In the books of Rural Literacy Society Income & Expenditure A/c for the year ended 31 March 2019 Expenditure Amt Amt Income Amt Amt To General Expenses 32,000 By Subscription (W.N.1) 2,72,000 To Newspapers 18,500 By Legacy 12,500 To Electricity 30,000 By Government Grant 1,20,000 To Rent 65,000Read more

In the books of Rural Literacy Society

Income & Expenditure A/c for the year ended 31 March 2019

| Expenditure | Amt | Amt | Income | Amt | Amt |

| To General Expenses | 32,000 | By Subscription (W.N.1) | 2,72,000 | ||

| To Newspapers | 18,500 | By Legacy | 12,500 | ||

| To Electricity | 30,000 | By Government Grant | 1,20,000 | ||

| To Rent | 65,000 | By Interest Received on Fixed Deposit | 9,000 | ||

| Less: Prepaid Rent (65,000/13) | -5,000 | 60,000 | (1,80,000*10%*6/12) | ||

| To Salary | 36,000 | ||||

| Add: Outstanding Salary | 6,000 | 42,000 | |||

| To Postage Charges | 3,000 | ||||

| To Loss on Sale of Furniture (W.N.2) | 13,000 | ||||

| To Surplus (excess of income over expenditure) | 2,15,000 | ||||

| 4,13,500 | 4,13,500 |

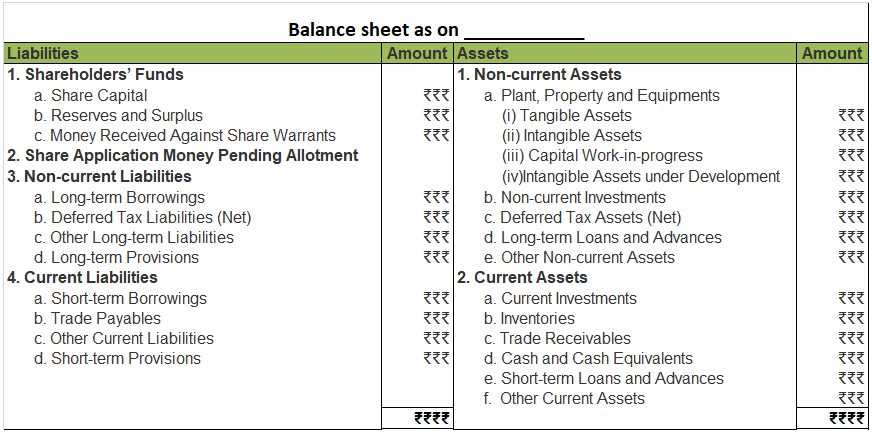

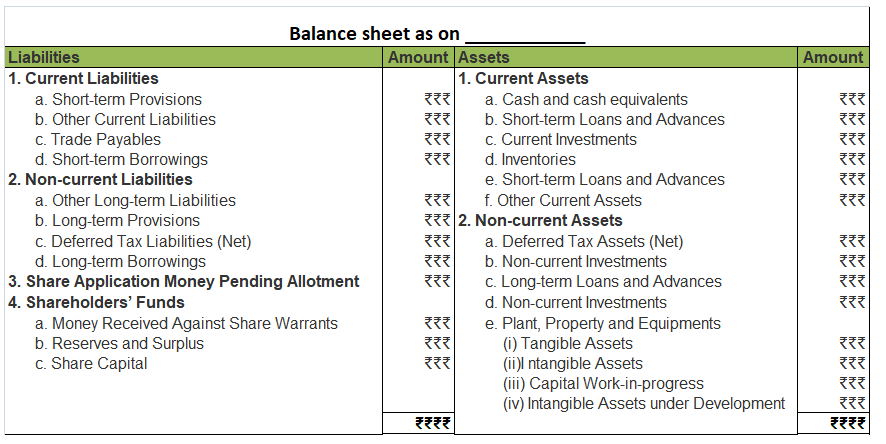

Balance Sheet as on 31 March 2019

| Liabilities | Amt | Amt | Assets | Amt | Amt |

| Capital Fund (W.N.3) | 3,85,500 | Fixed Deposit | 1,80,000 | ||

| Add: Surplus | 2,15,000 | ||||

| Advance Subscription | 5,000 | Books | 50,000 | ||

| Outstanding Salaries | 6,000 | Add: Purchased | 70,000 | 1,20,000 | |

| Furniture | 1,20,000 | ||||

| Add: Purchased | 1,05,000 | ||||

| Less: Sold | -50,000 | 1,75,000 | |||

| Outstanding Subscription | 15,000 | ||||

| Prepaid Rent | 5,000 | ||||

| Cash in Hand | 30,000 | ||||

| Cash at Bank | 82,000 | ||||

| Accrued Interest (W.N.4) | 4,500 | ||||

| 6,11,500 | 6,11,500 |

Working Notes:

W.N.1: Calculation of Subscription

| Subscription for 2018-19 | 2,65,000 |

| Add: Outstanding Subscription (31 March 2019) | 15,000 |

| Less: Outstanding Subscription (2017-18) | -8,000 |

| Total Subscription | 2,72,000 |

In the above calculation, for the year 2017-18 subscription amount was 12,000, and in the adjustment at the end of the year subscription was 20,000 so the difference of 8,000 is the amount of subscription that was outstanding.

