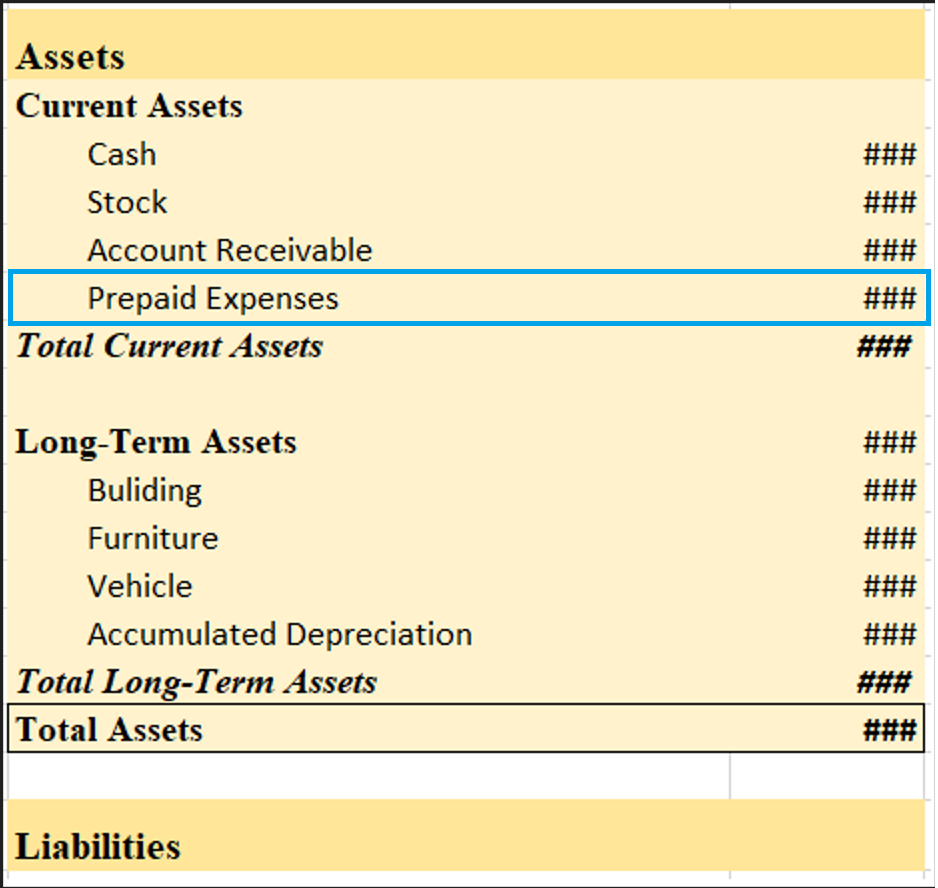

First, let us understand the meaning of a provision of depreciation. It is nothing but the total collection of all the depreciation over the years. This account is not like a normal account but a contra asset account. It is also called accumulated depreciation.

Annual depreciation charged is an expense for the business and hence has a debit balance. Whereas provision for depreciation as a contra asset account has a credit balance.

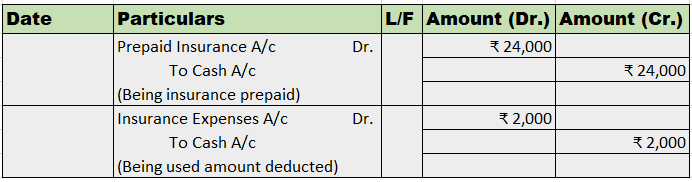

The journal entry for provision for depreciation is

| Depreciation A/c ……….Dr | XXX | |

| To Provision for depreciation | XXX |

Explaining the credit nature of this account. As we know that the depreciation is an expense for the business hence as per modern rules “Debit all the expenses and losses and credit all incomes and gains” therefore it is debited whereas the provision of depreciation is contra account it has a credit balance as it reduces the value of assets. So according to modern rule, we know a decrease in assets has a credit balance, hence shown in a negative balance on the balance sheet under long-term assets.

With the preparation of this account, we do not credit depreciation in the asset account but transfer every year to the accumulated depreciation account, and when assets are disposed of or sold we credit the ‘total’ of the provision on depreciation to the credit of the asset account just to calculate the actual profit or loss on a sale of the asset.

See less

Firstly, let’s understand the meaning of both terms. Revenue receipts: The term 'revenue' suggests these are the amounts received by a business due to its operating activities. These receipts arise in a recurring manner in a business. Such receipts don’t affect the balance sheet. They are shown inRead more

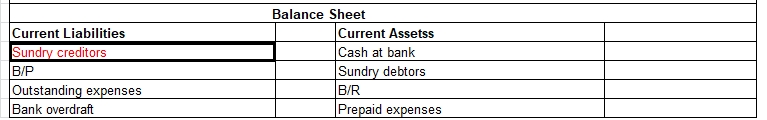

Firstly, let’s understand the meaning of both terms.

Revenue receipts: The term ‘revenue‘ suggests these are the amounts received by a business due to its operating activities. These receipts arise in a recurring manner in a business. Such receipts don’t affect the balance sheet. They are shown in the statement of profit or loss. Such receipts are essential for the survival of the business.

Examples of revenue receipts are as follows:

Capital receipts: The term ‘capital’ that such receipts are do not arise due to operating activities, hence not shown in the Profit and loss statement. These are the money received by a business when they sell any asset or undertake any liability. These receipts do not arise in a recurring manner in a business. They don’t affect the profit or loss of the business. They are not essential for the survival of the business.

Examples of capital receipts are as follows:

I have given a table below for more understanding:

See less