You must have knowledge of what depreciation is. Depreciation is the process of allocating the value of an asset over its useful life. It reduces the carrying value of the asset year by year till it is scraped. It is an expense (expense of using the asset for business purposes) and it is charged toRead more

You must have knowledge of what depreciation is. Depreciation is the process of allocating the value of an asset over its useful life. It reduces the carrying value of the asset year by year till it is scraped.

It is an expense (expense of using the asset for business purposes) and it is charged to profit and loss account.

Depreciation can be reported in the financial statement in two ways:

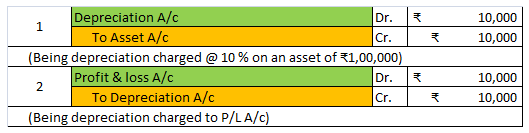

- Deduct depreciation from the asset account and show the asset at “depreciation less” value. See the journal entries below:

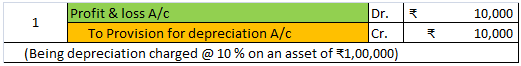

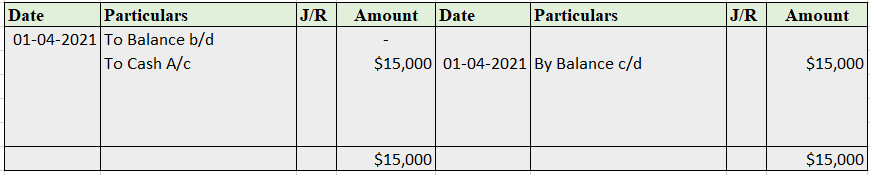

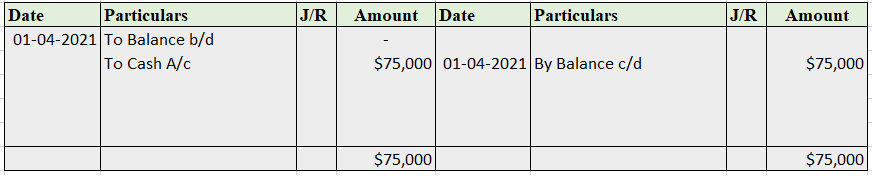

- Maintain a provision for depreciation account and show the asset account at original cost. In this method, no entry is passed through the asset account. See the journal entries below:

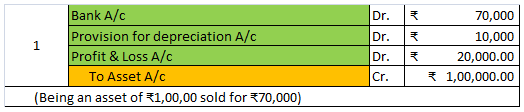

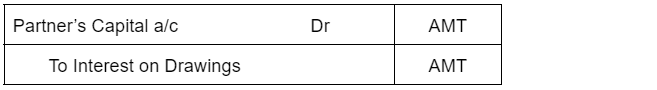

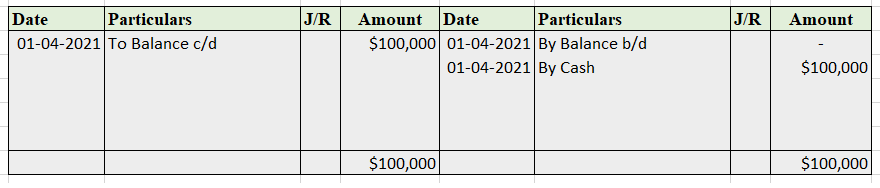

Provision for depreciation account represents the collection of total depreciation till date on an asset. That’s why it is also called accumulated depreciation account. When an asset is sold, its accumulated depreciation is credited to the asset account. See the journal entry below:

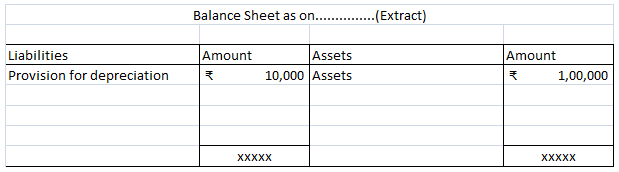

It is shown on the liabilities side of the balance sheet. It is a nominal account because it is shown as an expense in the statement of profit or loss.

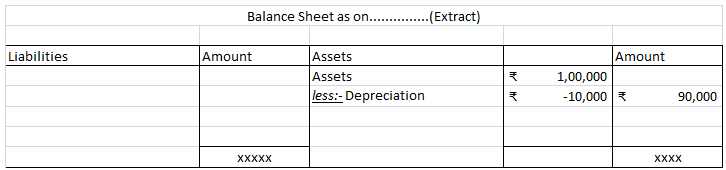

In case provision for depreciation account is not maintained then the balance sheet looks like this:

The journal entry for Cash Sales is- Particulars Amount Amount Cash A/c Dr $$$ To Sales A/c $$$ Sales Account is a Revenue Account and Cash Account is an Asset Account for the business. So, According to the modern approach for Sales account:Read more

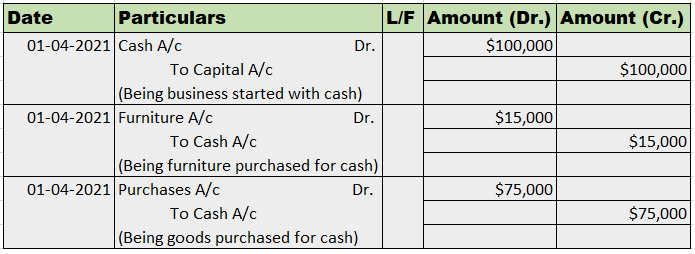

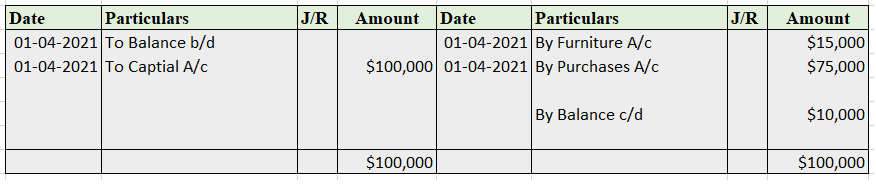

The journal entry for Cash Sales is-

Sales Account is a Revenue Account and Cash Account is an Asset Account for the business.

So, According to the modern approach for Sales account:

According to the Modern approach for Cash account:

So, the journal entry here is about cash sales and since there is an increase in Revenue on account of goods being sold, the sales account will be credited as per the modern rule and due to the increase in cash on account of sales, cash account will be debited.

For Example, Polard sold goods for cash worth Rs 2,000 for his business.

I will try to explain it with the help of steps.

Step 1: To identify the account heads.

In this transaction, two accounts are involved, i.e. Cash A/c and Sales A/c.

Step 2: To Classify the account heads.

According to the modern approach: Sales A/c is a Revenue account and Cash A/c is an Asset account.

Step 3: Application of Rules for Debit and Credit:

According to the modern approach: As Sales increases, because goods have been sold, ‘Sales A/c’ will be credited. (Rule – increase in Revenue is credited).

Cash account is an Asset account. As cash has been received on account of goods sold, there is an increase in assets and hence Cash account will be debited (Rule – increase in Asset is debited).

So from the above explanation, the Journal Entry will be-

See less