W.N.2: Calculation of loss on sale of furniture

| Book Value of Furniture | 50,000 |

| Less: Sold | -37,000 |

| Loss on Sale of Furniture | 13,000 |

W.N.3: Calculation of Capital Fund

Balance Sheet as on 31 March 2018

| Liabilities | Amt | Assets | Amt |

| Capital Fund (Balancing Figure) | 3,85,500 | Books | 50,000 |

| Furniture | 1,20,000 | ||

| Outstanding Subscription | 20,000 | ||

| Cash in Hand | 40,000 | ||

| Cash at Bank | 1,55,500 | ||

| 3,85,500 | 3,85,500 |

W.N.4: Calculation of Accrued Interest

| Interest as of 30 September 2018 | 9,000 |

| Less: Interest as of 31 March 2019 | -4,500 |

| Accrued Interest | 4,500 |

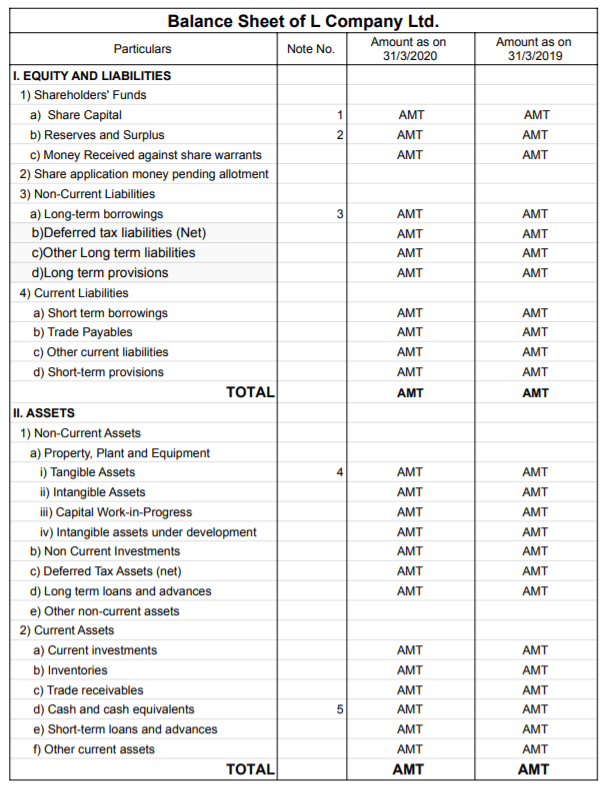

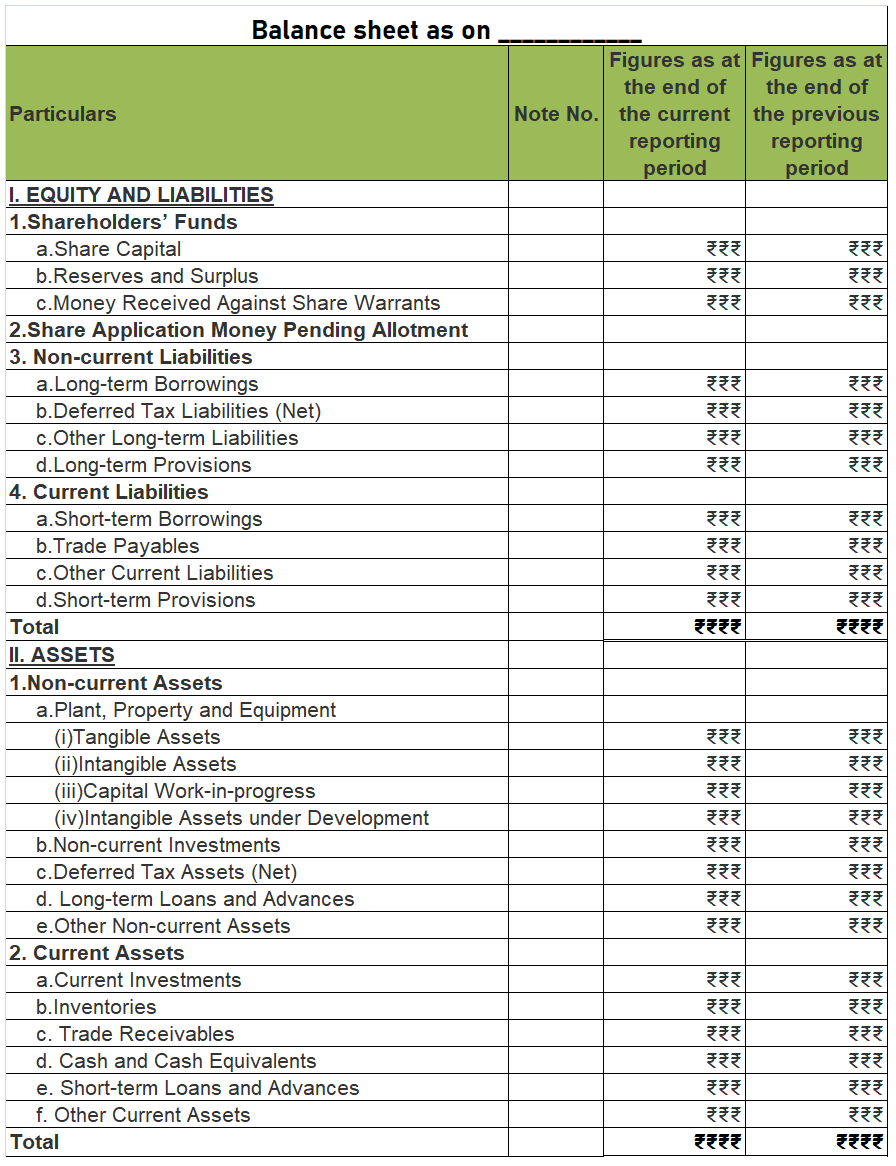

Introduction A capital reduction account is an account used to pass entries related to the internal reconstruction of a company. During reconstruction, paid-up capital reduced is credited to this account; hence its name is capital reduction account. It is also known as the reconstruction account. TyRead more

Introduction

A capital reduction account is an account used to pass entries related to the internal reconstruction of a company. During reconstruction, paid-up capital reduced is credited to this account; hence its name is capital reduction account. It is also known as the reconstruction account.

Type of account

A capital reduction account is a temporary account open just to carry out internal reconstruction. It represents the sacrifices made by the shareholders, debenture holders and creditors. Also, any appreciation in the value of assets is credited to this account. It is closed to capital reduction when internal reconstruction is completed.

Entries passed through capital reduction account

When paid-up capital is cancelled.

When paid-up capital is cancelled, the share capital account is debited and the capital reduction account is debited as share capital is getting reduced.

When assets and liabilities are revalued

At the time of internal reconstruction, the gain or loss on revaluation is transferred to the capital reduction account instead of the revaluation reserve.

Writing off of accumulated losses and intangible assets

The credit balance of the capital reduction account is used to write off the accumulated losses and intangible assets like goodwill, patents etc which are unrepresented by capital. The capital reduction account is debited and profit and loss account and intangible assets accounts are credited.

Treatment in books of account

The balance in the capital reduction account, whether debit or credit, it is transferred to the capital reduction account. Hence, it doesn’t appear on the balance sheet.

See less