‘Reserve and surplus’ is a heading under ‘Equities and Liabilities’ in which various reserves and surplus of profit of an enterprise appear. Reserve are the amount set aside to meet with uncertainties of the future. They have credit balance as they are internal liabilities of an enterprise. While ‘sRead more

‘Reserve and surplus’ is a heading under ‘Equities and Liabilities’ in which various reserves and surplus of profit of an enterprise appear. Reserve are the amount set aside to meet with uncertainties of the future. They have credit balance as they are internal liabilities of an enterprise. While ‘surplus’ generally means the surplus amount in the profit and loss A/c or the operating surplus in case of a non-profit organisation, reserves are of many types:

- Revenue reserve

- Specific reserves

- Reserves created from shareholder’s contribution

- Capital reserve

- Secret reserves

Let’s discuss each of the above:

- Revenue reserves:

Revenue reserve has two different definitions.

First – Revenue reserves are the reserves that are created out of the profit made by an enterprise in the ordinary course of business. As per this definition, the examples of revenue reserves are:

- General reserve: There is no restriction on the purpose for which this reserve can be used. It is a free reserve. Generally, this reserve is used to pay dividends.

- Debenture Redemption Reserve: This reserve is mandatory to be created by law. The purpose is to ensure the timely redemption of debentures.

- Dividend Equalisation Reserve: This reserve is created to maintain a steady rate of dividend every year even if the enterprise reports loss in any financial year.

- Capital Redemption Reserve: This reserve can be solely used to issue bonus shares to fill the void created in total capital by redemption of preference shares.

- Workmen Compensation Reserve: This reserve is created to pay for uncertain compensation that an enterprise may be liable to pay to its employees.

- Investment Fluctuation Reserve: This reserve is created out of the profit of

Second: Revenue reserve is a reserve from which can be used to any use. It can be the payment of dividends, creation of other reserves or reinvestment in the business. It is another name for general reserve.

- Specific reserves

These are the reserves that are restricted to specific purposes only. These reserves are not free reserves i.e. dividends cannot be declared out of these reserves. However, if in case such reserve is not a statutory reserve, an enterprise can very well use such reserves for other purposes too. Specific reserves can be further classified into two types:

- Statutory specific reserves: These are reserves that are mandatory to be created to comply with legal provisions applicable to an enterprise. Use of such reserves is restricted to some specific purposes.

If such reserves are not created whenever applicable or if the amount in such reserves is used for a purpose other than the purpose for which it is created, the enterprise can invite face legal consequences. The examples of statutory reserves are as follows:

- Capital Redemption Reserve

- Debenture Redemption Reserve

- Securities Premium Reserve

- Non – Statutory specific reserves: It is not mandatory to create such reserves. They are created to meet with specific uncertainties of the future.

- Workmen Compensation Reserve

- Investment Fluctuation Reserve

Important Note: Statutory reserve in the context of insurance companies means the minimum amount of cash and marketable securities to be set aside to comply with legal requirements.

- Reserves created from shareholder’s contribution

This is a reserve that is created out of a shareholder’s contribution. Securities premium reserve is the only such reserve that is created out of such shareholder’s contribution.

Securities Premium Reserve: It is a reserve that is created when securities of a company such as shares or debentures are issued at a premium. The share or debenture premium money is created for this reserve. The purposes of which this reserve may be used as per section 52 of the Companies Act, 2013 are as follows:

- For the issue of fully paid bonus shares.

- For meeting preliminary expenses incurred by the company

- For meeting the expense, commission or discount allowed on the issue of securities of the company.

- In providing premium payable on the redemption of preference shares.

- For the purchase of its own shares or other securities under section 68.

- Capital Reserve:

Capital reserve is a reserve that is created out of the profit made by an enterprise from its non-operating activities like

- selling of capital assets(fixed assets) at a profit

- buying a business at profit (where net assets acquired is more than the purchase consideration)

This reserve is used to finance long term projects of a company like buying or construction of fixed assets, writing off capital losses( selling of fixed assets at loss).

- Secret Reserve:

A secret reserve is a reserve that exists but its existence is not shown in the balance sheet of an enterprise. An enterprise creates such reserves to hide from its competitor that it is in a better financial position than it appears in its balance sheet. Although the creation of secret reserves is prohibited by law, there are provisions for banking companies to create such reserves.

See less

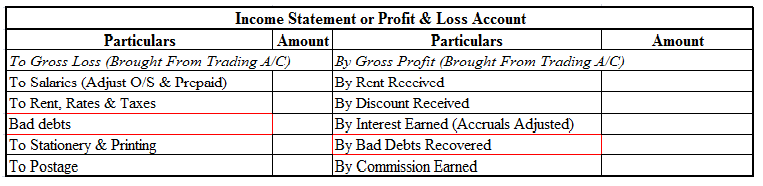

The journal entry for commission received is as presented below: Cash A/c / Bank A/c / A Personal A/c Dr. - ₹ To Commission received A/c - ₹ (Being ₹ commission received) The commission received means an amount received by a person or entity forRead more

The journal entry for commission received is as presented below:

Cash A/c / Bank A/c / A Personal A/c Dr. – ₹

To Commission received A/c – ₹

(Being ₹ commission received)

The commission received means an amount received by a person or entity for the provision of a service. For example, a firm sold goods worth ₹10,000 of a manufacturer and was paid an amount of ₹1000 in cash as commission. So, the entry in the books of accounts of the firm will be as follows:

Cash A/c Dr. ₹1000

To Commission received A/c ₹1000

Now, let’s understand the logic behind the journal entry through the modern rules of accounting.

Cash account, bank account and personal account are asset accounts. Hence, they are debited when assets are increased.

While the commission received account is an income account. Hence, when income increases, it is credited.

As per the traditional rules i.e. the golden rules of accounting, these are the explanations:

Commission can be received in cash or bank. Hence the Cash or Bank account is debited as they are real accounts.

“Debit what comes in, credit what goes out”

Also, when it is not received but accrued, then a personal account is debited (the person or entity who has received the service but has not paid for it yet). The following rule applies to the personal account.

“Debit the receiver, credit the giver”

Commission received is an income, thus it is a nominal account. It will be credited because of the following rule of nominal accounts:-

“Debit all expense and losses, credit all income and gains”

See less