Software is not depreciated but amortized, as it is an intangible asset. As per companies act the useful life of software is 3 years. The treatment of depreciation is the same as computers. Following are the software depreciation rates as per the companies act: As of 2021 Nature of Asset Useful LifeRead more

Software is not depreciated but amortized, as it is an intangible asset. As per companies act the useful life of software is 3 years. The treatment of depreciation is the same as computers. Following are the software depreciation rates as per the companies act:

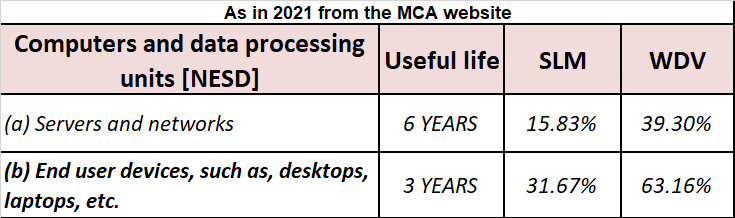

As of 2021

| Nature of Asset | Useful Life | Depreciation | |

| WDV | SLM | ||

| Servers and networks | 6 years | 39.30% | 15.83% |

| End-user devices such as desktops, laptops, etc. | 3 years | 63.16% | 31.67% |

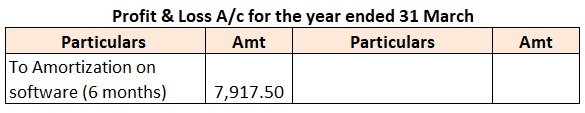

For example, XYZ Ltd purchased a new accounting software on 1 October for Rs.50,000. As per the Companies Act, the useful life of software is 3 years. Hence, the software will be amortized for 3 years and the company amortizes on the straight-line method.

Amortization amount = 50,000*31.67%

For full year = Rs.15,835

As the software was purchased on 1 October hence it will be amortized for 6 months.

For 6 months = 15,835*6/12

= Rs.7,917.50

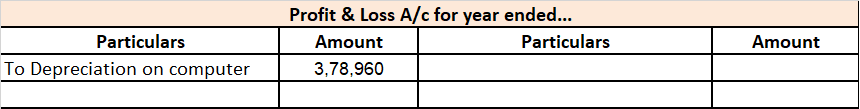

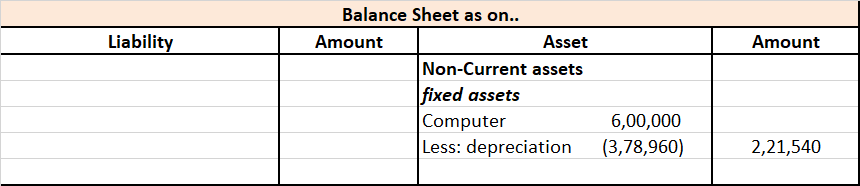

Amortization is the same as depreciation. Hence, treatment will also be the same. The amortization amount will be transferred to the Profit & Loss A/c on the debit side as a non-cash expense.

See less

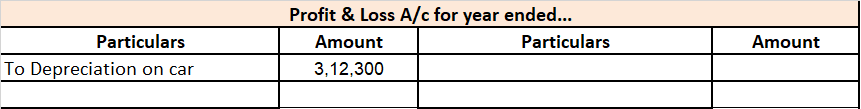

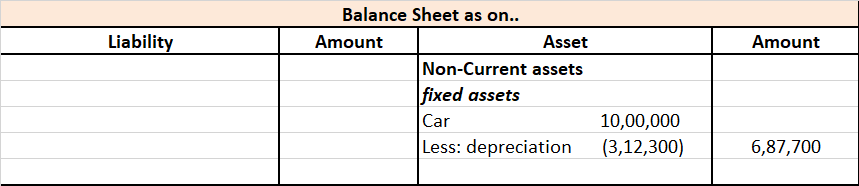

The rate of depreciation on a car as per the Income Tax Act depends upon the purpose for which it has been purchased and the year on which it was acquired. As per the Income Tax Act, cars come under the Plant and Machinery block of assets. The Act classifies cars into two categories, Group 1 - MotorRead more

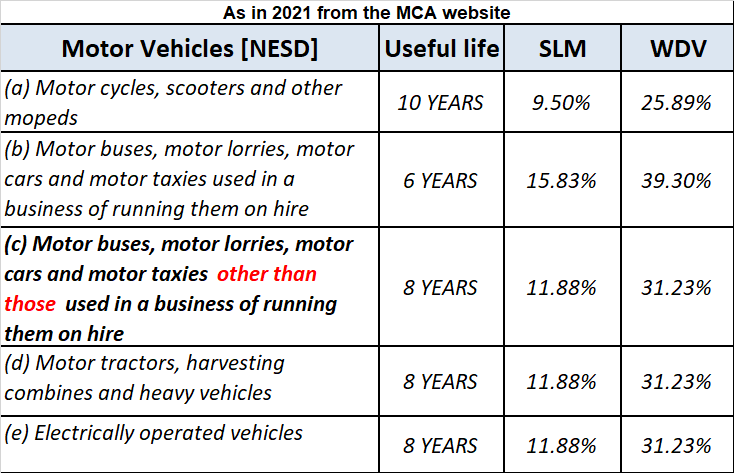

The rate of depreciation on a car as per the Income Tax Act depends upon the purpose for which it has been purchased and the year on which it was acquired.

As per the Income Tax Act, cars come under the Plant and Machinery block of assets.

The Act classifies cars into two categories,

Group 1:

Group 2:

Here is a summarised version of the rates applicable to cars,

The rates can also be found on the Income Tax India website.

See less